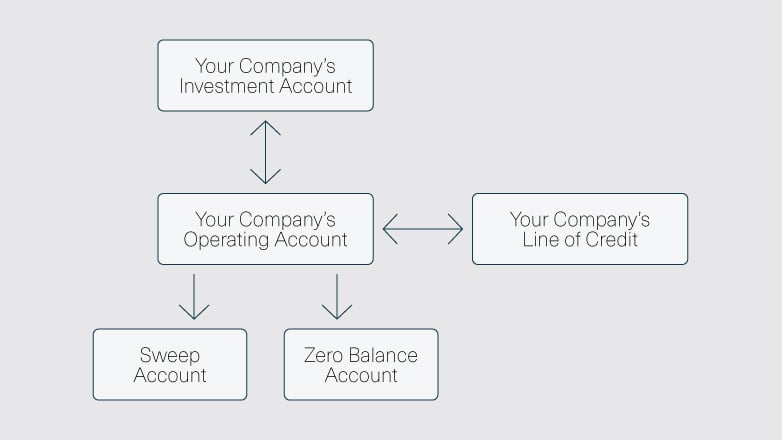

Sweeps & Zero Balance Accounts

Automate to improve cash flow and maximize your excess funds with sweep accounts. Move funds automatically between your accounts while maintaining adequate funds for disbursements.

Sweep Account Options

Line of Credit Sweep

Also known as an automated credit sweep, this refers to an arrangement between the bank and corporation where excess funds are used to pay down short-term borrowing.

Overdraft Sweep

Prevent potential overdrafts by linking one checking account to another.

Investment Sweep

This is a secondary bank account offering additional investment options on idle funds in a primary cash or checking account.

DDA-MMDA Option

Earn interest on funds swept from demand deposit accounts or money market accounts, and rest assured knowing that your funds are eligible for FDIC insurance coverage.

Zero Balance Account

A balance of zero is maintained by automatically transferring funds from a master account in an amount only large enough to cover checks presented.

Sweep Account Benefits

Optimize funds

- Cash concentration is in the operating account instead of remaining idle in multiple accounts.

- Eliminate the need for multiple transfers by automatically investing excess cash each day into an interest bearing account to reduce borrowings and maintain adequate funds for disbursements.

Save time and money

- Eliminate overdrafts and the need to monitor or anticipate disbursements to initiate borrowing requests or for investment opportunities.

- View sweep transactions daily in AccessJFG.

- Receive a monthly statement for both the sweep account and operating account, clearly identifying all sweep transactions.

We can also help you with...

Payables Management

Reduce your risk and the costs associated with disbursing funds to vendors, employees and investors using tools such as ACH payments and wire transfers.

LEARN MORE about payables management.

Receivables Management

Improve your company’s funds availability, cash forecasting and audit control by placing money where it can be best used for investing or debt reduction.

LEARN MORE about receivables management.

Information Management

Manage your cash while gaining optimal returns with solutions based on your business needs.

LEARN MORE about Information management.

Fraud Prevention

Prevent fraudulent activity against your accounts by combining our fraud prevention solutions with business best practices.

LEARN MORE about fraud prevention.Your Trusted Treasury Management Advisor

No matter what financial needs you may have, we are here for you. Our experienced advisors work closely with you to build the right path to help you achieve your goals.

FIND AN ADVISOR