Rock County Home Prices Continue to Climb

Share

- Rock County home prices continue to climb

- Peter Speca Joins Johnson Financial Group

- When Retirees Give Away Too Much Money

- $10bn Shop's Top Gatekeeper Gets ‘Interesting’ With Fixed Income

- After ‘rock fight’ in 2023, banks see businesses taking wait-and-see approach

- What does your spouse want in retirement? 6 questions to ask.

- When Retirees Give Away Too Much Money

- Johnson Financial Group: Expands presence in Madison new West Towne location

- Johnson Financial Group Shares Tips for Buying a Home in 2024

- Advisors Urge Caution On Penalty-Free IRA, 401(k) Early Withdrawals

- Donations of nearly $70K pour in following tool theft from Waukesha Habitat for Humanity

- Dominic Ceci appointed Chief Investment Officer for Johnson Financial Group

- Associated Bank, Johnson Financial partner to provide funding for affordable-housing project in Madison

- Understanding Interest Rates and Unlocking Financial Power

- Ben Pavlik, Top Corporate Counsel Award

- Your Guide to Women’s Wealth Management

- Tim Sheehy appointed to Board of Directors

- WMC, Johnson Financial Group: Announce 2023 Coolest Thing Made in Wisconsin

- Johnson Financial Group ready to serve Lake Country community

- Most Corporate Charitable Contributors in Wisconsin

- Preparing Clients For The Risk Of Cognitive Decline

- Johnson Financial Group expanding with acquisition in Appleton

- How Big A Gamble Is Monte Carlo For Advisors?

- Married … With Finances

- Johnson Financial Group CEO discusses branch strategy with one set to open and another in the works

- Squire to retire after nearly two decades as Johnson Bank regional president

- Bringing a Personal Touch to Digital Banking

- At This Rate: Financial Institutions Dealing with Higher Interest Rates and Lower Loan Demand

- Table of Experts: Reading the tea leaves

- Checking in on Wisconsin banks

- Beyond Lip Service In DEI

- Johnson Financial Group to sell its insurance business to Boston firm

- Johnson Financial Group plans new branches, including in West Milwaukee

- New Johnson Financial Group Branch Planned In West Milwaukee and Delafield

- Johnson Wealth Fixed Income Tilts at Emerging Markets Debt, Mortgage Backed Securities

- Your Financial Foundation with Al Araque on the Lifeblood Podcast

- Unexpected health insurance surprise possible when pandemic insurance programs expire

- Bond Investors: Be a Prudent Pig, not a Yield Hog

- Women Insurance Pros on Balance, Community and the Future

- Financial Planning For Couples Who Totally Disagree

- How To Help Clients Who Own Businesses in Declining Industries

- Johnson Financial Group presents 'Lightfield' coming to Cathedral Square Park

- Johnson Financial Group Named Top LGBTQ Workplace

- Financial advice is the midlife job that women want – but don’t know exists

- Expert Insight for Beginner Rental Property Investors

- Coolest thing made in Wisconsin announced by WMC and Johnson Financial Group

- Corporate Charitable Contributors in Wisconsin

- 'Coolest Thing Made in Wis.' voting begins

- Johnson Financial Group and Habitat for Humanity Kenosha work together to help homeowners

- We have a responsibility to be solution providers for our customers

- Being a leader is a team sport

- Jason Herried Joins Chuck Jaffe on Money Life

- Have questions about "Gray Divorce"? Attorney Kelly Mould, CRP® can help.

- Jazz in the Park Is Back Thursday Nights Starting July 21

- People in Business - Al Araque

- 2022 Housing Market Overview: Everything You Need to Know

- "Give Back More Than You Take" - Helen Johnson-Leipold

- A Brief History of Economic Crises, Crashes and Recoveries

- Kelly Mould and Kate Trudell Earn State Bar Award for Outstanding Service

- JFG Supports Affordable Housing through FHLBank Chicago

- Helen Johnson-Leipold shares business tips for success at Marquette speaker series

- Notable Commercial Banking Leaders: Thomas Moore

- Notable Commercial Banking Leaders: Viktor Gottlieb

- Johnson Financial Group partners with Racine Habitat for Humanity to service mortgages at no cost

- Upcoming Lineup Of Broadway Shows Announced At Marcus Performing Arts Center

- See the Milwaukee Business Journal's 2022 Real Estate Award winners

- Joe Maier “Employers are going to have to rethink their practices”

- Emotional Investments: Why They Happen and How to Avoid Them

- Investors are a growing force in the residential real estate market, but how should sellers evaluate these offers?

- Inflation advice for younger colleagues

- Amber Krogman: 40 Under 40

- Rising Stars in Wealth Management: Robert Schneider

- Should You Sell Your House to an Investment Company?

- Evoking change within the Milwaukee community with Johnson Financial Group's Jim Popp

- A Shift in the Tech Landscape

- Evoking change within the Milwaukee community with Jim Popp, CEO of Johnson Financial Group

- The Rising Trend Of "Gray Divorce" with Kelly Mould of Johnson Financial Group

- Evoking change within the Milwaukee community with Jim Popp, CEO of Johnson Financial Group

- Johnson Financial Group Recognized on Financial Planning's 2021 RIA Leaders List

- Find out why these business leaders are 2021 Milwaukee-area power brokers

- Thoughts for business executives on future-proofing a business

- Jim Popp Joins Fox 6 to Announce the Milwaukee Holiday Light Festival

- Milwaukee’s Holiday Lights Festival Kicks Off This Week!

- #FreeBritney: When Protections Turn Toxic

- WisBusiness: the Podcast with Jim Popp, president and CEO of Johnson Financial Group

- WE Energies Customer Spotlight On Energy Efficiency

- Johnson Financial Group donates $500,000 to United Way organizations across Wisconsin

- Madison’s Moving Business Forward Podcast

- Thoughts for business executives on return-to-office technology

- First look: Johnson Financial Group's new Downtown offices and branch

- Johnson Financial Group Shows Off High-Rise Office

- Six Tips for Developing a Business Plan for Uncertain Financial Times

- Is Bitcoin Here to Stay? An Assessment of Opportunities and Risk

- You may have a ‘huge edge over high-powered investors,’ says investing risk expert: Here’s why

- Executive Insights with Jim Popp

- CEO Jim Popp Honored as Distinguished Executive

- 2021 Guide to Wealth Management: A War on Wealth?

- Notable Alumni: Scott Cooney

- Jason Herried Joins Chuck Jaffe on Money Life Market Call

- Top Workplaces 2021: Q&A with three CEOs who were recognized for their leadership during a challenging year

- How will Biden's new tax plan affect you?

- American Jobs Plan: Potential Implications for You and Your Business

- Get on the Right Track to Financial Freedom

- Greater Madison area Top Workplaces 2021

- The Crazy Housing Market: Buy, Sell or stay on the sidelines?

- UPAF Ride for the Arts series will take place over three June weekends

- Financial services industry helped guide businesses through sharp downturn: Banks hustled to meet massive PPP demand

- Financial services industry helped guide businesses through sharp downturn: Banks hustled to meet massive PPP demand

- Johnson Financial Group matches food donations to help feed Wisconsin families

- Johnson Financial Group: To donate $300,000 to help feed Wisconsin families

- Women in Leadership: Sharing & Celebrating Women's Stories

- 2020 Milwaukee-area power brokers

- Dow Surges to Highest Level Since February on Vaccine Results, Biden Win

- Johnson Financial Group Named One of Wisconsin's Largest Corporate Charitable Contributors

- Don't forget about the "I" in D&I

- Johnson Financial Group to move Milwaukee offices to Cathedral Place

- Pandemic Uncertainty Leaves Wisconsin Bankers Ready To Reserve

- What's going on in the financial markets right now with Jim Popp of Johnson Financial Group

- Downside risk is now a pit, not a chasm. Still, underweight stocks & overweight (some) bonds.

- Why You Want To Keep Your Politics Separate From Your Investing

- Johnson Financial Group growing, still hiring on its 50th anniversary year

- The COVID Calculation

- Pleasant Prairie company gets boost from Paycheck Protection Program

- Banks locally, statewide step up to help businesses obtain $8.3 billion in PPP

- Johnson Financial Group donates $200K to support United Way, other nonprofits during COVID-19 pandemic

- Second round of PPP starts slowly as Milwaukee-area businesses still await loans

- Wisconsin lenders ready to shell out hundreds of millions in Paycheck Protection Program loans

- Planning opportunities under the CARES Act

- BizTimes Media Announces Milwaukee’s Notable Women in Commercial Banking

- Johnson Financial Group adviser honored

- Tech-driven R&D goes beyond the budget. Some Milwaukee execs speak up

- What would cause markets to react after Fed meeting

- Banking official remains confident in local economy's growth

- The coolest thing made in Wisconsin

- Dan Defnet named president of Johnson Bank

- Future Returns: Ignore Politics When Investing

- Local banker to get Forward Janesville's Lifetime Achievement Award

- Wisconsin Could See Economic Slowdown This Year, Not Recession

- When Corporate Bonds Are a Risky Investment

- Johnson Financial Group becomes Broadway at the Marcus Center title sponsor

- Getting Ready to Exit: What Baby Boomers know and should know about getting their business ready for sale

- Take Five: Putting some Popp in banking

- Jim Popp in the News

- Jason Herried's Take on the 'Booms and Busts' of the Economy

- Johnson Insurance creates new 'workplace of choice'

- Paul Ryan lauds Harvard award-winner Helen Johnson-Leipold

- Business Leader of the Year Helen Johnson-Leipold leads big parts of the Johnson family business

- Johnson Financial Investment Expert: More growth, low inflation ahead

- Foxconn's Balance Sheet Tipped in Mt. Pleasant's Favor

- JFG honored by Department of Defense

- The Open Road comes to the Milwaukee Art Museum

- 3 business lessons from the new Johnson Financial Group CEO

- Executive Q&A: Jim Popp takes the helm at Johnson Financial Group

- Banking exec Jim Popp named president of Johnson Bank

- Banker: Focus on millennials, not president

- American Birkebeiner Legacy Lives on with Support from Johnson Bank and Johnson Family Foundation

- TEMPO MILWAUKEE 2020

AFTON

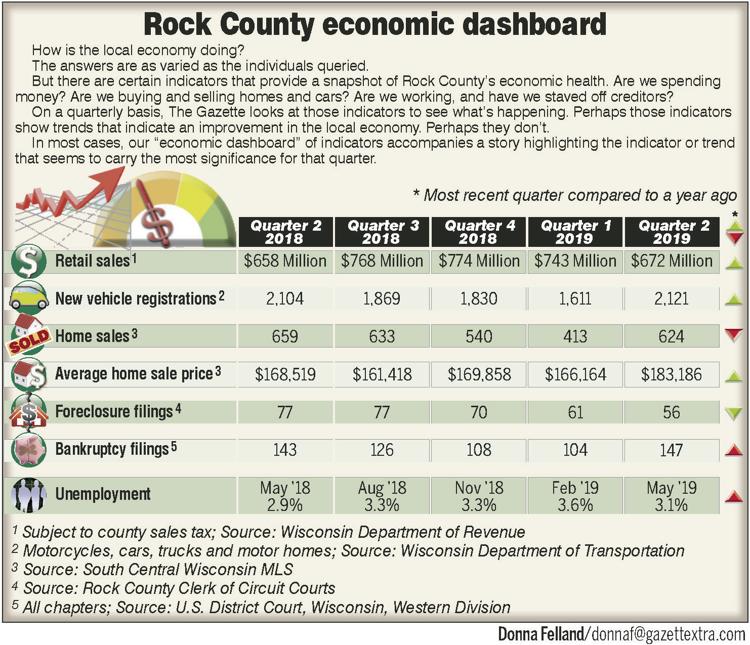

The wildflowers growing next to a 2,000-square-foot ranch house on West Bass Creek Road might not realize it, but the property where they live likely will sell for about 10% more than it might have last year.

The Rock County housing market continues to experience tighter-than-average inventories, and dips earlier this year in federal interest rates and recent gyrations in the stock market have begun to light the market’s fuse.

In the second quarter of this year, home sale prices shot up significantly, outpacing prices of a year ago by 8.7%. It’s a sign of a market on the rebound after flat sales earlier this year.

In June, the average sale price for the existing 234 homes sold was $197,500, according to South Central Wisconsin Multiple Listing Service data.

That’s significantly higher than the $170,000 average sale price in June 2018.

Those numbers lead the pack for economic indicators The Gazette tracks in its quarterly economic dashboard.

Local Realtors and mortgage lenders say the price jump isn’t enough to consider the market overheated. However, it does put the average home sale price at nearly double what buyers paid in 2012, when the local economy was in recovery mode.

Loren Fellows, a mortgage manager for Johnson Bank in Janesville, said she believes a federal interest rate dip last month along with tight local availability of homes are driving an emerging set of sellers.

Some of them, Fellows said, are second-time or third-time homebuyers who have equity and are eyeing a chance to buy a different home at a favorable mortgage rate. At the same time, she said, recent announcements about tariffs on Chinese goods have caused movement from the stock market into the bond market, which is closely tied to housing.

Those forces have fueled an increase in new listings, bolstering an inventory that had just three months of available housing a year ago. That’s about half the amount most real estate analysts consider a “balanced” housing market—one equally favorable to buyers and sellers.

The local housing market saw a 25% increase in residential listings at the end of June, compared to the same period a year ago.

Overall, available home inventory has climbed to 3.8 months of homes available.

“It’s become the perfect storm for people being a little more willing to jump into the real estate market,” Fellows said.

That might explain why a three-bedroom ranch in Afton (with a $198,000 price tag) got an accepted offer last week, less than a month after it was listed. It was bought by a local person who also sold a home in equally short order.

“There is an urgency to buy while the money is cheap,” said Erika Penny, a Realtor for Briggs Realty Group in Janesville. She’s the agent who listed the house.

Penny stopped at the house Monday to tack up an “accepted offer” card on the real estate sign in the front yard.

The house had drawn multiple suitors. The eventual buyers sent a letter to the owner that explained how much they love the home and the property around it.

Traditionally, home sellers and prospective buyers hardly ever meet or speak to each other before closing.

“The letter—that’s something that’s new,” Penny said. “It’s something people started to do recently. Anything to set yourself apart.”

Fellows said the housing market is seeing more buyers who are moving to the Janesville area from out of state. The ink just dried on a pair of mortgages her staff wrote for people who are moving here from Colorado, she said.

“It’s jobs. Some of them are manufacturing positions, everything from laborer-manufacturing stuff, hourly workers to new management those companies are bringing in,” Fellows said.

She said she’s also seeing more homes bought by airplane pilots, high-tech engineers, doctors, doctors-in-residence and other medical workers, all of whom are moving here for work.

Adam Briggs, a broker and Realtor who operates Briggs Realty Group, said he’s watching for signs of an overheating market.

If prices continue to climb for lower-priced homes, it could become harder for first-time homebuyers on government loan programs to bankroll a mortgage—particularly if the homes they want need remodeling.

Briggs said if the number of people listing homes keeps increasing, the extra inventory could ease the upward march in prices.

“I’m not complaining about the current market we’re in,” he said. “At some point, it probably will level itself out.”