Wealth Insights

Living Up to Lofty Expectations

5 minute read time

A few weeks ago, Green Bay Packers fans were ecstatic. The addition of quarterback crusher Micah Parsons via trade had energized the defense and led to two dominant performances to open the season. Expectations for the Green and Gold went from playoff team to Super Bowl contender.

But living up to lofty expectations isn’t easy, and a pair of clunkers in recent weeks have curbed fans’ enthusiasm. There are reasons to be optimistic (a bye week may refocus the team and allow the offensive line to get healthy) and reasons for caution (giving up forty points to the Cowboys and questionable in-game decision making).

This Packers season has parallels to today’s financial markets. The Artificial Intelligence (AI) boom has propelled markets higher for the past 3 years. The S&P 500 is up just shy of 15% through 9/30/25, following 20%+ years in 2023 and 2024. High valuations (the S&P trades at 22.8 times next year’s profits vs. the 30-year average of 17 times earnings) and rising margin debt (when investors borrow from their broker to buy stocks), are signs of soaring sentiment - investors expect the good times to keep rolling.

But a cooling job market and sticky inflation could become obstacles to further big gains and provide reason to diversify from an increasingly concentrated US equity market.

What’s Going Right

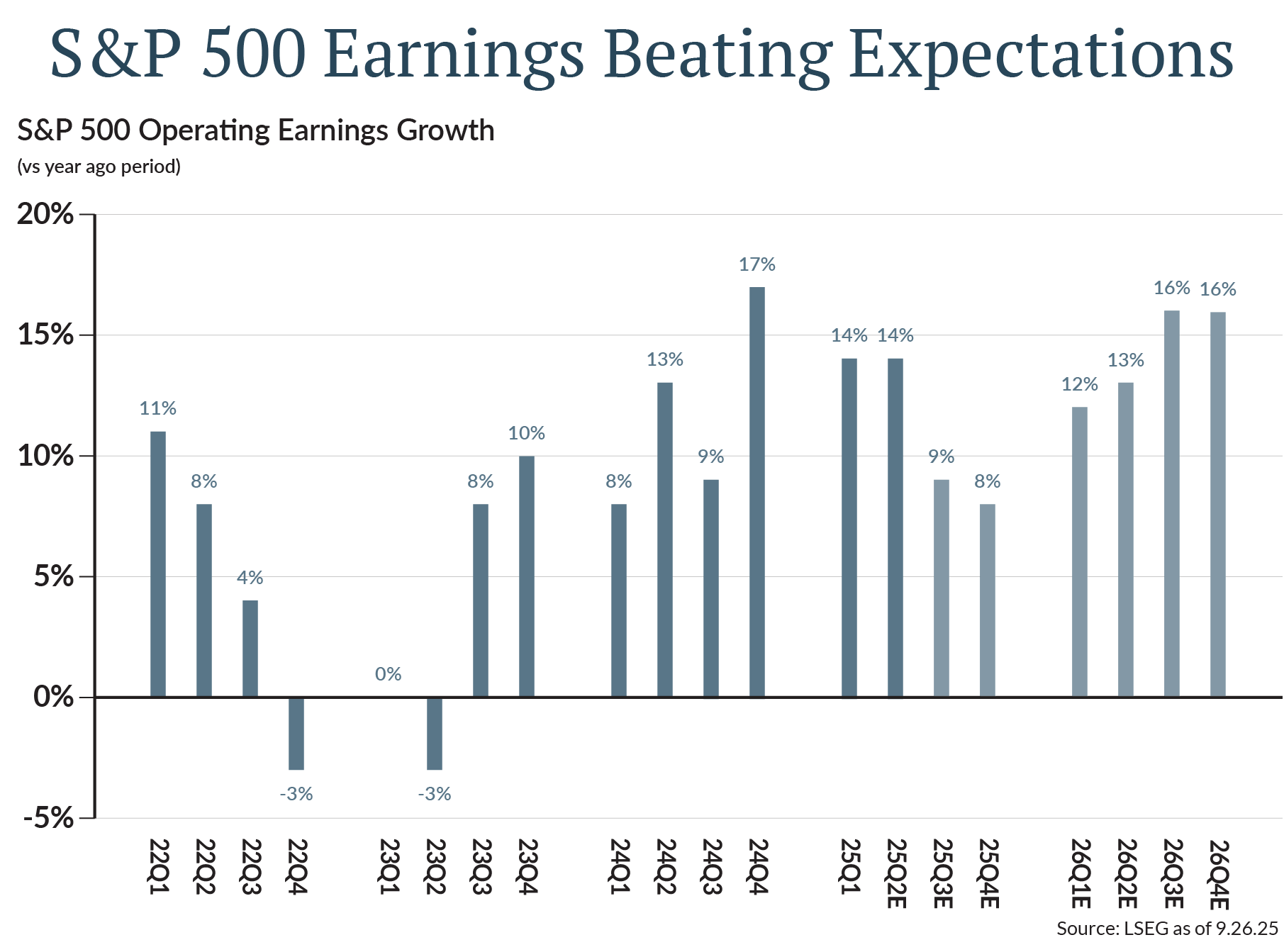

In short, earnings and AI. Profits drive the long-term performance of stocks, and profits continue to rise. S&P 500 earnings grew 13.8% in the second quarter of 2025 vs. the 5.8% increase analysts expected at the start of the quarter. Estimates for the third and fourth quarters have been revised higher, and double-digit earnings growth is projected in 2026 [Figure 1].

How much of this momentum is AI-driven? In a recent research note, JP Morgan noted that AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022. This stunning statistic is why the S&P is increasingly concentrated, with the “Magnificent 7” mega-cap technology stocks comprising about 35% of S&P 500 market value.

Could this narrow leadership continue? Of course! But it is a little like asking Micah Parsons to win games by himself. Greater market breadth, with smaller company earnings growth accelerating, would be a sign that markets can hold up even if AI investment slows down from its breakneck pace. We got a glimpse of that in the third quarter, when small-cap value stocks outperformed large-caps and earnings trends for small-cap shares turned higher after moving sideways over the past 2 years. Lower interest rates, as we’ve seen this year, can act as a catalyst for economically sensitive small caps, that often rely on short-term debt to fund operations.

What Could Go Wrong?

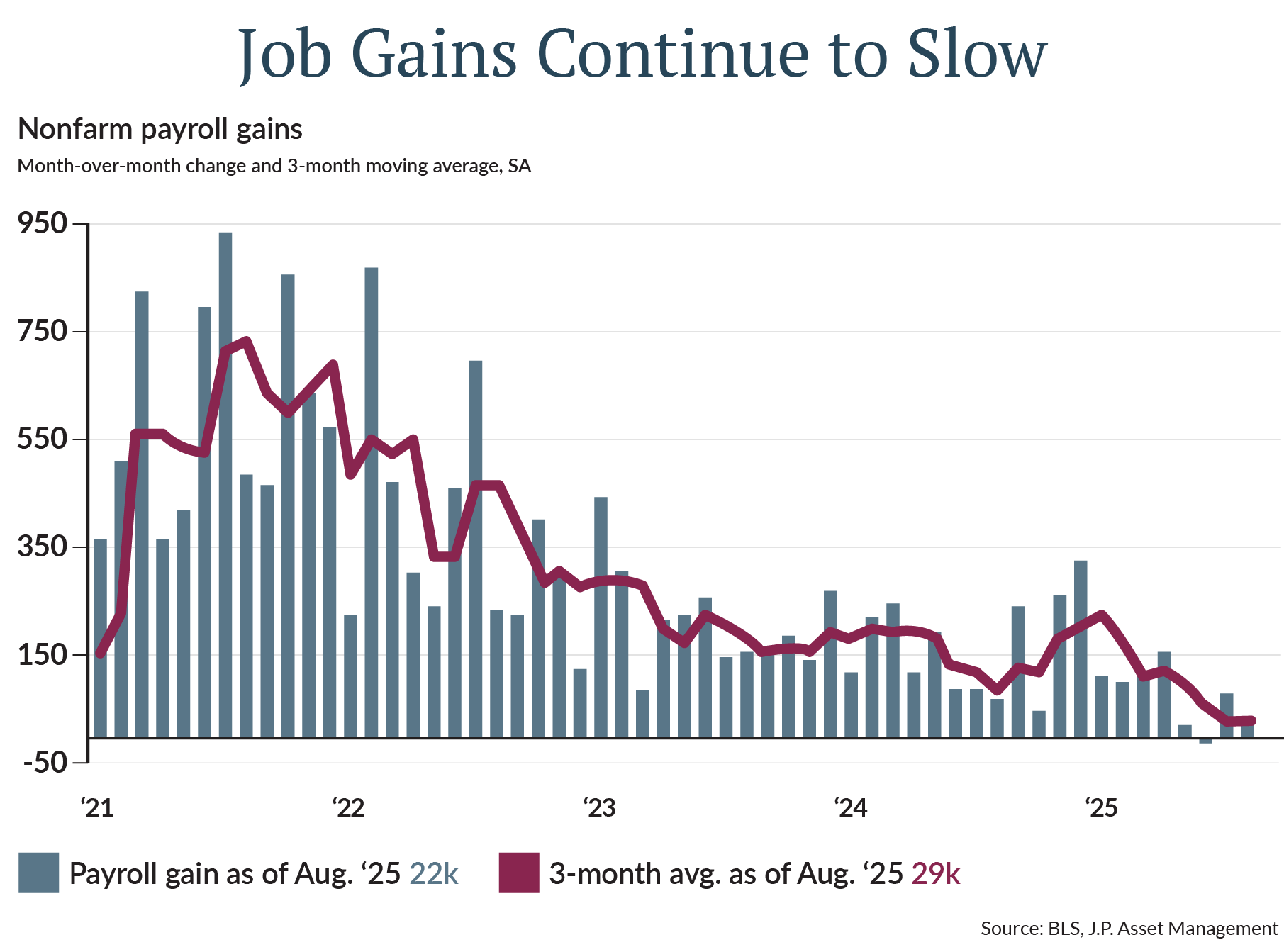

The weakening employment picture is the main macroeconomic concern for investors. Job growth has slowed from a solid pace of ~166K monthly gains in 2024, to just under 30k over the past three months [Figure 2].

Although the unemployment rate remains low at 4.3%, anemic job growth is what prompted the Fed to cut rates in September for the first time in nine months. More cuts are expected, with markets pricing in a 3% Fed Funds rate by this time next year.

Rate-cutting cycles are typically bullish for both stocks and bonds. Bond prices rise as interest rates fall, and corporations benefit from a lower cost of capital and less competition from high-yielding safe assets such as money market funds, where yields are poised to decline.

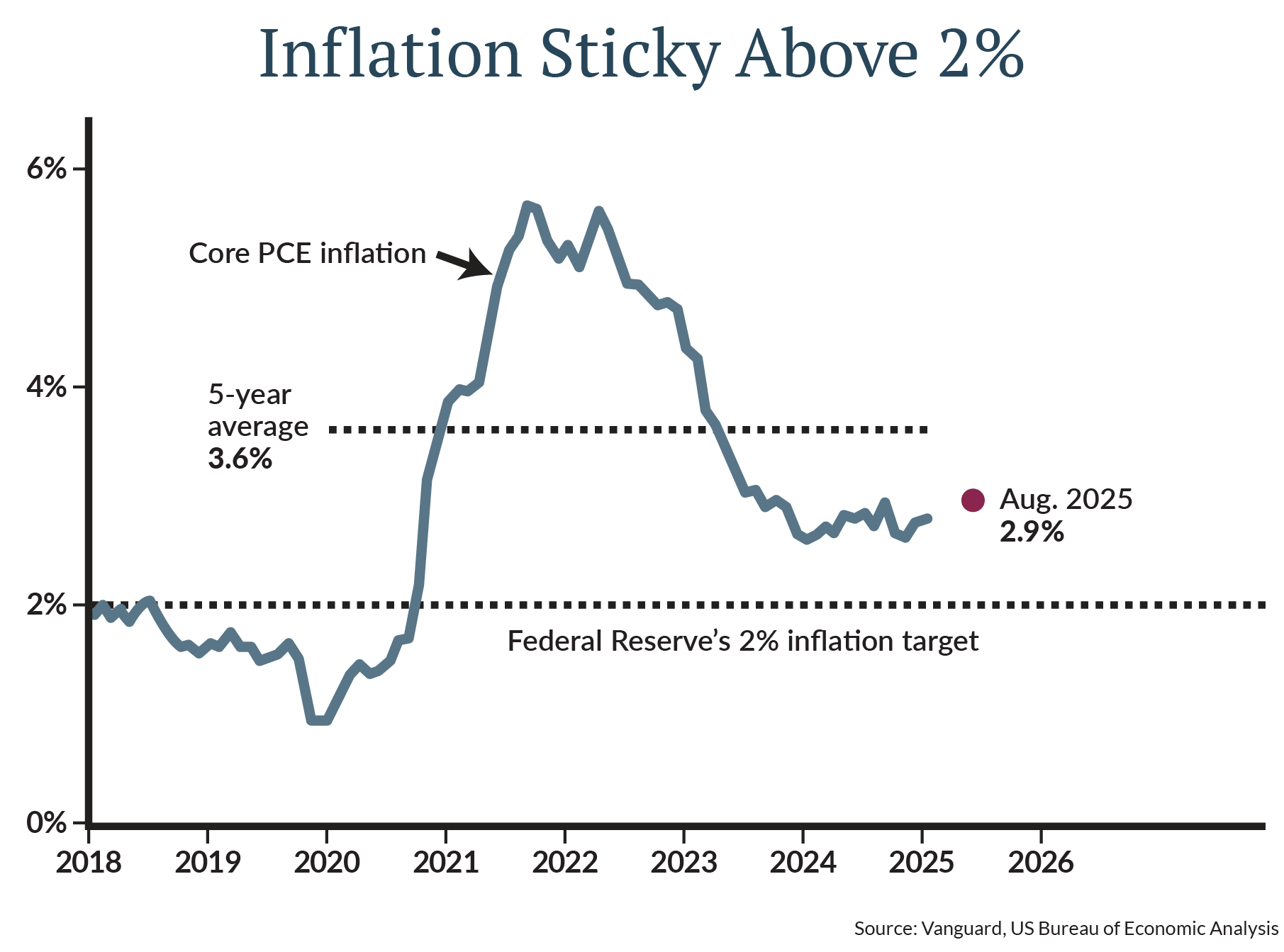

What could complicate this rate-cutting cycle? Inflation. The Fed’s preferred measure of inflation, which excludes food and energy, rose 2.9% in August and has remained above the Fed’s 2% target for 5 years [Figure 3].

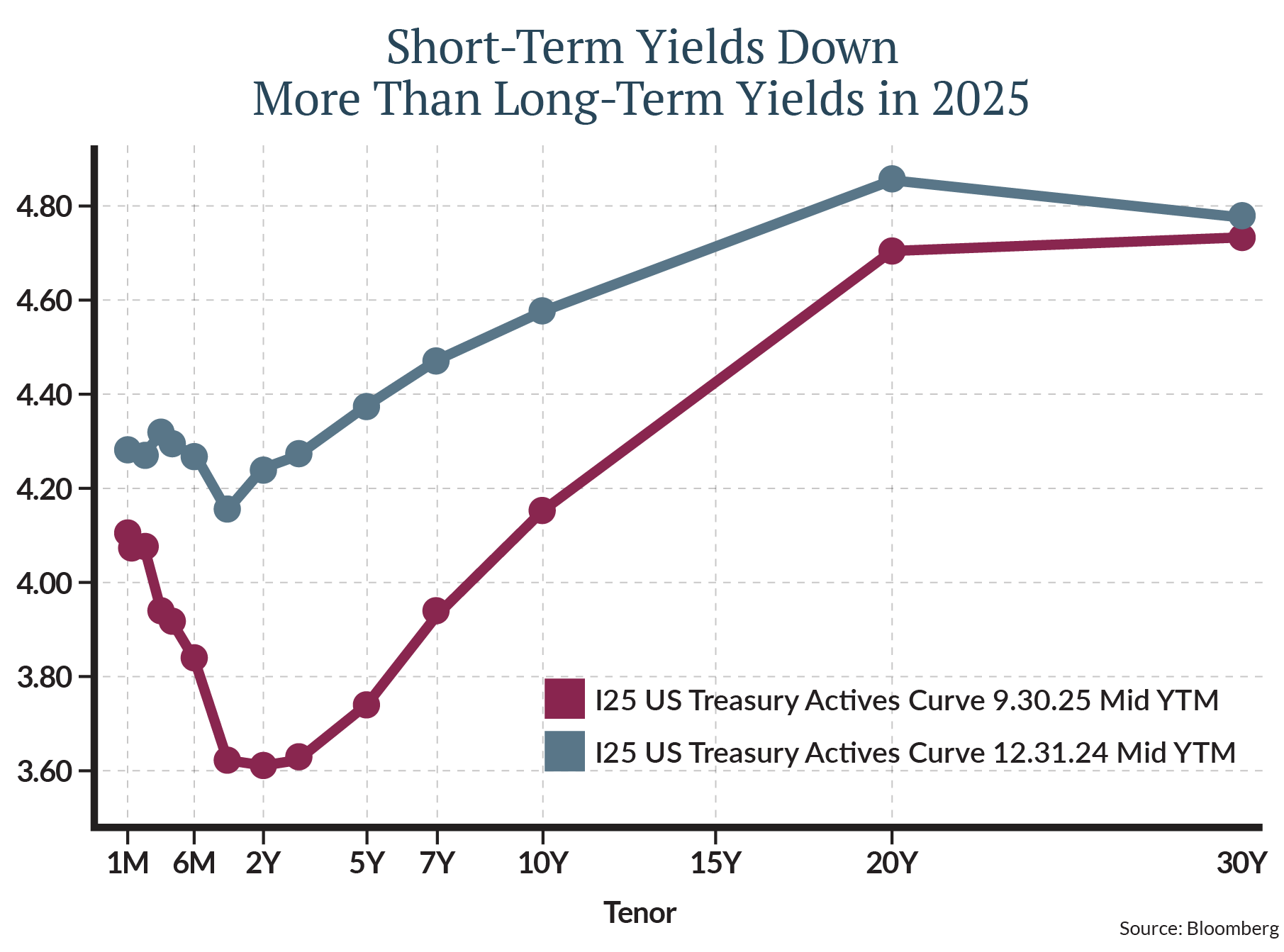

Inflation uncertainty and continued fiscal challenges in the U.S have kept longer-term bond yields above 4%, even as short-term yields have plummeted [Figure 4].

If the Fed can’t tame inflation, it will be hard for long-term interest rates to decline, weighing on housing, small cap shares, and other rate-sensitive sectors of the economy. In such a scenario, stock market leadership may remain concentrated in large, high-quality companies with wide economic moats and low debt burdens.

It Still Pays to Diversify

As investors have priced in the outlook for further rate cuts, intermediate-term bonds have seen robust 5%-6% total returns. But high-quality bonds still yield 4%-5%, providing income in addition to serving as ballast to portfolios. This will prove especially valuable if the job market portends a slowing economy. With credit spreads at record tight levels, we remain focused on quality in fixed income and recommend investors consider municipal bonds, which remain attractive for investors in higher tax brackets.

As we’ve recently noted in a previous article, The US Dollar and Why International Stocks are Outperforming YTD, international stock outperformance is highly correlated with a declining dollar in cycles that can last for many years.

Have a Plan

"Everyone has a plan until they get punched in the mouth," is a great saying attributed to retired boxer Mike Tyson. The Packers are learning that expectations don’t matter when you step on the field. You have to prove it every week. Similarly, today’s fully valued market will have to prove it with further earnings gains and broader breadth.

Rate cuts and a relentless AI investment cycle offer reason to believe the bull market can continue, but investors should remain diversified and have a plan if the AI story loses momentum. Neither one player, nor one type of investment, should make or break a team or investment portfolio.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE