We hope you found value in our quarterly video update on market and economic topics. This article builds on that recorded conversation with Johnson Financial Group’s Jason Herried and Eric Trousil.

Let’s pause a moment to reflect on how far we’ve come over the last year in financial markets. A year ago, the COVID-19 virus was spreading across the globe, significant portions of the economy were shutting down and financial markets reacted with a precipitous decline to reflect the associated risks. Today we are solidly on the road to recovery.

- Equities are off to a strong start in 2021, and the backdrop remains favorable. The economy is on the cusp of a rapid recovery that may lead to GDP growth of 6-8%.

- Economic data has been better than expected and consumer and business sentiment have improved.

- As the growth outlook has improved, inflation expectations and interest rates have also increased.

- The changing outlook for growth, inflation and interest rates have also been highly influential to equity markets through higher prices and a change in leadership.

Equities Higher Along With Recovery Outlook

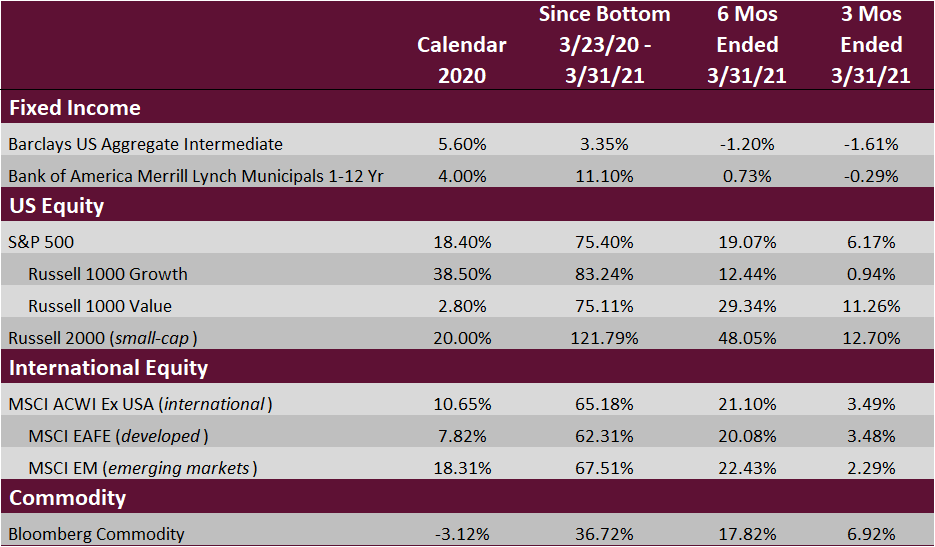

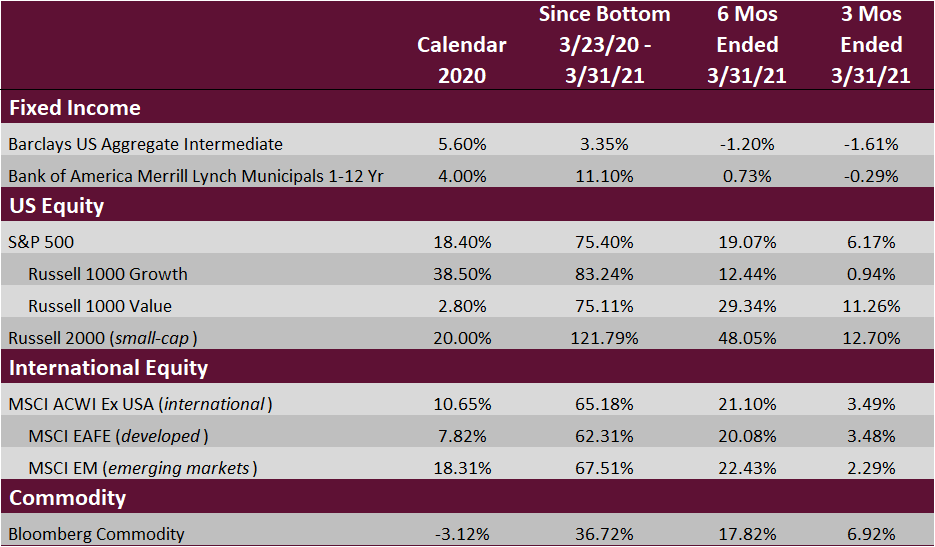

As detailed in [Exhibit 1], the S&P 500 Index climbed 6% during the first quarter in the context of an improved outlook for the economy and profits. Even more impressive than the first quarter return is the 75% gain since the March 23 market bottom, which is far better than we dared to imagine at the time.

Also evident is the rotation in leadership from growth to value. Returns for the growth style increased 38% in 2020 compared to 3% for the value style. Over the past six months, however, the value style has returned 29% compared to 12% for the growth style.

Exhibit 1: Asset Class Returns

Source: Morningstar Direct as of 3.31.21

The Reopening Rotation From Growth To Value

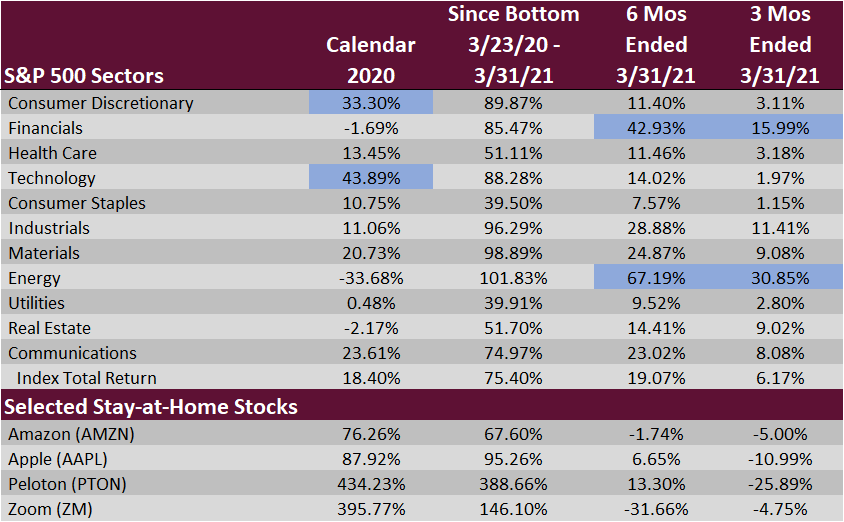

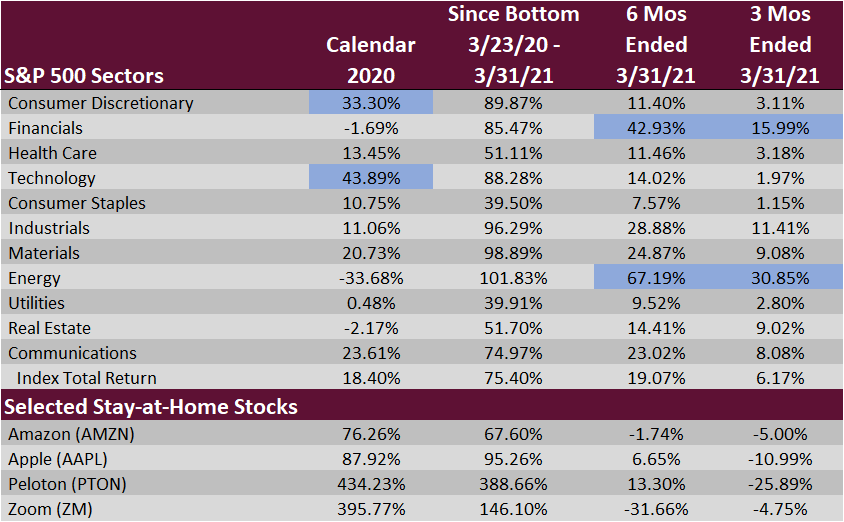

The reason for the rotation from growth to value is that there has been a significant change in performance at the sector level [Exhibit 2]. During most of 2020, the growth style was propelled by a heavy weighting to the technology sector, which benefited from, or at least proved resilient to, the pandemic-induced recession. However, value sectors such as Energy, Financials, Industrials and Materials have led markets over the past six months based on the hope that arrived with vaccines and more recently the reopening of the economy.

While we have no particular opinion on these individual stocks, it is interesting to look at the performance of some of the darlings of the stay-at-home economy. For example, Peloton and Zoom gained 434% and 396% respectively in 2020 but have posted lackluster returns since prospects for the economy improved and investor attention focused on companies poised to benefit from the recovery.

Exhibit 2: Equity Sector Returns and Selected Stocks

Source: Morningstar Direct as of 3.31.21

Earnings Rebound Underway

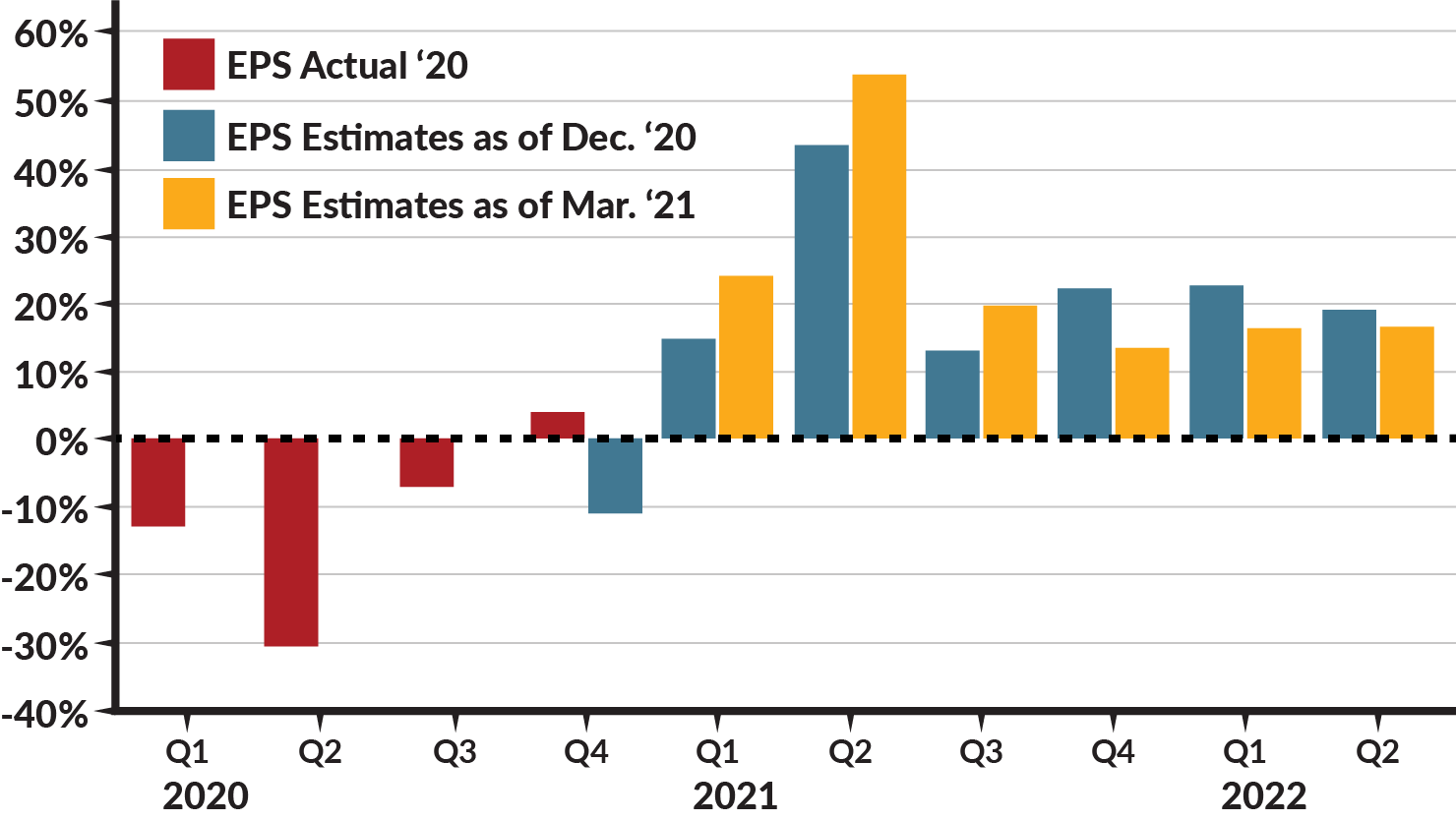

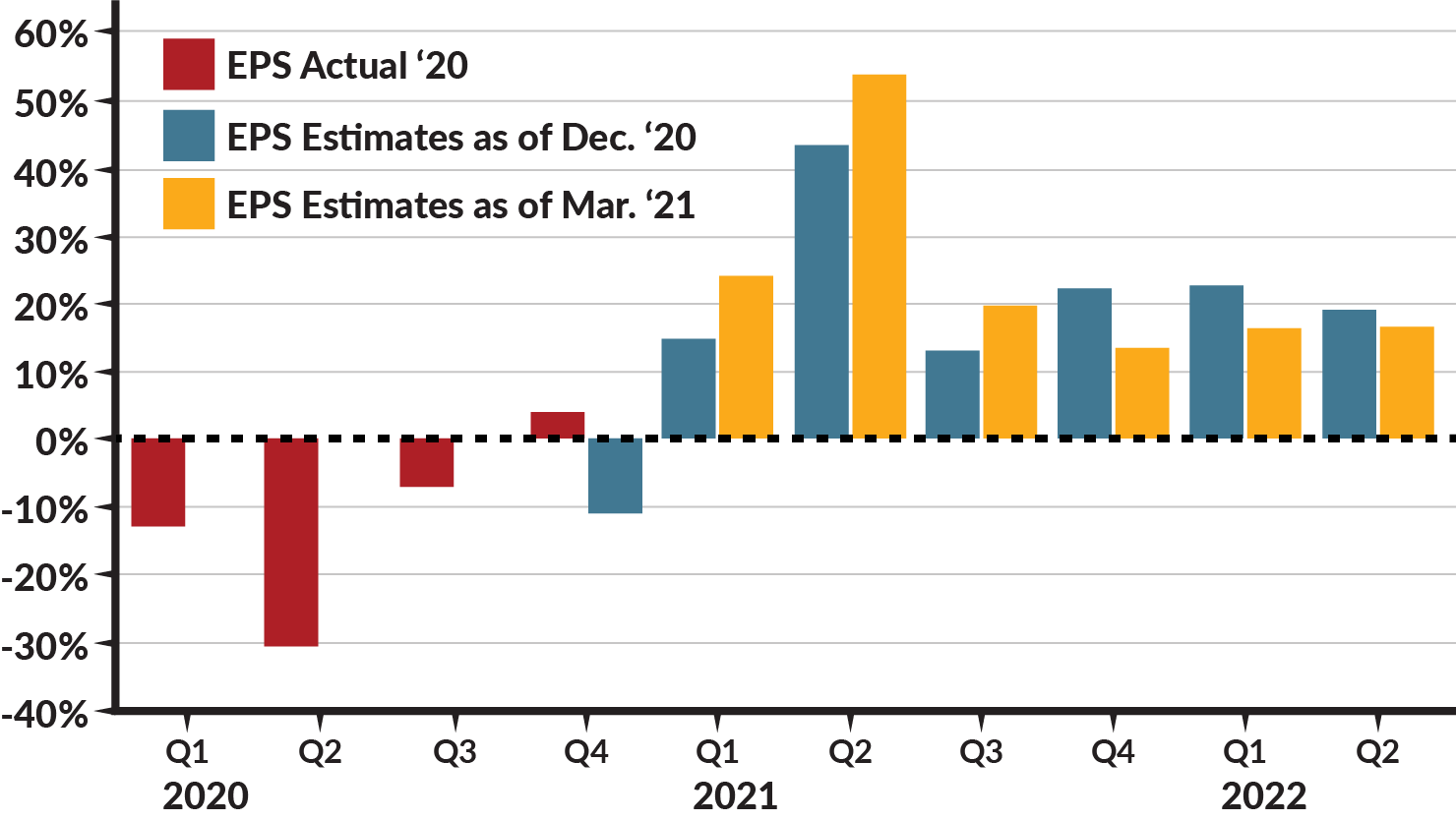

The recovery in cyclical sectors is in anticipation of better economic growth and a recovery in earnings. Investors were too conservative with their earnings estimates last quarter as companies crushed expectations, posting gains of 3.8% compared to expectations for an 11% decline!

The improvement carried forward into 2021, with earnings now anticipated to return to pre-pandemic levels during the fourth quarter. Looking to the first two quarters of 2021, earnings are expected to increase 24% and 54% compared to the earnings plunge companies faced during the comparable quarters a year ago.

S&P 500 Operating Earnings Growth by Quarter

(Year over Year Percent Change)

Source: I/B/E/S data from Refinitiv as of 4.1.2021

Equity Market Outlook

We expect the backdrop for equities to remain positive for at least the next quarter or two. The reopening of the economy is proceeding ahead of expectations providing visibility toward what is likely to be multiple years of earnings growth. In addition, financial conditions remain loose as evidenced by credit availability, the recently passed $1.9 trillion fiscal relief package and no sign of an immediate change in Federal Reserve policy.

Given this backdrop, we have sought to position our portfolios with a small overweight to stocks, with the equity sleeve tilted toward cyclical sectors, which we believe will benefit as the economy reopens. While companies within cyclical sectors are expected to benefit from the reopening, we continue to have exposure to secular growth stocks as markets have been quick to adjust at the first sign of trouble. In other words, diversification remains as important as ever.

The primary risks to the positive backdrop for equities relate to the virus, policy and sentiment:

- Any setback in the containment of the virus or rollout of vaccines would push back the recovery in earnings, and prices may correct to reflect the new reality.

- While policy is supportive today through fiscal spending and easy monetary policy, a booming economy may change the timing of interest rate hikes or the level of fiscal support. In addition, the infrastructure package currently being discussed includes an increase in corporate, income, capital gains and estate taxes, which would be headwinds for earnings and investor returns.

- Finally, sentiment is currently optimistic based on the strength of the recovery. Once the good news is reflected in stocks, prices are at risk of even minor disappointment.

Closing Thoughts

As we reflect on the past year, it is amazing that equity markets are making new highs and have been for months. This is a reminder that equity investors are forward looking in nature and climb a wall of worry as risks that once seemed highly probable fade away.

Currently the risks are fading and optimism is justifiably running high. While we may receive some minor bad news that may cause some turbulence for the equity market, the overall backdrop is positive and we would seek to use corrections as buying opportunities.

With that said, now that markets have recovered, now is a great time to revisit your financial plan and your risk tolerance to make sure your plan is on track and the risk embedded in your portfolio remains appropriate.

ABOUT THE AUTHOR

SVP Wealth Portfolio Manager | Johnson Financial Group

As Senior Vice President, Wealth Portfolio Manager, Eric works with individuals and non-profit organizations to create customized investment solutions. With a strong emphasis on providing a personalized experience, Eric actively listens to each client’s unique needs to deliver the most relevant financial solutions.