Kelsey Ellsworth

VP Wealth Portfolio Manager | Johnson Financial Group

As Vice President, Wealth Portfolio Manager, Kelsey works with clients to achieve their unique goals and objectives.

Wealth Insights

5 minute read time

After welcoming my twin daughters this year, I feel deeply thankful for the journey that has changed me in ways I never imagined. Balancing sleepless nights, endless diaper changes, and double the laughter has taught me strength, patience, and gratitude on a whole new level. When I sit quietly with one of my daughters in our rocking chair, my mind begins to wander. What will the world look like when they’re older—what will shape them in high school and beyond? I look back to my high school days when Facebook was just starting, and flip phones were the norm. Being a new parent, I naturally have many questions. Typically, I would Google something like, “when will my baby start to crawl.” More recently, however, I, like many others, have turned to AI tools like ChatGPT. It has even helped me quickly compare two car seats so I could make a quick and informed decision. As the world changes rapidly, it’s hard to envision what things will look like in a few years or decades, but the data points to some key themes ahead.

Some key themes that are driving the AI boom include an aging population and the need for increased productivity growth. By 2040, my girls will be learning to drive (help me!), and the workforce will look a bit different, with about 27% of the population in retirement age and beyond.

In order to combat a declining labor force participation rate, there will be a need for increased worker productivity. This is where productivity gains from generative AI and other AI technologies come into play. JPMorgan estimates productivity growth of 1.4-2.7% resulting from these AI tools, in addition to the expected 1.5% annual productivity growth projected by the Congressional Budget Office. According to a report from METR and JPMorgan, the length of tasks that some of these AI models can complete with 50% reliability has been doubling approximately every seven months for the last 6 years. There is tremendous potential, and many investors want a piece of the action.

As Brian Schaefer illustrated in his recent piece, high expectations can be tough to meet. With AI use growing exponentially, company revenues have climbed, but not as much as their funding needs. OpenAI and Anthropic, two of the largest private AI companies, need to spend so much on chips and datacenters that they have no profits. Anthropic expects to just break even for the first time in 2028. Investors are hopeful, but reality about the bottom line is starting to sink in.

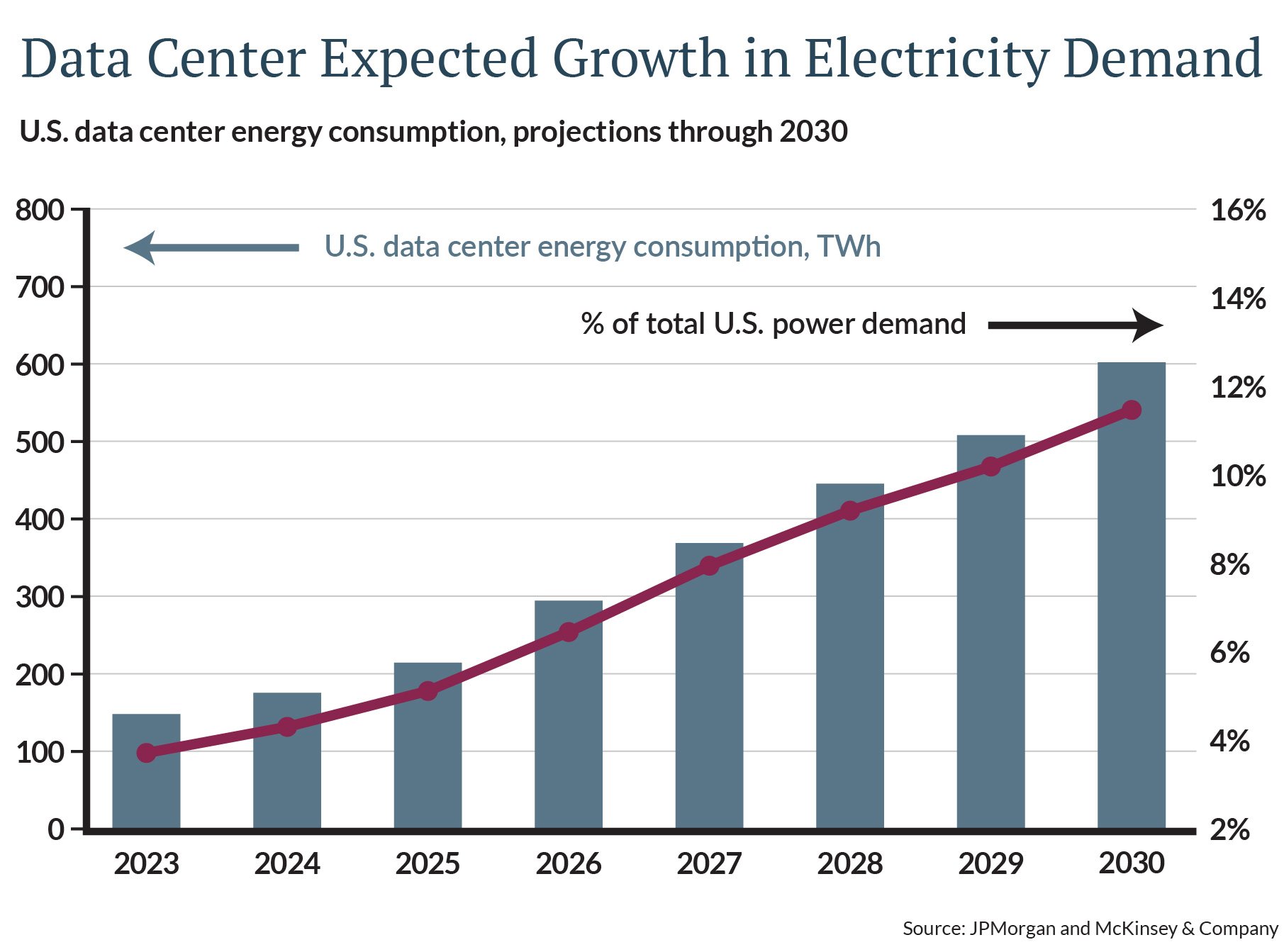

As public companies such as Meta and Microsoft report earnings, shares have declined recently due to uncertainty about the outsized spending dedicated to AI. At some of these tech companies like Nvidia, Alphabet, and Microsoft, profits have been climbing this year mainly as a result of investing in or being a supplier to the private companies building AI technology like OpenAI and Anthropic. Some of the largest technology companies in the S&P 500 report that they will spend a combined $400 billion in AI related capex. On top of that energy needed to power the demand is expected to triple through 2030 and has supercharged recent data center construction. The United States now houses almost 40% of world datacenters according to a report by Piper Sandler.

While we see parallels being drawn to the Tech bubble of the early 2000s, the key difference is that earnings growth data shows profits have been keeping pace with prices this time. Still, as company shares hit all-time highs along with exorbitant capex spending, and the power demand needed, we see investors begin to get nervous about bubble territory. We believe investors should recognize the volatility and risks of this cohort. Four out of the seven Mag 7 stocks are underperforming the index this year and only two are in the top 50 performing S&P 500 stocks this year—Alphabet and Nvidia. This year we have seen a well-diversified portfolio pay off.

This year has certainly been a significant one for me. For the markets and the economy, it has been a big year as well. Rate cuts and no recession have been positive for stocks and bonds. U.S. Equities are positive in the mid-teens while international equities are in the high twenties. Bonds are up over six percent. A diversified portfolio has rewarded investors especially during the second quarter when tariffs were first announced, and we have seen stock and bond correlations decline slightly. We have also seen much in the headlines regarding the government shutdown, but market reaction to government shutdowns has historically been restrained and this shutdown was no exception.

This month, JP Morgan released its annual Capital Market Assumptions. This is the long-term outlook for asset classes like domestic stocks, international stocks, bonds and alternative investments. These assumptions are built into our financial planning software to help determine our clients’ proper asset allocation and probability of success. Because of the excellent returns that we’ve had over the past three years, equity predictions on a go forward basis are lower year-over-year. Investors are now paid 4-5% to hold high-quality fixed income and no longer need to take on as much risk as they once did.

As we round out another great year, it’s a good time to schedule a review with your advisor. There is much to be thankful for this year. All of us at Johnson Financial Group wish you a good holiday season!

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE