Our underlying theme for 2026 is that investors should focus on Process Over Predictions. The instinct of many investors is to chase the "winners" of the previous cycle or expect spectacular growth to continue indefinitely.

However, this assumes that the future will mirror the immediate past. While the economy appears solid with expected nominal growth near 5%, risks remain regarding inflation stickiness and the pace of payroll gains.

Over the next year and decade, we believe the prudent approach is a diversified portfolio that aligns with your goals, anchored by the following themes:

- Rebalancing – It's OK to take profits! Rebalancing is the risk management process that realigns your portfolio to your long-term asset allocation target. We recommend a systematic approach: rebalancing when markets correct, and rebalancing again to lock in profits after recoveries. This ensures decisions are rules-based, avoiding emotional reactions to market headlines.

- Diversification – As uncertainty regarding valuations increases, we recommend adding breadth to portfolios. Diversification helps a portfolio weather different types of investment environments. In addition to a core allocation to U.S. equities, we advocate for a mix that includes international equities for valuation opportunities, high-quality bonds for income, and alternative investments to provide a third pillar of return unrelated to daily stock market fluctuations.

- Patience – Using a baseball analogy, wait for your pitch. With equity valuations historically high, we believe a patient approach that maintains exposure close to long-term asset allocation targets is prudent. We remain ready to act when market dislocations create opportunities, rather than reaching for risk in a fairly valued market.

Markets and economy snapshot

Last year proved to be a dynamic year for investors, characterized by a pivot in monetary policy and shifting market leadership. International stocks led the way, supported by a weaker dollar, while U.S. markets navigated a landscape of resuming interest rate cuts and fiscal policy adjustments. This backdrop puts most investors in a strong position as we enter the new year, with portfolios benefiting from the steepening yield curve and the broadening of equity market returns.

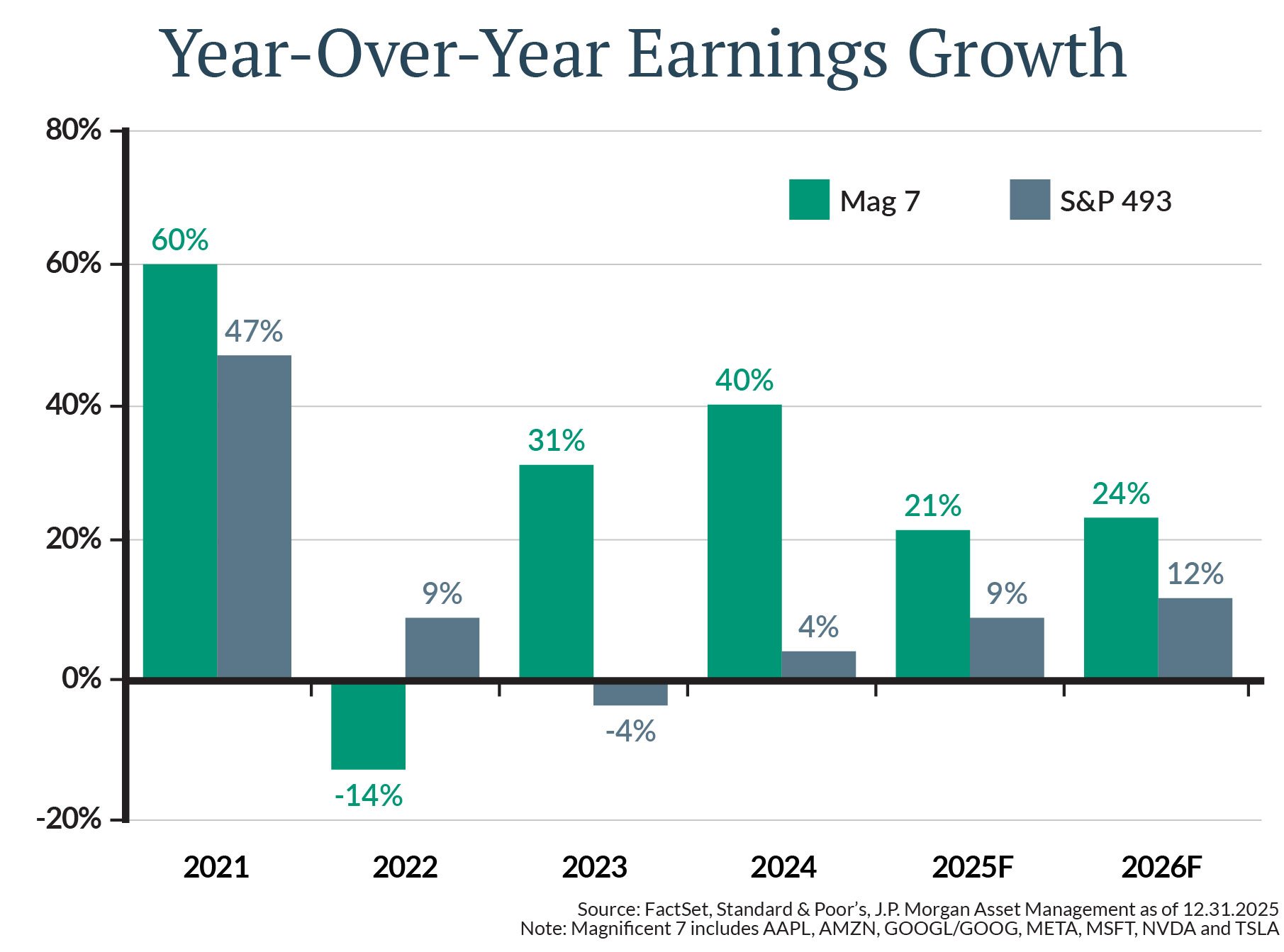

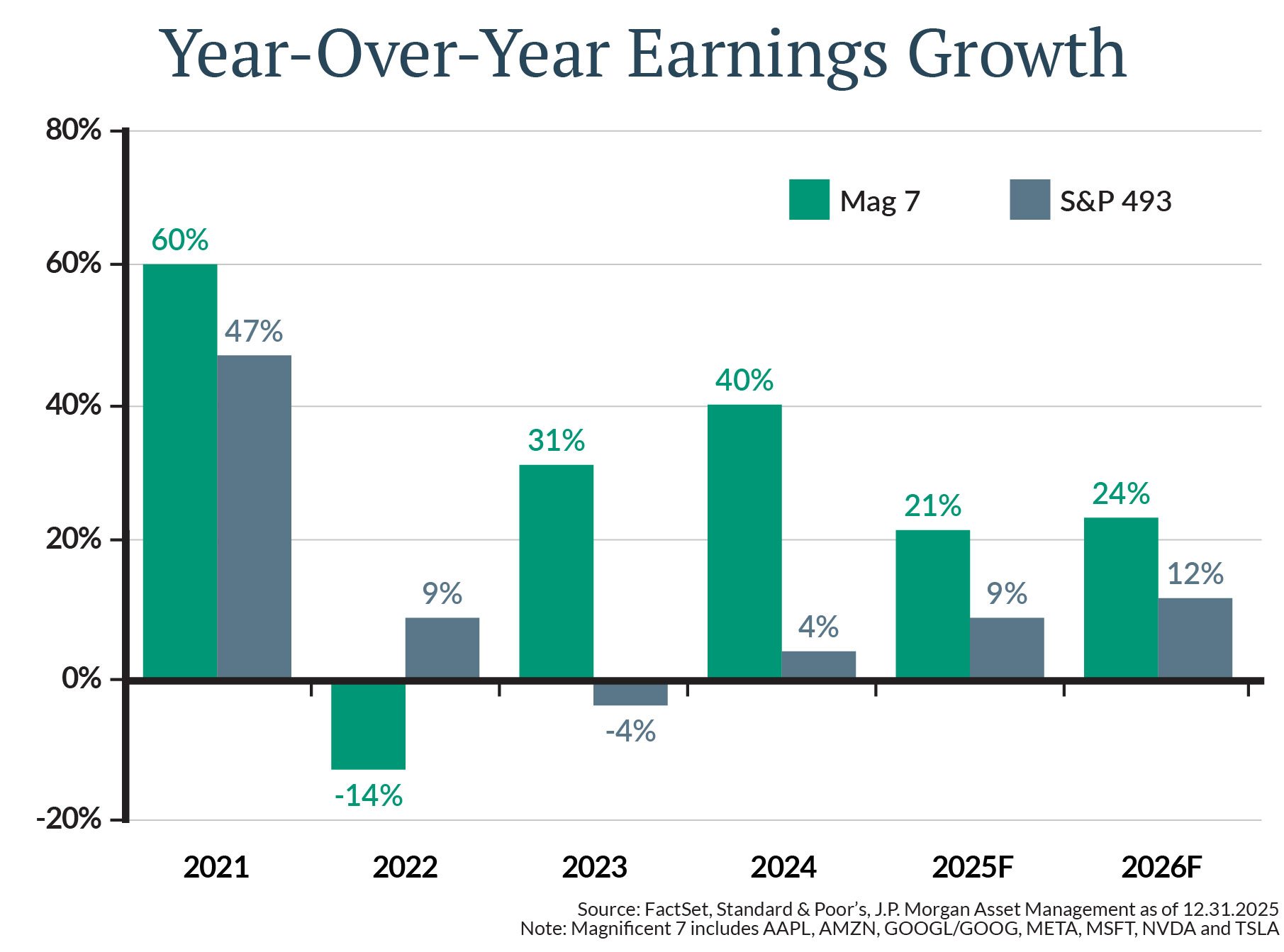

While 2025 saw the Federal Reserve lower rates by three-quarters of a percentage point late in the year—boosting market returns—the outlook for 2026 suggests a distinct shift in drivers. In particular, we expect earnings growth to do the heavy lifting for returns, replacing the multiple expansion seen in previous years.

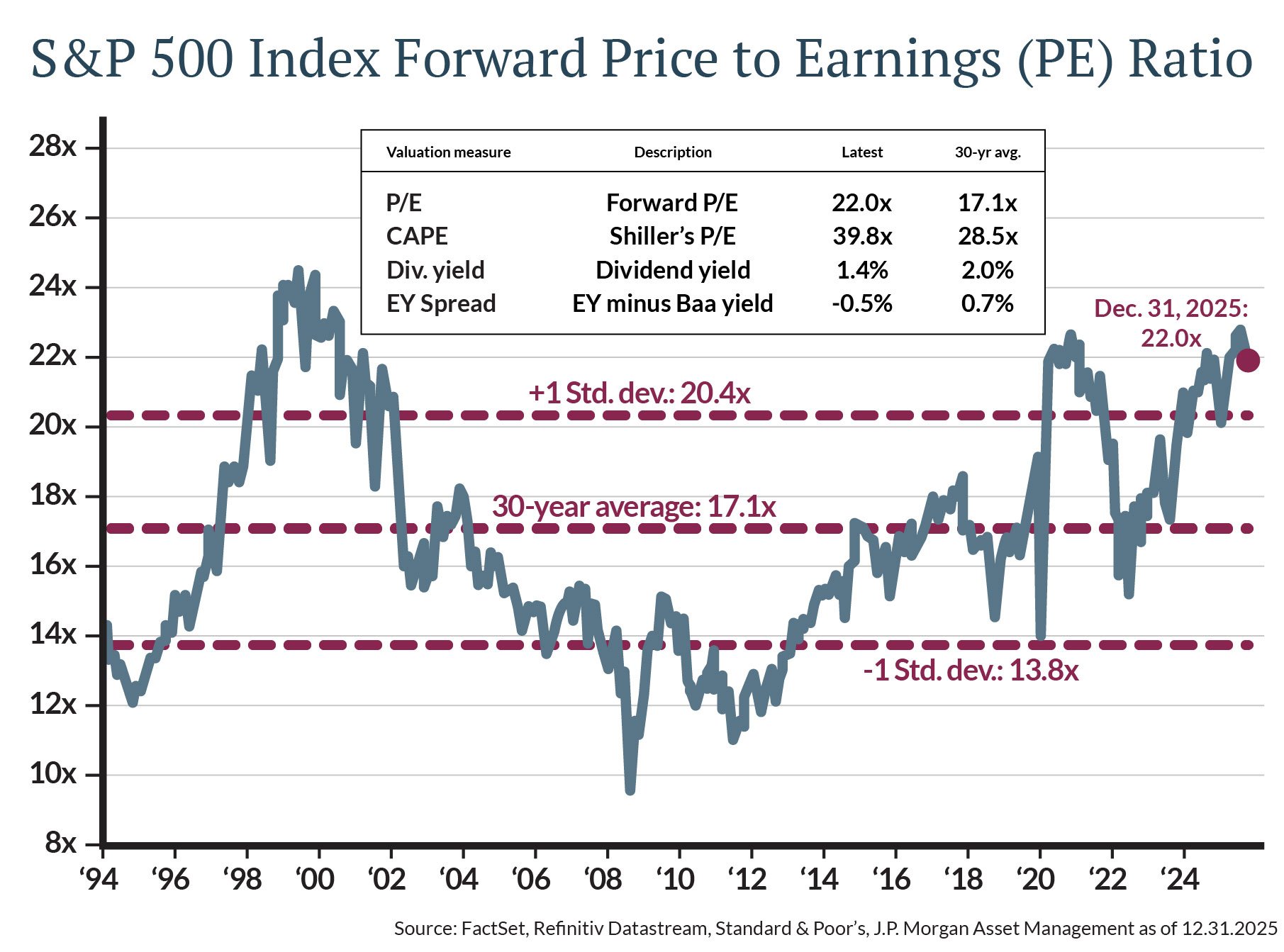

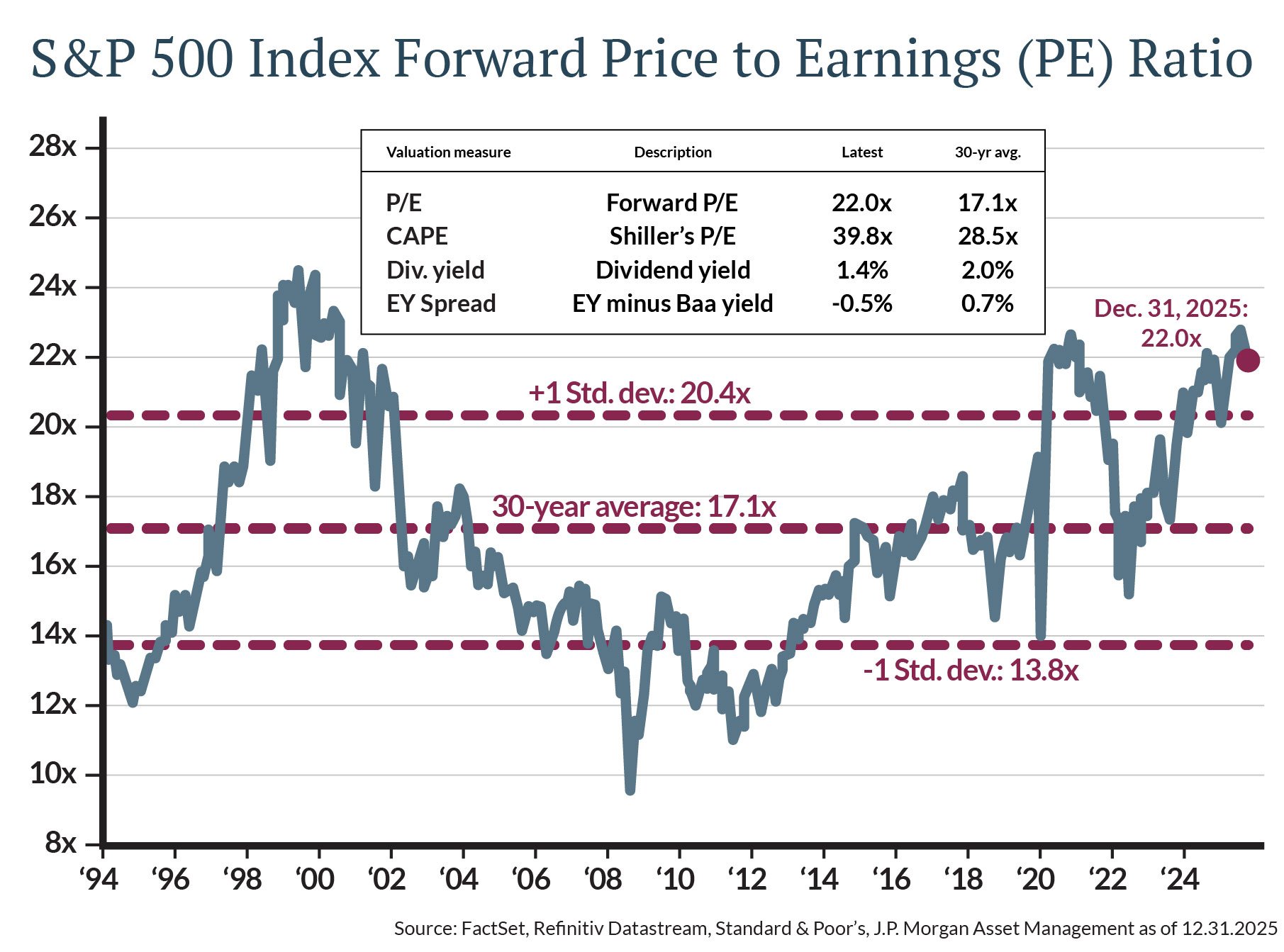

Economic growth is tracking toward a sustainable 2-3%, aided by tax changes and ongoing capital investment in AI. However, with U.S. large-cap valuations elevated at approximately 22x forward earnings, future returns will likely depend on realized profit growth rather than rising valuations.

Combine this with the potential for moderation in the pace of gains, and we expect investors will appreciate a disciplined focus on high-quality fundamentals across stocks, bonds, and alternative investments.

Expected returns

Our base case outlook supports expectations for positive returns for stocks, bonds, and alternative investment asset classes in 2026. However, the range of returns will likely be influenced by the trajectory of corporate earnings, the impact of the 2025 tax bill, and the inflation moving lower from the current level around 3%. While near-term returns are difficult to forecast, long-term return expectations based on current valuations and starting yields help investors set reasonable assumptions.

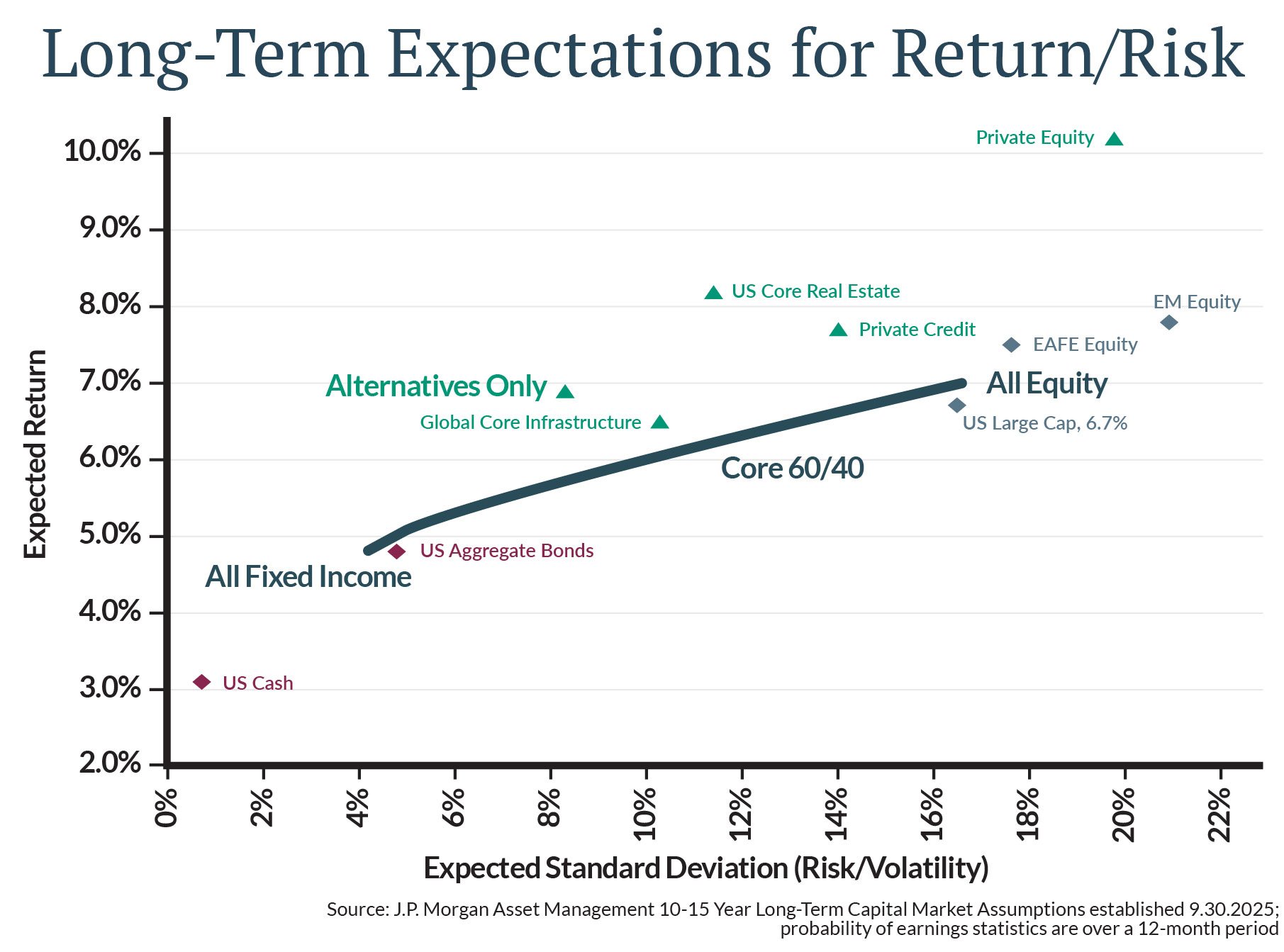

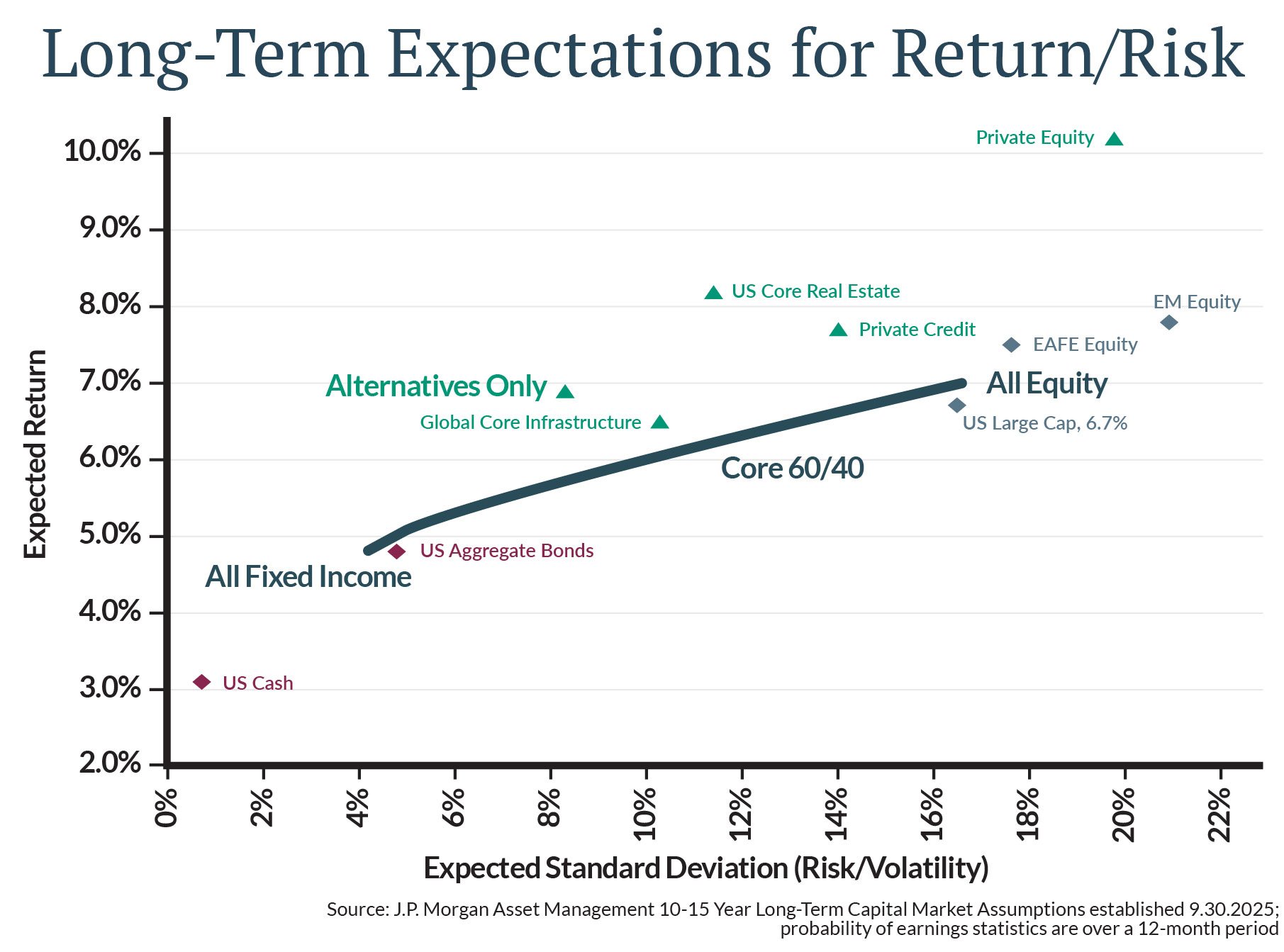

The chart below provides a summary of the average expected return for major bond, stock, and alternative asset classes over the next 10-15 years. We expect diversified portfolios to return roughly 6% on average over this period. This outlook reflects a return to "normalcy," where bonds provide genuine income and stocks offer growth driven by fundamentals rather than speculation.

Stocks: Let earnings do the work

The primary role of stocks in your portfolio is capital appreciation and purchasing power preservation. We expect stock returns to average about 7% per year over the next 10-15 years. This is below the robust returns of recent years, primarily because starting valuations for U.S. large caps are elevated. Returns in 2026 and beyond will need to be driven by double-digit earnings growth, which we expect to broaden beyond the mega-cap technology names.

While domestic valuations are high (see figure below showing forward price to earnings ratios), stocks remain a vital component for growth. We are particularly watching for continued strength in AI- related capital spending to support margins. Furthermore, international stocks warrant a meaningful allocation for diversification, having demonstrated leadership in 2025.

Bonds: Back to doing their job

Investors can once again rely on bonds to provide relative stability and an attractive stream of income. The Federal Reserve's resumption of rate cuts in late 2025, with another two quarter-point cuts priced in for 2026, has created a favorable environment. With short rates declining more than long rates, the yield curve has steepened, allowing bonds to do their traditional job.

Investors can expect a 4-5% return from bonds over the next decade, as starting yields remain a reliable predictor of future returns. As money market rates are expected to drift toward 3% by year-end 2026, the appeal of staying in cash will diminish. We emphasize high-quality core sectors where tight spreads dictate caution against reaching for excessive credit risk.

Alternatives: Additional return and diversification

Investors continue to find value in alternative investments as a practical way to smooth volatility and enhance long-term potential. We continue to favor allocations that bring income and inflation-linked cash flows, specifically within private real estate and infrastructure.

Return expectations for these segments typically range from upper-single to low-double digits over the next decade. With the correlation between stocks and bonds having increased in recent years, the role of alternatives as a diversifier is critical. They offer a "third pillar" of stability and return potential that is less dependent on the immediate path of interest rates or public equity sentiment.

Portfolios for the next decade

Considering the transition to a period of steady economic growth and normalizing interest rates, we believe investors should prioritize process over predictions in 2026. To recap:

- We recommend rebalancing portfolios to ensure equity exposure hasn't drifted too high given current valuations.

- We suggest diversifying stock holdings to include international exposure, utilizing high-quality bonds for reliable income as cash rates fall, and maintaining an allocation to real assets.

- Finally, have the patience to stick to your plan, using these long-term inputs to guide your financial future rather than keeping score on a one-year basis.

As always, we welcome you to contact your financial advisor at any time to talk about these topics or anything specific to your financial situation.