Transition of Assets to BNY Mellon | Pershing

Our Priority is You

As part of our ongoing commitment to exceptional customer service, we regularly evaluate our relationships with our third-party vendors and service providers. Firms like ours work with custodians to ensure the safekeeping of client assets, along with administrative services such as processing transactions. Because of the significance of custodial relationships, we believe working with the best custodians is paramount.

After a thorough and rigorous vetting process, we are excited to announce a new strategic relationship with BNY Mellon | Pershing. We are confident this will allow us to best serve you and your financial needs going forward.

Transition Timeline

Your Wealth Account(s) Will Transition on September 30, 2022

We continue to make progress with the transition of your wealth account(s) to BNY Mellon | Pershing, which includes finalizing your paperwork and setting up your new BNY Mellon | Pershing account(s). Thank you for your patience and diligence in working with us to complete the paperwork.

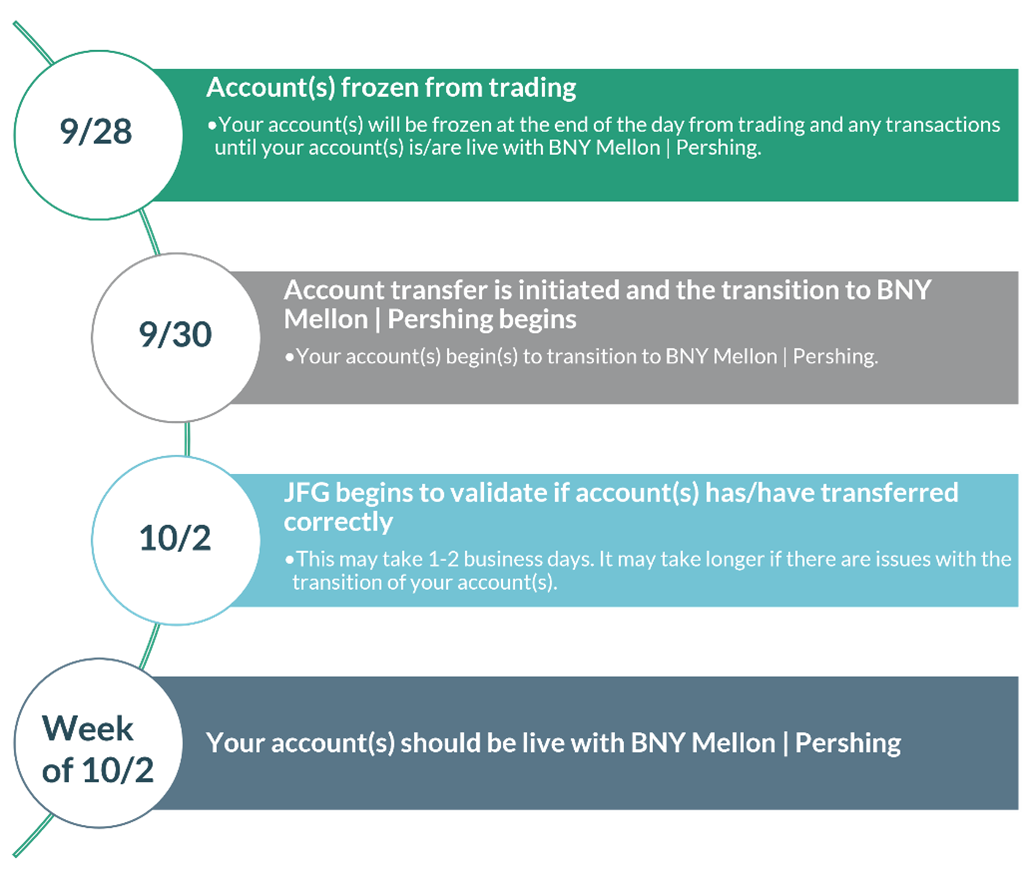

As noted in our last communication, we will begin transitioning your wealth account(s) on September 30, 2022. We expect to complete all transfers the week of October 3, 2022. View the key dates for the transition below.

The timeline outlined above is based on industry standards. Your account(s) may transfer faster or slower based on a number of factors. Timing is subject to change.

Key Transition Details

- No action is required by you during this time period.

- Your account(s) will be frozen two business days before we initiate the transfer to BNY Mellon | Pershing. This means your account(s) will be frozen from trading at the end of business on September 28, 2022 until live at BNY Mellon | Pershing.

- If you have scheduled payments during this timeframe, we are working with SEI to initiate those payments early. If you anticipate making any distributions or have other cash needs during this time period, please contact me today to initiate those requests before end of business on September 28, 2022.

- You will know that your account(s) is/are in transition to BNY Mellon | Pershing once your account number(s) changes in Wealth Management & Trust to start with YAV. Your account(s) should be live at BNY Mellon | Pershing the week of October 3, barring any issues during the transition. Once live, trading will resume on your account(s) and cash needs can be processed. You will also see the new account number(s) reflected on your October statement.

- During this process, you can continue to view your account(s) via our website, Wealth Management & Trust. Please contact you Johnson Financial Group Advisor if you don’t have access.

Our Commitment to You

Brian Andrew, EVP & Chief Investment Officer, recently recorded a short video discussing our ongoing commitment to providing you exceptional customer service. This is the foundation of why we entered into a strategic relationship with BNY Mellon | Pershing, whom we believe is a leading service provider qualified custodian for you – our valued client - going forward.

What This Means To You

Key benefits of this transition include:

Key Benefits

-

An improved digital experience empowering you to make informed financial decisions with real-time account information and analytics

-

Greater ability to support complex planning needs with expanded investment options

-

Award winning, easy to understand statements and transaction reports

-

Ability to move funds intraday between bank and wealth accounts

-

No transaction fees

-

Industry leading platform that safeguards your personal financial information

-

View Complements Holdings

-

The relationship with your Johnson Financial Group team will not change

Description

-

With the transition to BNY Mellon | Pershing, we will be able to provide an improved digital experience that will help empower you to make informed financial decisions with:

- access to real-time account holdings and information. You will be able to view various documents such as statements, trade confirms, tax documents and account notifications.

- Providing more consistent, modern analytics and reporting of our investment recommendations crafted based on your goals.

- Putting your money to work faster by simplifying the process to open your account(s) and quickly address any issues that may arise with your account(s) over time.

-

We will be able to better support more complex planning needs with an expanded offering of Mutual Funds, ETFs and Donor Advised Funds (DAFs). A DAF is a simple, tax-smart solution for charitable giving.

-

BNY Mellon | Pershing's award-winning statements and transaction reports will assist you in better understanding and managing investments. Key benefits, include:

- The ability to access all your statements and reports through our Wealth Management & Trust portal

- Statements will more clearly define taxable and non-taxable investments to assist with annual tax planning

- An enhanced, modern design to make it easy to understand and manage your investments.

-

With the transition to Pershing, you will have the ability to move funds intraday between your Johnson Financial Group bank accounts and wealth checking accounts.

-

You will not be charged transaction fees.

-

Access to BNY Mellon | Pershing’s leading-edge technology will help safeguard your personal financial information by staying ahead of latest cybercriminals.

-

If you have complements (alternative investments) with one of our partners as part of your portfolio, you will now be able to view these positions on monthly investment statements. You will also be able to access these statements online through our Wealth Management & Trust portal.

-

Please know that your relationship with Johnson Financial Group will not change. You will continue to work with the advisors you know and trust.

Online Portal

With the transition to BNY Mellon | Pershing, we will be able to provide an enhanced digital experience through our Wealth Management & Trust portal.

Through our portal, you will be able to access:

- real-time holdings and account activity

- statements and tax documents

- performance of your assets

- and more!

If you don’t have access to our portal or you’d like to review the benefits of online access, please contact your Johnson Financial Group Advisor.

Automated Communications

Once your paperwork is finalized and processed, we will open your account(s) at BNY Mellon | Pershing. As your account(s) is/are opened, you may begin to receive automated communications under the email address: donotreply@digital.johnsonfinancialgroup.com or by mail.

Click here to view examples of these automated communications.

No action is required with these emails. We strongly encourage you to access our Wealth Management & Trust portal for real-time holdings, account information and all your documents. If you have questions on these communications, please contact your Johnson Financial Group Advisor.

Frequently Asked Questions

Please know that your relationship with Johnson Financial Group will not change. You will continue to work with the advisors you know and trust.

As part of our ongoing commitment to exceptional customer service, we regularly evaluate our relationships with our third-party vendors and service providers. Firms like ours work with custodians to ensure the safekeeping of client assets, along with administrative services such as processing transactions. Because of the significance of custodial relationships, we believe working with the best custodians is paramount.

SEI has provided custodial services to many of our client accounts, including yours, for a number of years. While SEI has served our clients well, we are excited to announce a new partnership with BNY Mellon | Pershing whom we believe will allow us to best serve you and your financial needs going forward.

After a thorough and rigorous vetting process, we are confident BNY Mellon | Pershing will help us continue delivering the highest level of service and expertise to you.

BNY Mellon | Pershing will help us transform our business, maximize efficiency, and manage risk and regulation. They will provide our firm with the scale needed to grow our business through innovative solutions and technology as well as provide more efficient, high-touch customer service.

Key benefits of this transition for you, include:

- An improved digital experience empowering you to make informed financial decisions with real-time account information and analytics

- Greater ability to support complex planning needs with expanded investment options

- Award winning, easy to understand statements and transaction reports

- The relationship with your Johnson Financial Group team will not change

See the What This Means To You section to learn more about the above benefits.

For most of our clients there will not be any tax consequences associated with the transition. There may be certain instances that we need to adjust some aspects of client portfolios due to the transition that may result in tax consequences. For those clients, our team will work to minimize those consequences as best we can.

Yes. We are transitioning client assets from SEI to BNY Mellon | Pershing on September 30, 2022.

We will transition client assets from SEI to BNY Mellon | Pershing on September 30, 2022. More specific details around the transition of account assets will be communicated over the coming months.

Have Questions?

We encourage you to contact your Johnson Financial Group Advisor if you have any questions.

Contact Wealth Support