SUMMARY

Learn how to create a sustainable retirement budget that covers essential expenses, lifestyle costs and unexpected events. Discover tips on managing retirement income, estimating expenses and maintaining financial security throughout your golden years.

As you navigate retirement, budgeting becomes a critical aspect of ensuring you enjoy a comfortable and stress-free post-work life. We've identified some key strategies that can help you manage your finances effectively and make the most of your golden years.

Finding Your Purpose

One of the significant changes you’ll face is the shift from earning income to living off your savings. Try to view retirement as an opportunity to focus on your personal goals, rather than a period of reduced spending.

Think to yourself: If you had all the time in the world, what would be the three things you’d spend your time doing? Would it be a new hobby, revisiting a past passion, traveling, spending time with loved ones or committing to volunteer work? By focusing on the areas that matter to you most, you can create a fulfilling retirement that’s tailored just for you.

Understanding Your Financial Landscape

Retirement Income Sources

First, you need to consider all potential income sources, including your pension, Social Security benefits and retirement accounts like your 401(k) and IRA. Understanding how these sources contribute to your overall retirement income is foundational.

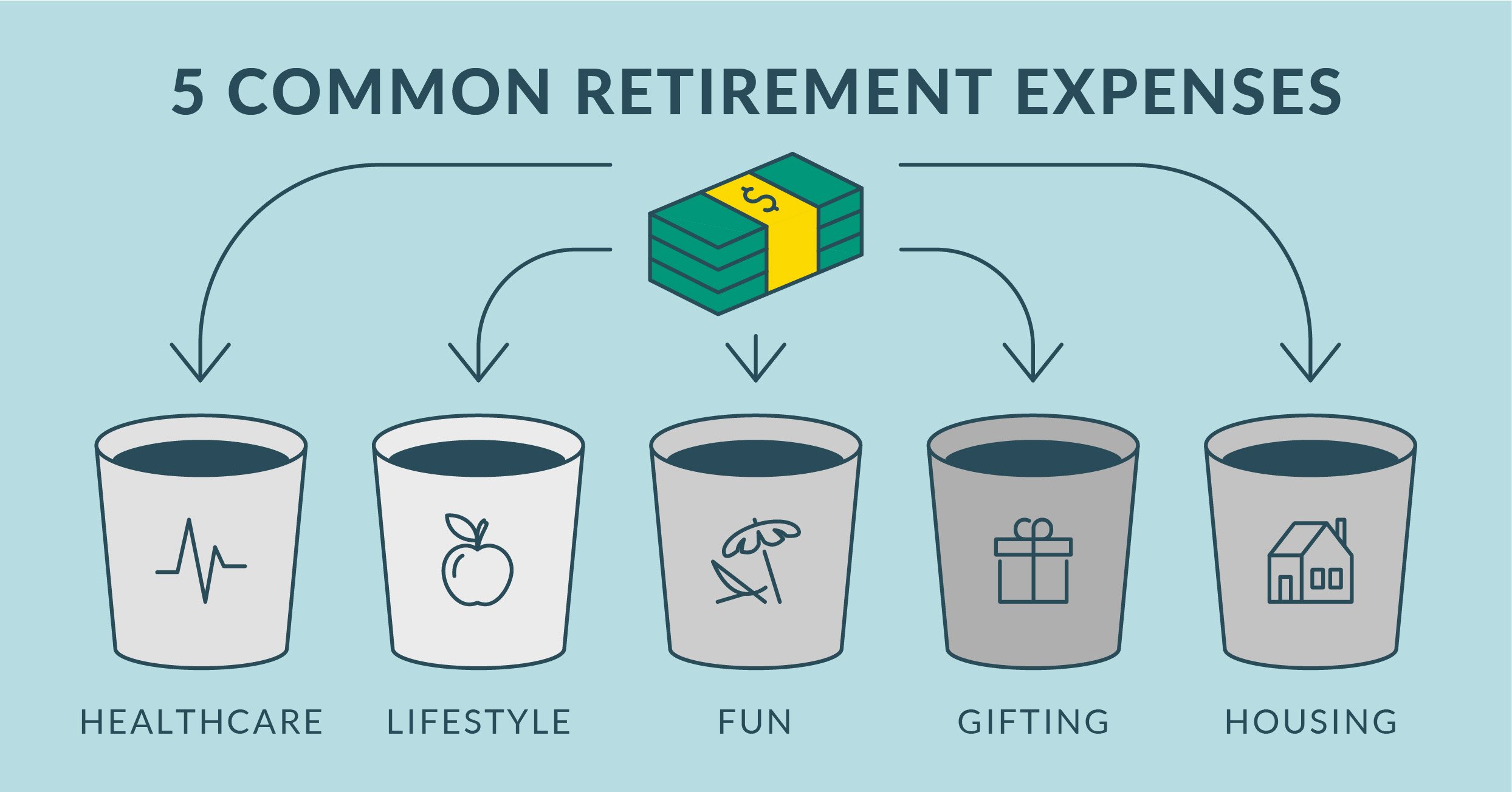

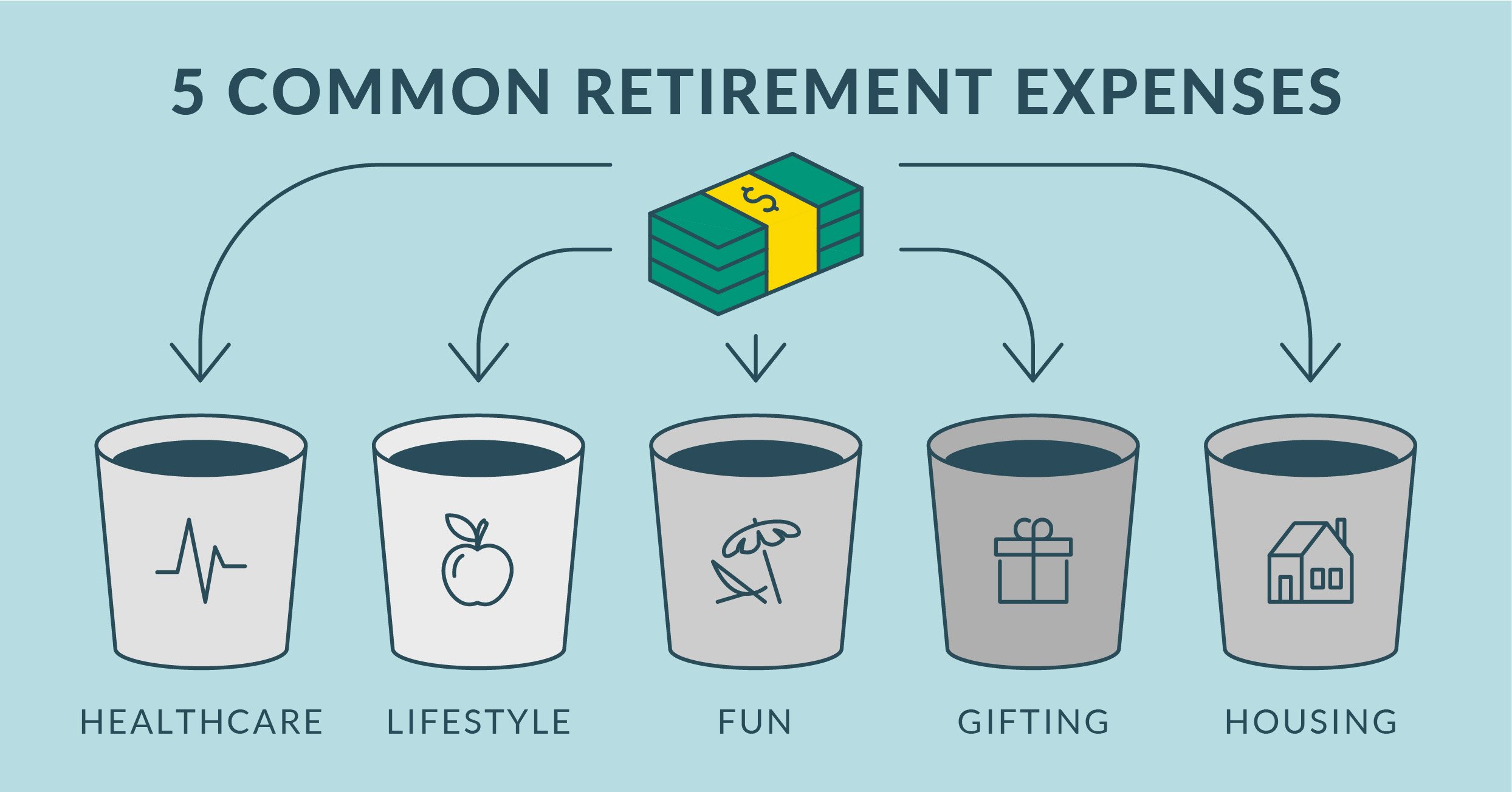

5 Common Retirement Expenses

You’ll need to anticipate various expenses, some of which may have changed from your pre-retirement spending habits. Here are some key areas to consider:

- Healthcare and Long-term Care: If you retire before age 65, healthcare coverage can be a significant expense until you're eligible for Medicare. A common estimate is $1,000 per month for marketplace coverage. There’s also a potential need for long-term care. Make sure to create a “just-in-case” plan for this possibility.

- Lifestyle: These are your normal day-to-day costs like utilities and groceries.

- Fun: You may have travel plans, volunteer work or hobbies you’d like to focus on. You'll need to budget for those dream vacations and activities.

- Gifting: You might want to gift money to your kids, grandkids or charitable organizations, either directly or by paying for education expenses.

- Housing: No matter if you’re buying a second home, downsizing or moving to be closer to loved ones, it’s important to think about where you want to be in retirement.

4 Strategies for Managing Your Retirement Finances

Here are some strategies to consider that can help you manage your finances effectively:

- Sustainable Withdrawal Rate: A common rule of thumb is to withdraw 3-5% of your retirement portfolio annually to ensure sustainability. However, this can vary based on your individual goals, circumstances and age.

- Distribution Planning: Managing required minimum distributions (RMDs) from your pre-tax retirement accounts can help minimize taxes. Strategies like Roth conversions and qualified charitable distributions (QCDs) can be beneficial in reducing RMDs - you'll need to discuss this with your financial advisor.

- Budgeting and Expense Tracking: Creating a detailed budget and regularly reviewing expenses can help you stay on track. Download our retirement budgeting worksheet to get started today.

- Flexibility: Be prepared to adjust your plans as needed. Regular reviews with your financial advisor can help ensure that your retirement goals remain achievable.

How to Create a Retirement Budget Plan

Here's how you can create a solid plan:

- Start with a Comprehensive Financial Plan: Working with a financial advisor can help you understand your financial situation and create a tailored plan.

- Detail Your Expenses: You'll categorize your expenses into areas like housing, healthcare, lifestyle, gifting and long-term care.

- Regular Review Your Budget: You'll need to regularly review and adjust your budget to ensure it remains aligned with your retirement goals and changing circumstances.

- Meet With Your Advisor: Don’t forget to meet at least annually with your advisor to help keep you on track.

Working with a financial advisor and maintaining a budget are key to navigating your retirement journey with ease. If you have any questions about retirement planning, please reach out to your advisor or connect with one today.