Wealth Insights

SMAs and Cocktail-Party Cachet

5 minute read time

I am about 5’10” (when not slouching), and I never made it beyond eighth grade basketball. But some days I feel a deep kinship with basketball great Dikembe Mutombo. The 7’2” Hall of Fame center was one of the greatest shot blockers in NBA history. After swatting away an opponent’s shot, he would wave his index finger back and forth in a “not in my house” gesture. Later, he made some hilarious Geico commercials capitalizing on his trademark wag.

It's in my role as a member of our research team that I channel my inner Mutombo. Wall Street is a marketing juggernaut, and the number of calls and emails our team receives from people selling the latest and greatest investment products is staggering. Most of these investment vehicles don’t stand up to our research process due to high fees, poor processes, insufficient track record or dubious assumptions. Swatting the imposters away is a big part of the job, even if we don’t do it with as much flair as Mutombo.

But our job is also to take note of industry trends and make sure our clients have access to the vehicles and strategies that add value. One of these trends is the growth of Separately Managed Accounts, or SMAs.

SMAs Attracting Assets

SMAs are separately managed portfolios of individual securities. In the past, smaller investors could only gain access to broad diversification and professional money management via mutual funds or ETFs. However, with technology, account minimums have decreased, allowing more investors to benefit from institutional-style professional management, customization and greater tax efficiency across a wide range of equity and fixed-income strategies.

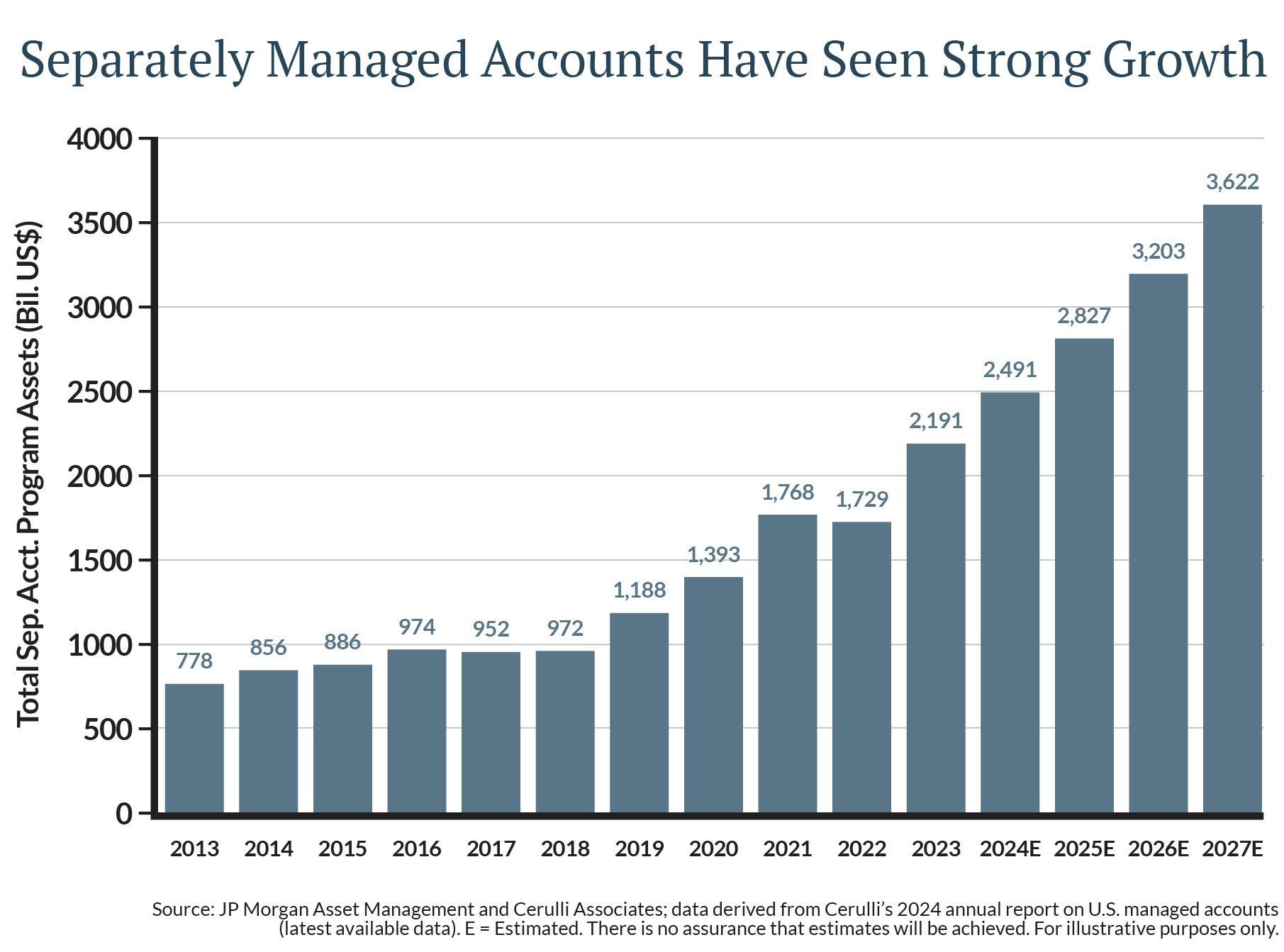

According to research firm Cerulli Associates, assets in separately managed accounts (SMAs) are expected to reach $3.6 trillion in 2026, up from $778 billion in 2013 and $2.2 trillion in 2023 [Figure 1].

Charts like that make asset managers see dollar signs, and it is no wonder that industry publications are encouraging advisors to take notice. One such publication was blunt in its advice to advisors. “ETFs are great, but don’t sleep on SMAs and their cocktail-party cachet,” they said.

Let’s take a closer look at equity SMAs and the reasons you might consider one.

Why Consider an SMA?

The most compelling reasons to invest in equity SMAs include:

- Transparency: SMAs allow for a real-time view into portfolio holdings.

- Tax Efficiency: Since the underlying securities are purchased directly, SMA investors only pay taxes on gains related to their account. Mutual fund investors are subject to gains embedded in the fund when they buy in.

- Customization: SMAs allow for tailored investment strategies that can align with individual client goals, including security and industry restrictions.

You’ll notice I didn’t include performance or the ability to invest with a star portfolio manager (otherwise known as cocktail-party cachet) in my list of reasons to own an SMA. It is a tempting thought to invest with a guru who can shorten your path to wealth with prescient trades. But technology and instant access to data have leveled the playing field for stock pickers. When we evaluate managers, we focus more on the firm, investment team, process, consistency and cost. In fact, perhaps the most compelling type of SMAs is the most boring: Direct Indexing.

Direct Indexing and Maximizing Tax Efficiency

Direct indexing is a strategy that looks to replicate an existing stock index, like the S&P 500, through direct ownership of individual stocks, in a taxable account. The biggest benefit of direct indexing comes from the opportunity for tax-loss harvesting. This involves selling positions that are down— “harvesting” or recognizing the losses—and using those losses to offset capital gains from other positions. A key feature of the process is that the index manager can buy similar but not identical stocks to the ones that are sold to keep overall performance close to the desired benchmark.

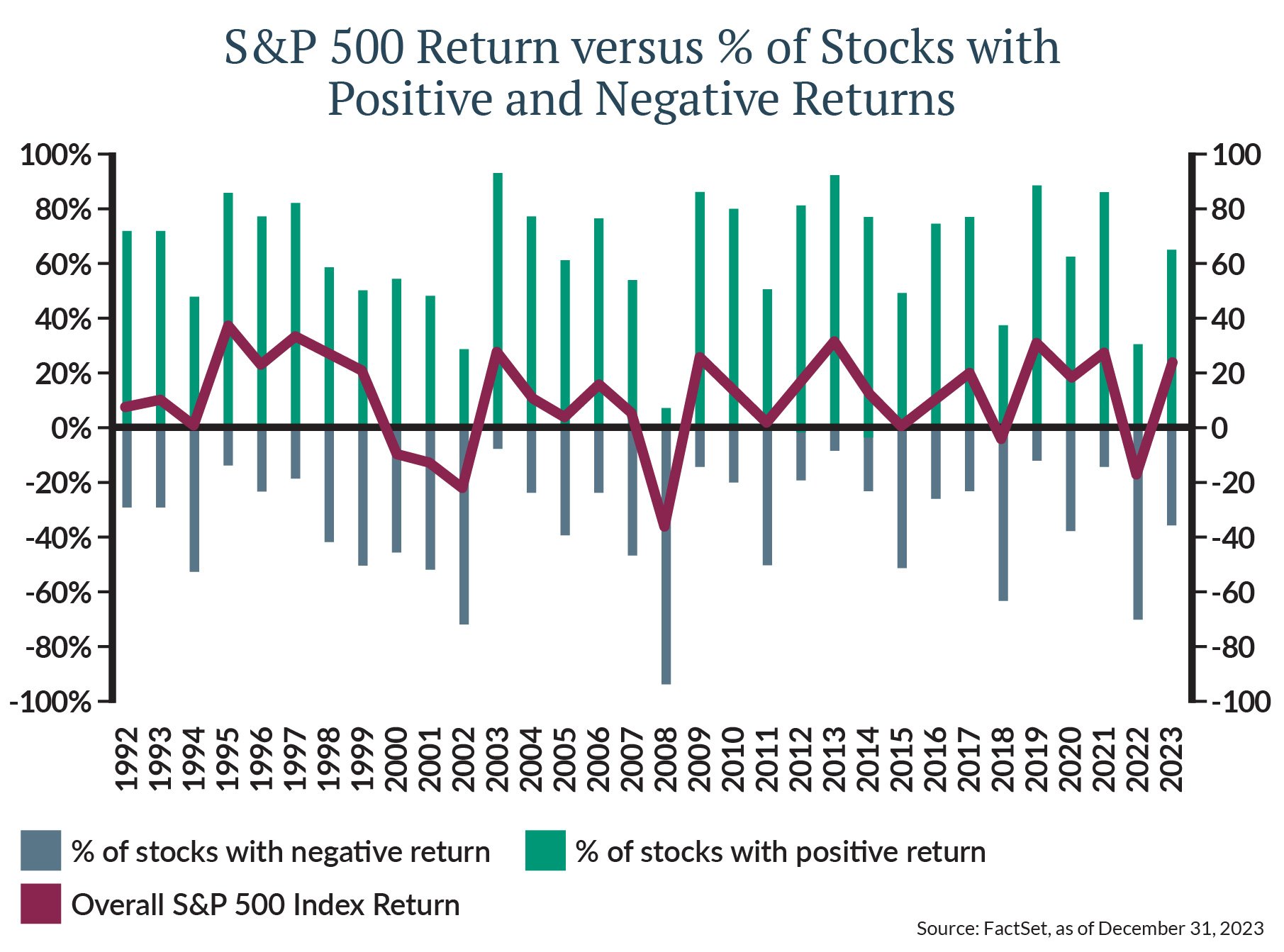

Because personalized indexing investors have direct ownership of the individual stocks in their portfolios, losses can be captured even in a year when the index gains in value. The chart below illustrates that even in the best years for the S&P 500, many individual stocks decline, offering a large opportunity set to harvest losses.

Vanguard estimates that the “tax alpha” from personalized indexing could boost investors’ after-tax returns by 1% to 2% or more. It is no wonder that Direct indexing strategies closed out 2024 with $864.3 billion in assets – nearly double the level reported in 2021, according to Cerulli Associates.

Direct Indexing can involve higher management fees and higher minimum investments, but for the right client, it can be one of the most compelling Separately Managed Account Solutions.

Investing for the Right Reasons

Before he passed, my dad told me something about business that I have tried not to forget: “Nothing happens in a business until somebody makes a sale.” That continues to strike me as incredibly important to keep in mind.

On the one hand, it gives me greater respect for the salespeople who make my job as an analyst and portfolio manager possible. On the other hand, it underscores the duty that our investment team has to offer responsible investment strategies that can improve client outcomes rather than offering investment based on marketing appeal.

SMAs and Direct Indexing, when used properly, can be effective tax-management strategies. They aren’t going to make you more fun at cocktail parties, but they may keep more money in your pocket. And that is the right reason to consider an SMA.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE