WEALTH INSIGHTS

Become an employer of choice with a retirement plan tailored to fit your organization's overall benefits program, combining world‐class open architecture investment options with local, personal service and effortless administration.

Your organization's retirement plan is key to a comprehensive employee benefits program. It should help you attract and retain quality employees without requiring all of your time and energy to administer.

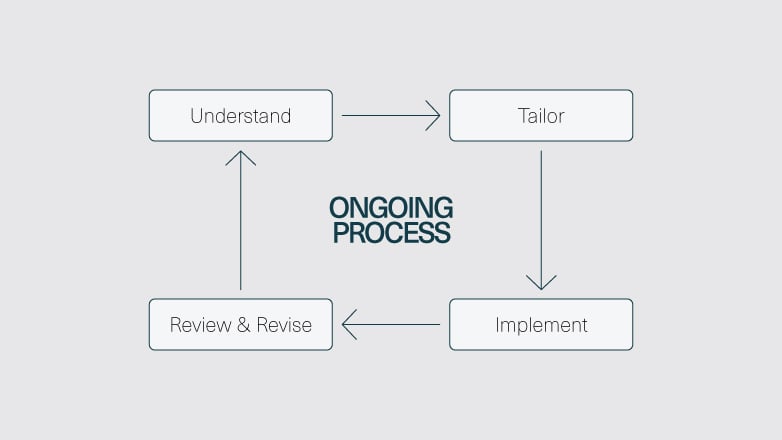

Our advisors will work closely with you to understand the unique needs of your organization and tailor a comprehensive retirement plan program that fits your overall employee benefits strategy. Our team then delivers and services your program to ensure accountability.

Investing can be scary for plan participants and can create anxiety that keeps them from engaging with your company’s plan.

Your plan’s Target Date Retirement Funds Series is a great solution for many employees that desire a less-is-more contact approach with their retirement savings. But for those employees that have more complex finances, defined goals, and specific investment strategies, our team can help.

We are now offering professionally managed portfolios as investment options for your employees at no additional cost to the Plan. Click here to learn more.

Your employees may set aside pre‐tax or Roth dollars in their retirement account to be invested in funds chosen by you with our professional guidance. Contributions and earnings grow tax‐deferred.

Our integrated professional administrative team streamlines the day-to-day operations of the plan, saving you significant time and energy while providing you with the personal attention you deserve.

Communicating with your employees about retirement planning can increase participation, deferral rates and appreciation for the benefit you're providing. Educated employees make better saving and investing decisions, increasing their retirement readiness and long-term happiness.

To keep your employees engaged, we use a variety of touchpoints.

We take a holistic approach to delivering communications and education through customized group and one-to-one meetings while employing campaigns to target participant behaviors. Our advisors partner with you to ensure your organization's needs are met in the following areas.

Our advisors will create a smooth enrollment process for your employees by providing:

We'll work side by side with you and your organization to ensure your employees are on a better path to retirement by providing:

We'll design an approach based on your ongoing education and communication needs, considering demographics utilizing the following services:

Our team will align your organization's retirement plan with your strategic priorities through:

As an important part of your company’s benefits package for employees, it’s critical that you have a partner to help with employee engagement and to assist with helping employees with their long-term retirement success. Learn more our approach to your participant’s retirement plan experience and enrollment process.

LEARN MORE about retirement plan resources.

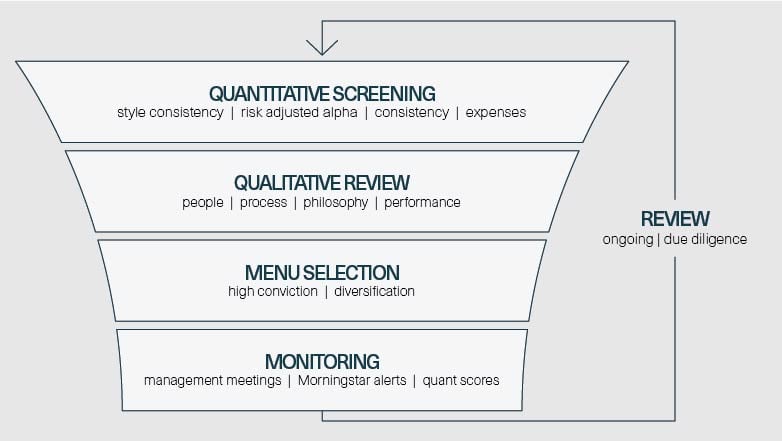

Our open architecture investment approach means that we're not tied to any proprietary funds, so you can be certain you'll receive objective advice regarding your fund offerings.

WEALTH INSIGHTS

EDUCATION & GUIDANCE

BUSINESS GUIDANCE

Our advisors work hard to ensure your retirement plan is tailored to fit the needs of your organization's overall benefit program.

FIND AN ADVISOR