SUMMARY

Discover how to create impactful money memories with your kids with advice from our advisors.

Your Financial Life

6 minute read time

Discover how to create impactful money memories with your kids with advice from our advisors.

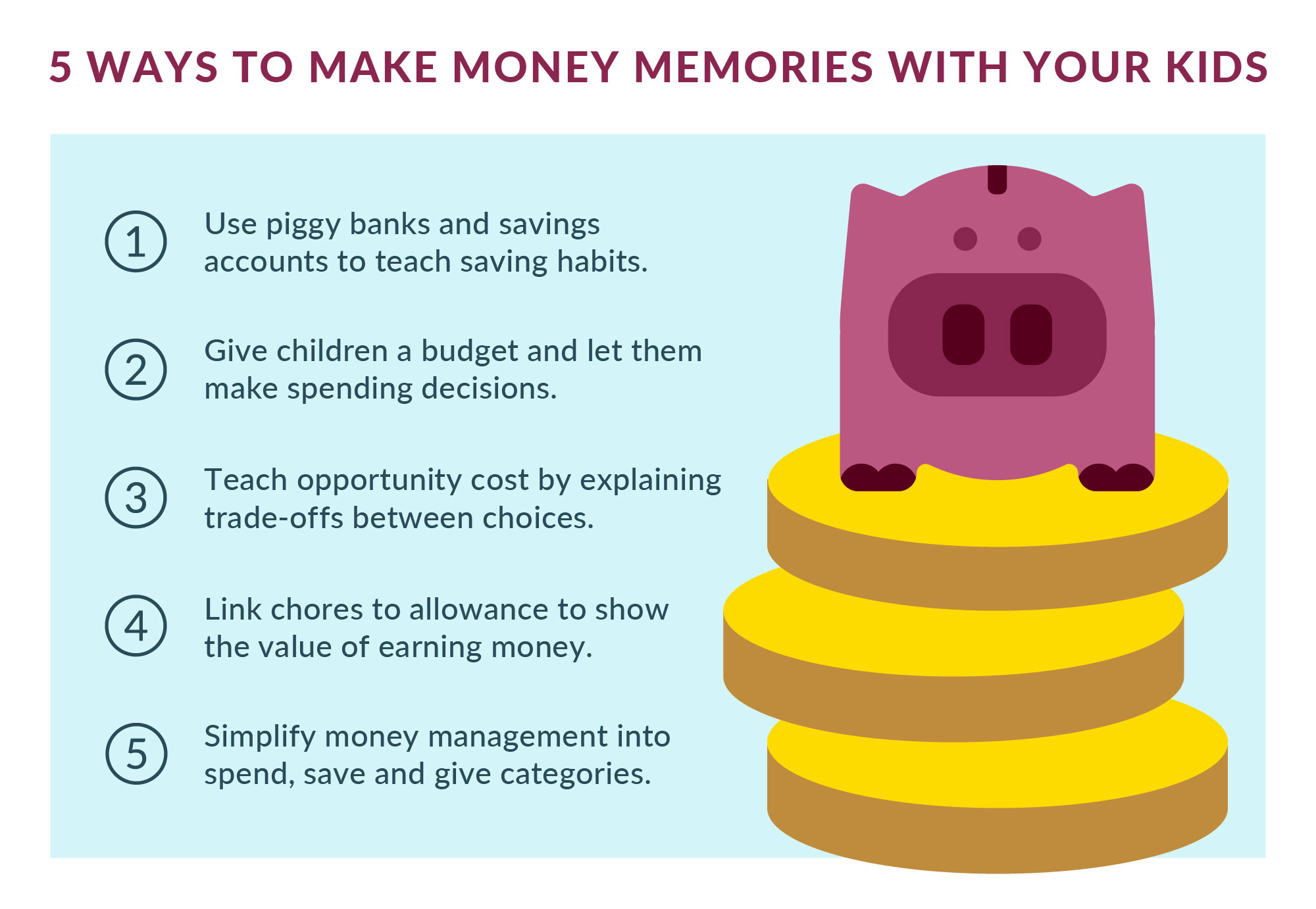

Teaching children about money management is one of the most valuable life skills parents can share. The lessons learned in childhood often shape financial habits that last a lifetime. Our advisors have shared their personal experiences and insights on how to create meaningful "money memories" with their kids, providing a unique perspective on effective ways to educate yours about financial responsibility:

“Each of our kids had piggy banks. Whenever they found loose change around the house, they would immediately deposit the money. We discussed the value of coins and later introduced them to currency. They also had savings accounts at the bank where they deposited money from their birthdays and holidays. The savings habits we taught them as children still hold true today and they are teaching their children about money. To continue the tradition, our grandchildren have piggy banks and savings accounts.” — Mark Rose, VP Private Banking

“My 3-year-old son and I grabbed random things from around the house — a banana, a book and a toy dinosaur — and set up a pretend shop. We made tiny price tags out of sticky notes: $.25 cents for the banana, $1 for the book and $2 for the dinosaur. Using my son’s little toy cash register, one of us played shopkeeper, the other a customer. We took turns handing over coins, making change and even pretending to save up for the "expensive" items. It was amazing to see how he started to understand the buying and selling of goods using money. That day was more than just a game — it was a little adventure in learning, laughter and make-believe.” — Brittany Sparks, AVP Branch Manager

“One of my favorite money memories was when we took a family trip to Disney. The kids had been saving up for months — doing chores, helping out and even stashing birthday money. And when it was finally time to go, I gave them their spending money…all in $1 bills. They each had a fat little envelope stuffed with singles — and you should’ve seen their faces. They felt rich! The deal was simple: You can spend this money on whatever you want at Disney — as long as you can afford it. It worked like magic. They took their time, looked at prices, made choices and felt super proud when they found something they really wanted — and could actually pay for it. It turned into a fun lesson on budgeting, decision-making and the value of a dollar. And best of all? No meltdown at the gift shop!” — Kim Jankowski, VP Private Banking

“I have two children, a 9-year-old and a 12-year-old, and I’m trying to teach them the concept of opportunity cost. People think about cost in monetary terms but there are all kinds of costs, like time. Once, when we had a free day, they wanted to go to both the zoo and the museum. We explained that we only had four hours to spend, and we had to decide to either go to the zoo or the museum, each one would cost us four hours. They chose to spend the four hours at the museum, so the opportunity cost is the trip to the zoo that we did not make. We also do it with money as well. We gave them $20 to spend at the store and they found a $20 stuffed animal, but wanted other things as well. So, they had to decide to allocate that money towards the stuffed animal or another item they wanted. Since they’ve started grasping the idea of opportunity cost, they’ve started to see that there are tradeoffs in life with both money and time.” — Dominic Ceci, Chief Investment Officer

“I let my kids set a money rule: It was their choice if, when and how they got to spend their fun money. The fun money went into a jar that they decorated. Stickers. Glitter. Jewels. Markers. Paint. Pictures. The more bling, the better! We made a big deal and celebrated loudly when fun money was added or spent. We still talk about and remember fun money fondly to this day. It was a simple, fun thing to do.” – Lynn Carlson, VP Consumer Banking Regional Manager

“I remember the fond memories of my wife taking my boys to Chuck-E-Cheese when they were younger. She would give the boys $10 each to spend on games (which if you are familiar with Chuck-E-Cheese that won’t go very long). This made them think, what is a want and what is a need even if it was for entertainment purposes. I recall coming home from work and hearing the boys playfully complain that mom only gave them $10 to spend and they had to choose what games would have the biggest bang for their buck. We laugh about these memories to this day.” — Eric Bernal, SVP Portfolio Manager

“My wife and I try to do whatever we can do to “materialize” and bring meaning to what a dollar can do or provide. The art of being able to “stretch a dollar” is a way of life for many and a skill that is refined over time. We discuss the cost of the various sports and recreational activities our girls are involved in and how packing meals and snacks when we go to these activities vs. ordering food or going to a restaurant saves a lot of money that can be used for other purposes.” — Scott Wisnewski, SVP Wealth Advisor

“As parents to pre-teens, my wife and I teach our kids the value of money by asking them to pitch in around the house. From walking the dog, to doing the dishes and taking out the trash, each chore they do every week is worth a different allowance amount. They can spend the money on something they want but we also teach them to save for something as well. Last summer they were both excited to see a new movie and so we agreed that they would save up and it would be “their treat” to take my wife and I as our wedding anniversary gift. They had earned just enough for a trip to the movies, popcorn included. As we sat in the theater, I thanked them and reminded them, “You earned this.” Their smiles said it all. On the way home, my daughter said, “We should do more chores so we can save enough to go see it again!” That moment stuck with me — not just because they enjoyed the movie, but because they began to understand the connection between work, saving and reward.” — Scott Kolodzinski, SVP Consumer Banking Manager

“A good way to teach kids about money is to simplify things. I like the concept of spend, save and give. What do you want to spend your money on? What do you want to save — ideally for a purpose that is measurable. And lastly, how do you want to give your money to causes or organizations? This exercise is fun when you ask kids their goals in each of these buckets, but when you explain you only have so much money, it gets them thinking about how to best allocate their funds. As they get older, yes, the dollar amounts change but the fundamentals remain similar.” — John Chidester, SVP Commercial Banking

Parents can help their children develop healthy financial habits and a deeper understanding of the value of money. By starting early and being consistent, you can give your kids the gift of financial literacy and a strong foundation for a lifetime of smart financial decisions. For more tips, check out our blog or connect with an advisor today.