Wealth Insights

Bonds Still a Good Bet

6 minute read time

2025 was a great year for bond investors. High starting yields and falling interest rates (bond prices rise when interest rates fall) combined to produce above-coupon returns in most fixed income sectors. While yields begin 2026 at lower levels, they remain above inflation and provide an attractive income cushion of 4%-5% to offset volatility that could arise from the appointment of a new Federal Reserve Chairman, another charged election season, or investor angst about industries disrupted by Artificial Intelligence.

After 2025’s three rate cuts, totaling 0.75%, cash yields have fallen. Higher intermediate-term and long-term yields provide incentive to move out of cash. We believe this makes bonds a solid bet for another good year, and we encourage investors to consider modestly extending maturities to lock in today’s yields.

Steepening Yield Curve and Healthy Credit Markets

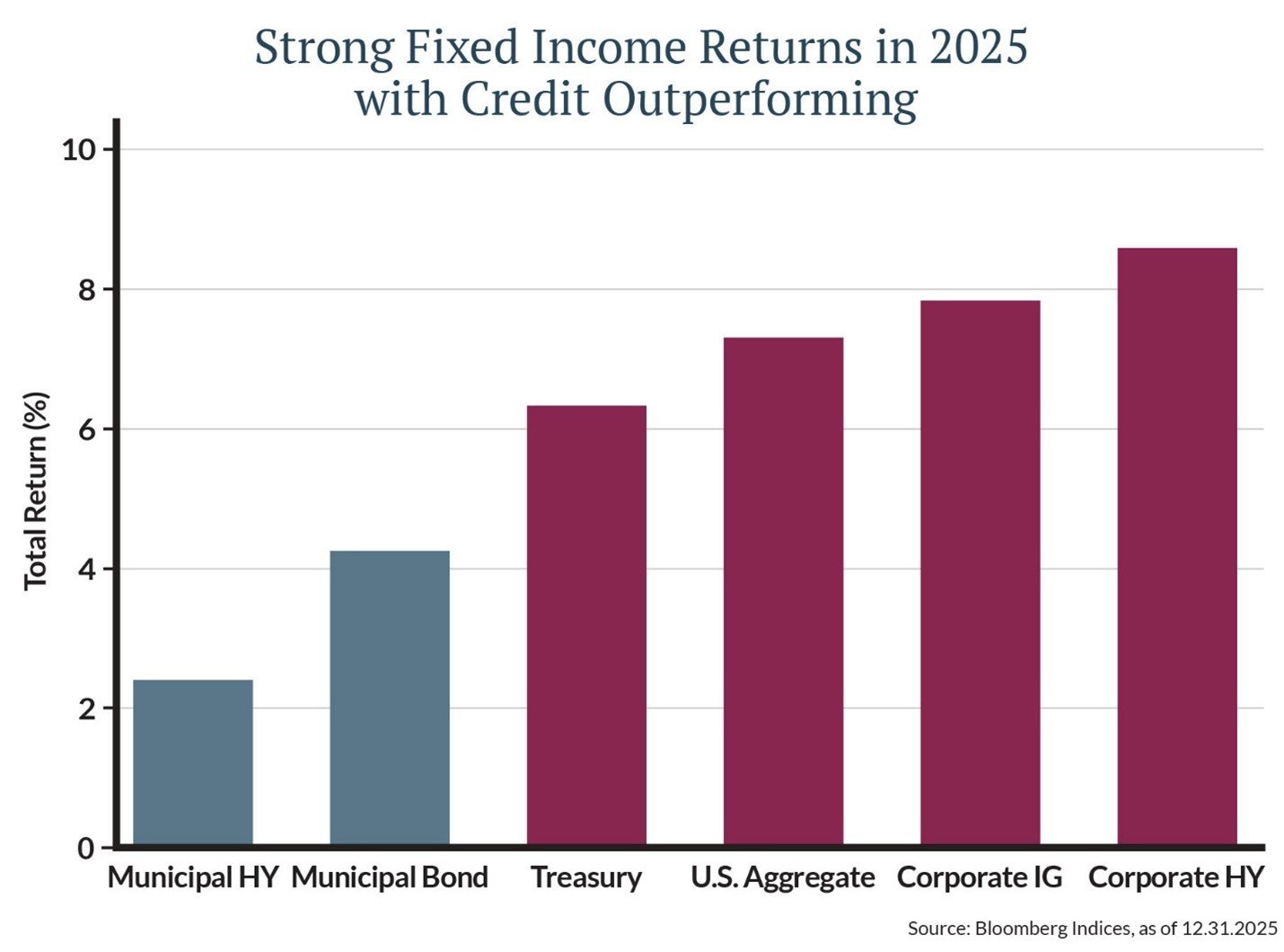

Total returns in 2025 ranged from 5% in Investment Grade municipal bonds to over 8% for High Yield corporate bonds. The widely followed U.S. Aggregate Index posted its best year since 2020, rising over 7%. Despite narrow credit spreads (the additional yield over Treasuries that investors demand to assume risk of default), strong fundamentals kept demand for corporate credit robust throughout the year and spreads remained near historic tights. Only lower-rated municipal bonds lagged, as spreads widened in some high yield sectors.

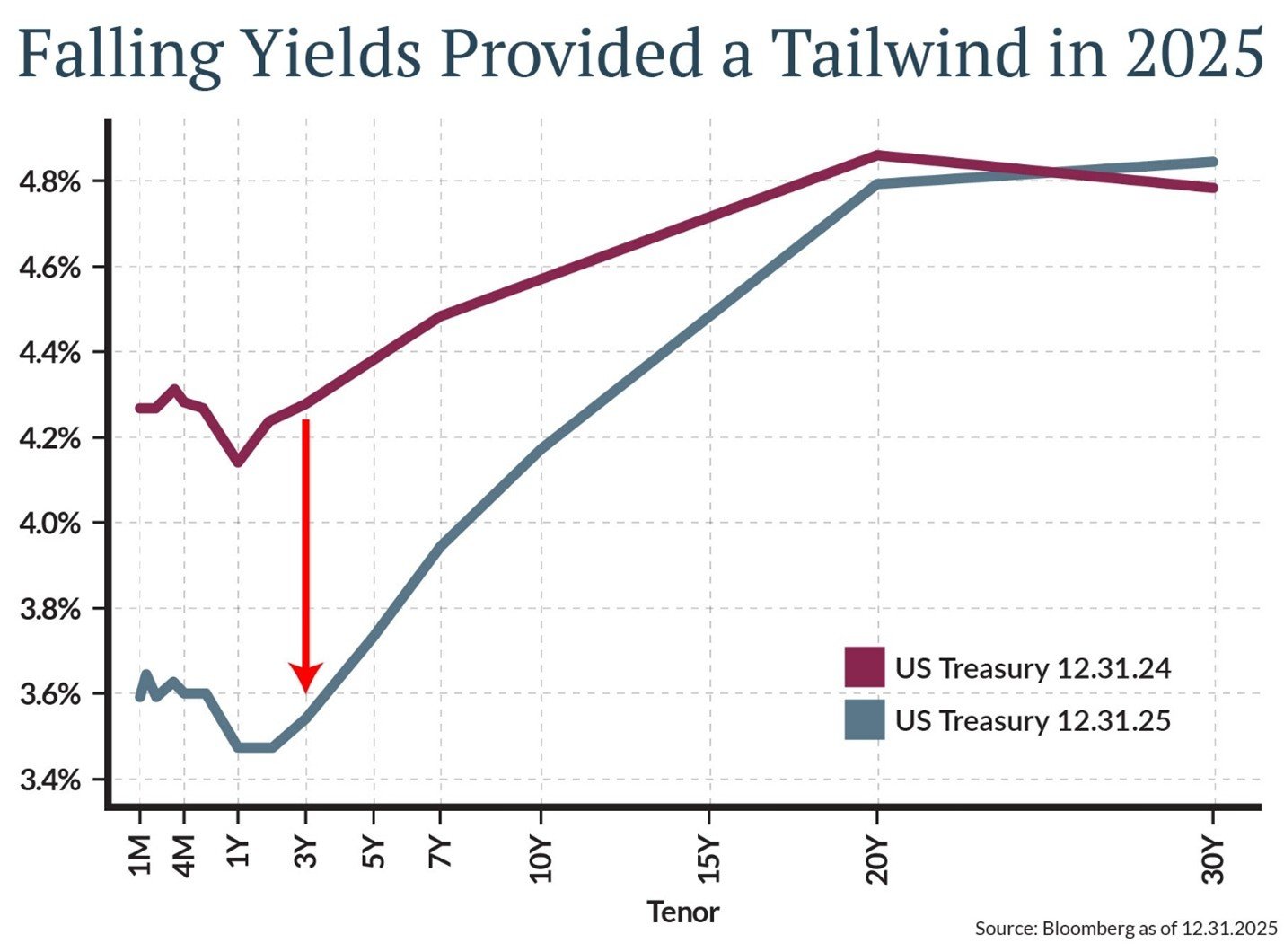

Falling yields are a tailwind for bond investors, and Treasury yields fell in all but the very longest maturities in 2025. The greatest move came in short maturities, where the 2-year yield dropped 0.76% to 3.48% in anticipation of rate cuts. The 10-year fell 0.41% to close the year at 4.17%.

The steeper curve makes the short end of the maturity spectrum less attractive and offers investors willing to extend into longer maturities the potential to benefit from “roll down” return. Roll down is the return generated from a bond's price appreciation as its yield falls along an upward-sloping curve. We believe that by taking a modest amount of additional interest-rate risk by moving out the curve, investors can set themselves up for another year of strong performance.

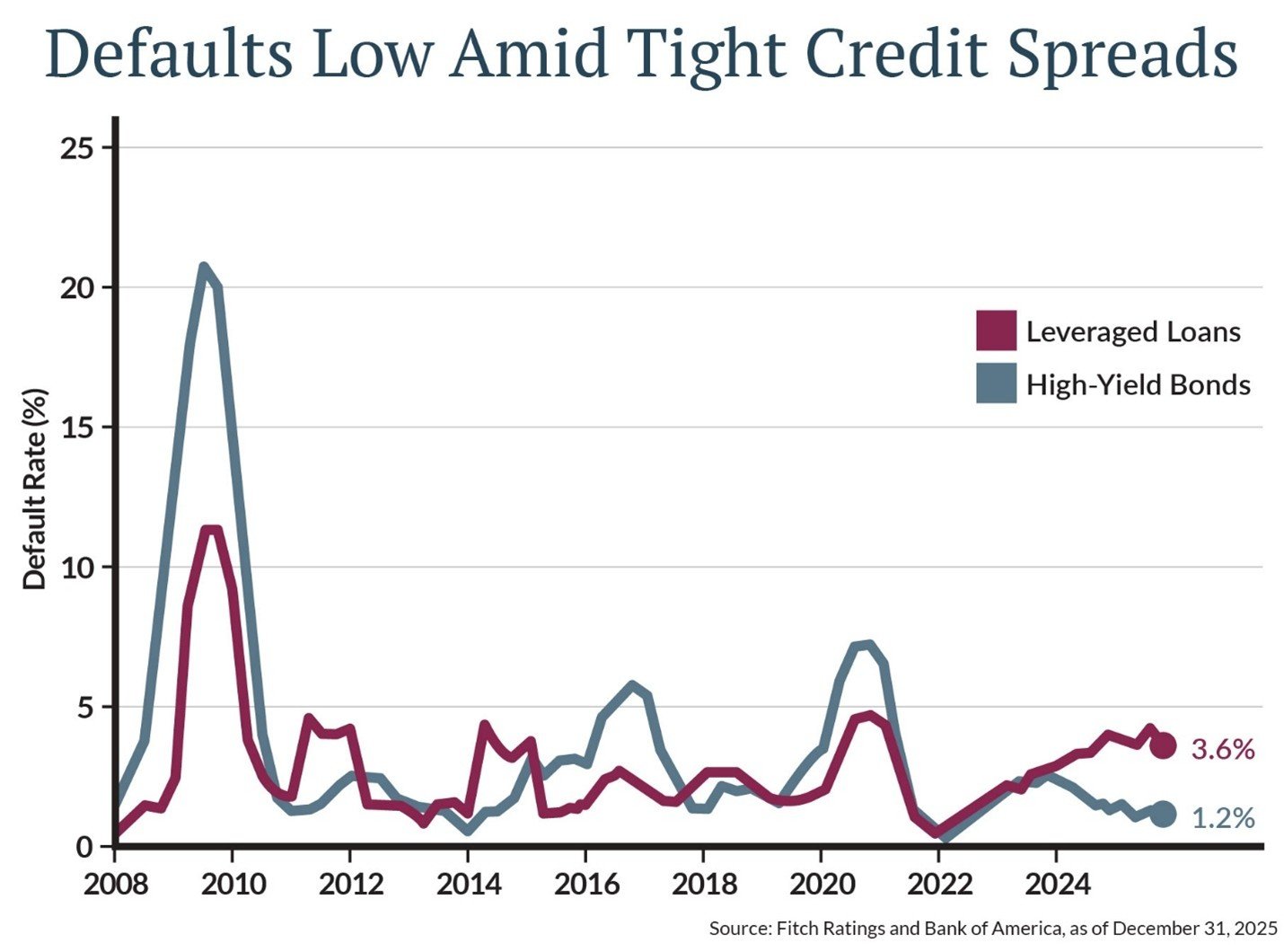

While we are looking to extend maturities where appropriate, we are not looking to add materially to lower-rated credit. Our modest exposure to below investment grade bonds continues to benefit from robust economic growth and low default rates, but high yield bond spreads do not provide a wide enough margin of safety to warrant an increased allocation. We remain patient and focused on high quality corporates, mortgages, treasuries, and an allocation to securitized markets where commercial mortgage-backed securities and asset backed securities provide better relative value.

Are Munis Right for You?

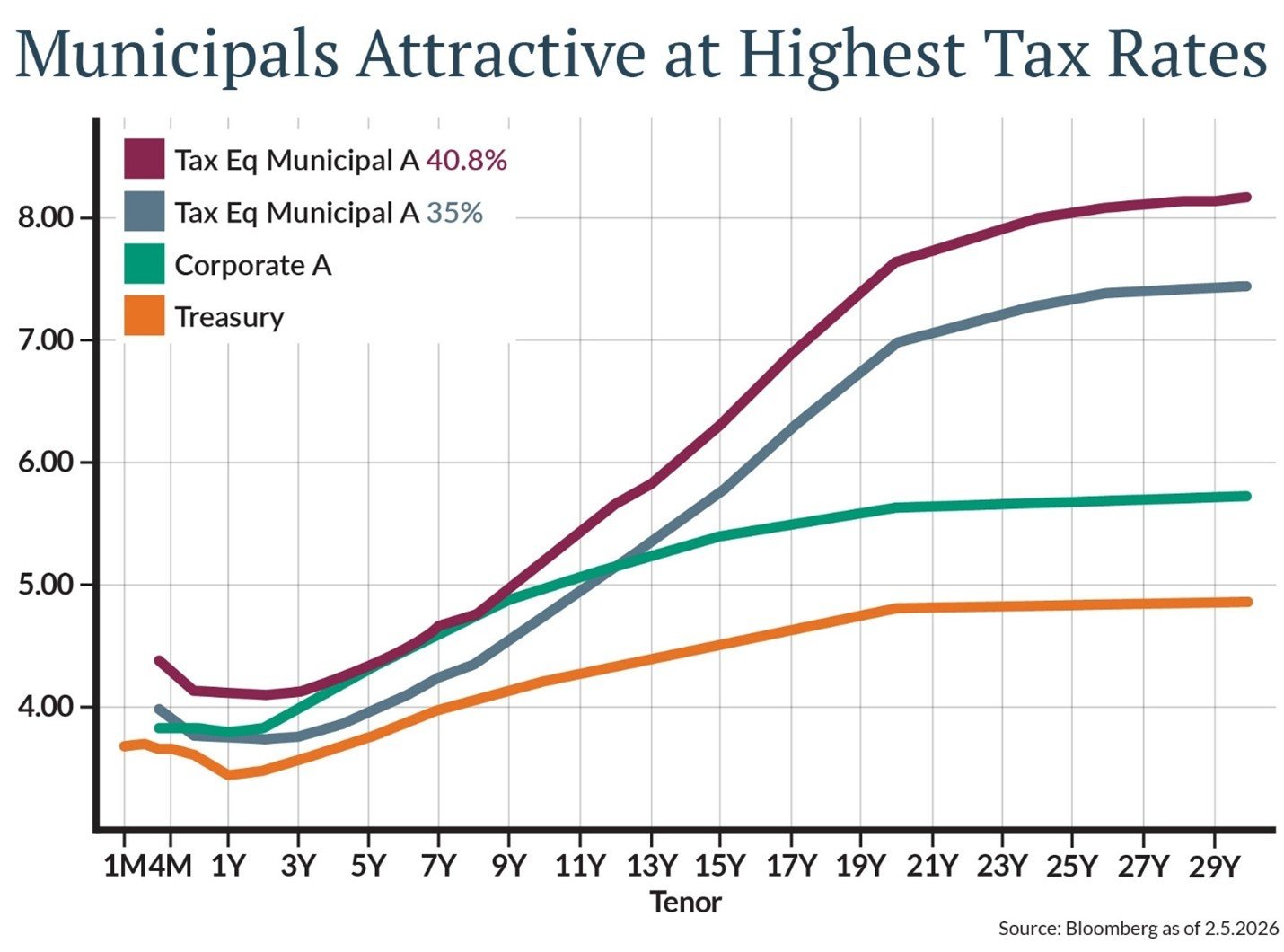

2025 was an interesting year in the muni market. It was a record year of new issue supply, and there were concerns early in the year that the Trump Administration could target the municipal tax-exemption as part of the OBBB. Those factors led to a weak first half of the year that reversed as increasingly attractive valuations drew in investors. With credit concerns limited to a few areas such as charter schools and higher education, and strong relative value, we believe municipal bonds could be in for a strong year in 2026 even amid continued robust supply.

For investors in the highest tax brackets, taxable equivalent yields approaching 6% for intermediate-term maturities or 7% for longer-term bonds appear attractive relative to both corporate bonds and treasuries. Johnson Financial Group offers both intermediate and long-term separately managed accounts. Your JFG advisor can help you decide which is right for you.

Fed Independence Fears Abating

Bond investors faced growing fears in recent months that the longstanding tradition of Federal Reserve independence is under attack. Independence is seen by most experts as vital to the central bank’s ability to control inflation even when restrictive monetary policy is politically unpopular.

After interviewing a number of candidates considered loyalists, the president chose Kevin Warsh, a central bank veteran who was at the Fed during the 2008 Financial Crisis. Warsh is viewed a mainstream candidate and received a favorable response from Wall Street. Precious metals, sometimes viewed as a hedge against uncertainty, sold off in the aftermath of the appointment, signaling investors’ worst fears abating.

Warsh has been critical of how the Fed has grown its balance sheet in recent years, so investors will be watching not only interest rate policy but whether the asset purchases that were used to support markets during the Financial Crisis and Covid will be curtailed under his leadership.

Get Invested

The temptation to sit in cash and wait is powerful and provides comfort when markets are volatile. However, history shows repeatedly that the best time to invest is now. With fixed income offering attractive starting yields of 4%-5% that are highly correlated with long-term performance, we suggest getting off the sidelines and getting invested.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE