Wealth Insights

No, The End Is Not Near for Bonds

5 minute read time

Here we go again. Inflammatory quotes and big personalities get headlines and stoke fear, but don’t let the latest loud narrative derail a carefully crafted financial plan.

The Fear

If you are paying attention to the news and social media (a harrowing hobby these days), you have been exposed to a new round of fear mongering. This time around, the ongoing budget negotiations have placed a spotlight on the United States’ lack of fiscal discipline. Persistent deficits and growing debt have been ignored by both political parties for years, and the current budget proposal is no different. Since the government must issue bonds to fund its spending, some loud voices have raised the alarm on bonds, suggesting they are unsafe. We disagree.

The spending bill currently under consideration in the Senate is projected to expand the deficit by $2-4 trillion over the next 10 years and increase the ratio of debt to gross domestic product (GDP) to around 130% of GDP by 2035 from 120% in 2025. These projections have caused a rift between The President and billionaire-turned-budget-hawk Elon Musk. It also prompted a scary-sounding comment from JP Morgan CEO Jame Dimon. “You are going to see a crack in the bond market,” he said. “I’m telling you this is going to happen. And you are going to panic. I’m not going to panic. We’ll be fine.”

That is interesting. JP Morgan owns billions of dollars of Treasury bonds, but Dimon insists that he is not going to panic, and that JP Morgan will be just fine, even while YOU panic. Let’s ignore Dimon’s poor record of predicting markets and assume that what he is doing here is using his role as a global leader to influence the politics of the US budget process—to reduce spending, deficits, and debt. In that case, his comments are welcome, but we do not believe that US government bonds are at risk of default or that intermediate-term bonds are likely to suffer large losses, and by all indications neither does he.

The Reality

Over the long run, there hasn't been much correlation between bond yields and the level of debt and deficits. In fact, Treasury yields have declined over the last four decades despite the rising debt-to-GDP ratio. Part of this is due to support provided by the Federal Reserve, but part of it is also because the US Dollar is the global reserve currency. The US economy remains the envy of the world, with deep, liquid capital markets, strong institutions supported by the rule of law, and a vast market for its debt. There is no near-term alternative to the dollar as a global reserve currency, as no other country can boast these attributes. That is a tremendous asset that keeps demand for dollars strong and bond prices supported.

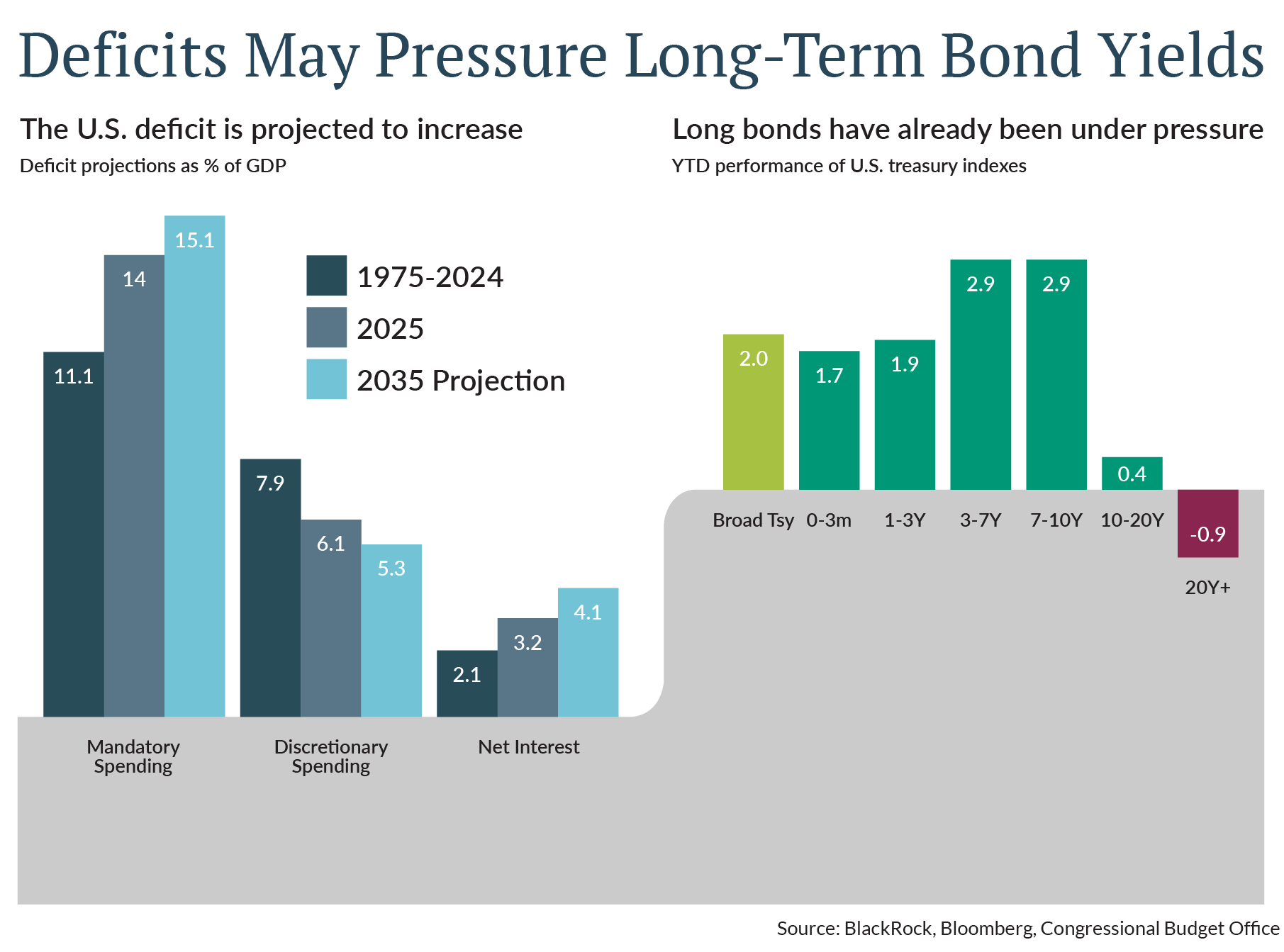

Still, we don’t dismiss deficits and the debt, and the impact they can have on the economy. The left half of the chart below illustrates the difficulty of cutting government spending, as mandatory spending (including popular programs like Social Security, Medicare, and Medicaid) represents about 65% of the budget, and is the largest (and growing) contributor to the deficit. If continued deficit spending results in greater issuance of Treasuries to fund the government, that could increase upward pressure on long-term yields.

In fact, we have seen some of that this year. The right half of the chart below shows that bonds maturing in 20 or more years are the only part of the Treasury market to log negative returns this year. Long bonds reflect uncertainty about future spending, growth, and inflation. Short-term bonds have provided steady prices and solid income this year as investors focus on the present and the near-term repayment of principal.

What to Expect

Jamie Dimon and others are correct to point out the potential impact on long-term bond yields from a lack of fiscal discipline, but they should choose their words more carefully. Let’s look at the performance impact of persistently rising rates on a hypothetical bond portfolio.

- Most JFG clients are invested in intermediate-term bonds, with an average maturity of 4-5 years and a yield of about 5%.

- Assuming a starting yield of 5% on an intermediate bond portfolio with an average life of about 4 years, a 1% increase in rates would result in a price decline of about 4%.

- The total return would be 1% for the year in this example (5% income minus a 4% price decline).

- The following year if rates rose another 1%, the total return would be 2% (6% minus 4%).

- In the third year, assuming another 1% increase, the total return would be 3% (7% minus 4%).

This is hardly something to panic about. The impact on stocks would likely be far greater in such a scenario since borrowing costs for corporations would go up and weigh on corporate profits, and investors would demand a higher return for taking on the risk of investing in stocks rather than buying government bonds.

While interest-rate volatility is likely to remain elevated as the US grapples with persistent deficits, there is no near-term risk of the US defaulting on its debt or of interest rates racing uncontrollably higher, in our opinion. Productivity gains boosted by AI and other technologies may in fact act to curb some of the inflationary pressures in the economy and allow the Federal Reserve to lower interest rates sooner rather than later.

Investors who hold US Treasuries to maturity will continue to receive their principal and interest. Meanwhile, US corporate balance sheets are healthy, and companies are well-positioned to service their debt. State and local government finances remain in good shape, and municipal bonds can provide high income investors with a reliable source of tax-free income with very low historical default rates. Interest rates remain at the high end of their range since the great financial crisis, and we believe bond investors can look forward to returns of 4% to 5% over the next 10-15 years.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE