Saving for College: Ages 13-18

Learn how to make the most of your savings in the years leading up to college.

Saving For College When Time Is Limited

As your child enters their teenage years, the need to focus on saving for college ages 13-18 becomes more urgent. With tuition costs soaring and numerous educational paths available, proactive planning can significantly impact your family's financial future.

Navigating the financial landscape of higher education begins with understanding college expenses. While tuition and fees are major costs, they are just a portion of the total expenses. Additional expenses such as room and board, textbooks, supplies and personal costs can add thousands of dollars to your annual budget. It's crucial to account for these extras when estimating the full cost of attendance.

Is it too late to start saving for college?

Don't worry if you haven't started yet. This chart provides a clear plan to help you make the most of your remaining time and get back on track for your child's education expenses:

| Life Stage | Age of Child | Savings Goal | Recommended Actions |

| Teenage | 13-18 years | Maximize savings |

|

| High School Senior | 17-18 years | Finalize savings |

|

| College Years | 18-22 years | Manage and use savings |

|

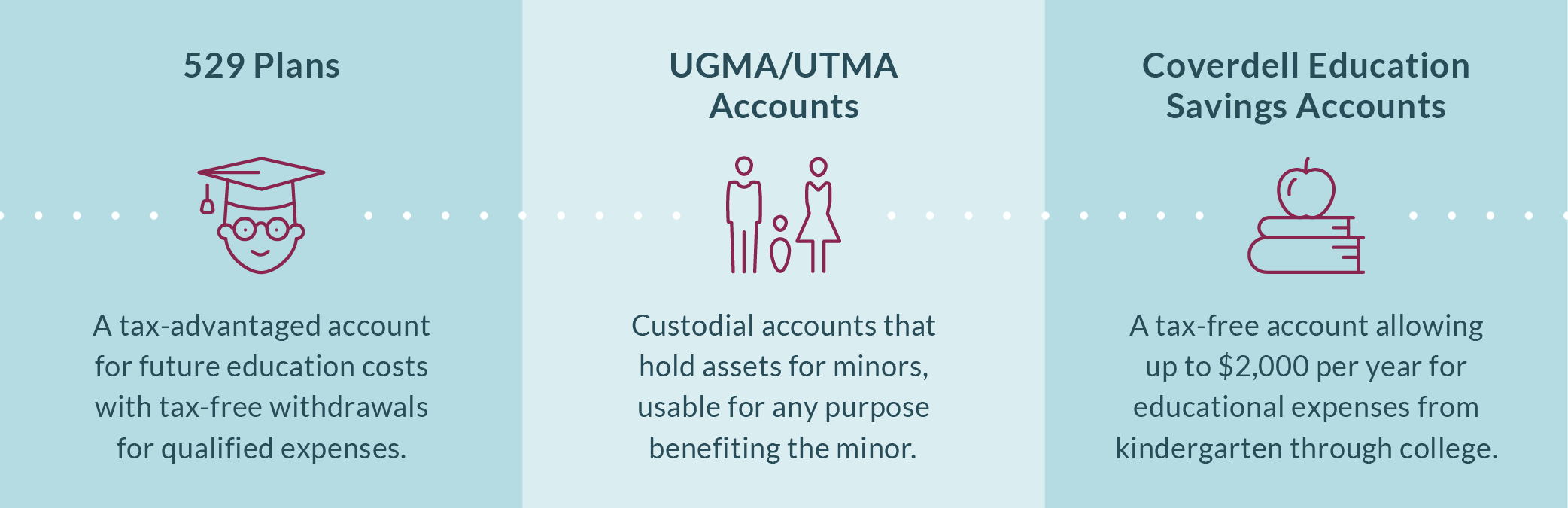

3 Effective College-Savings Tools

529 Plans

529 plans are state-sponsored investment programs specifically designed for educational savings, offering two distinct options: prepaid tuition plans and education savings plans. Prepaid tuition plans enable you to purchase units or credits at participating colleges and universities for future tuition at today's prices, which can be a strategic way to manage future educational costs. On the other hand, education savings plans allow you to open an investment account to save for a variety of future college expenses, including tuition, mandatory fees and room and board.

Benefits:

-

- Tax Efficiency: Gains accumulate tax-free and withdrawals are tax-free for eligible educational expenses.

- State Incentives: Many states offer income tax deductions or credits for contributions.

- Flexibility: Accounts can be transferred between relatives.

- Accelerated Gifting: Contributors can make a substantial initial deposit by combining five years' worth of the annual gift tax exclusion.

UGMA/UTMA Accounts

UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfers to Minors Act) accounts are custodial accounts that allow assets to be held in a minor’s name without the need for an attorney to establish a trust. These accounts are used to gift or transfer assets to minors and the funds can be used for any purpose to benefit the minor, not just educational expenses.

Benefits:

-

- Flexibility: Funds can be used for any purpose to benefit the minor.

- Control: Once the minor reaches the age of majority (18 or 21, depending on the state), they gain control of the account.

Considerations:

-

- Financial Aid Impact: Assets in these accounts are considered the minor's property, potentially affecting financial aid eligibility.

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESAs) are tax-advantaged investment accounts designed to cover educational expenses from kindergarten through college. These accounts offer flexibility in funding various educational needs.

Benefits:

-

- Broad Coverage: Covers expenses from kindergarten through college, including tuition, fees, books, supplies and technology.

- Tax-Free Growth: Contributions grow tax-free and distributions are tax-free for qualified expenses.

Limitations:

-

- Contribution Limits: $2,000 per year per beneficiary.

- Age Restrictions: Contributions can only be made until the beneficiary turns 18 and funds must be used by age 30.

- Income Limits: Higher-income earners may be restricted from contributing.

Strategies for Maximizing Your College Savings

Encouraging student involvement in saving and budgeting fosters responsibility and ownership over their financial future. Have discussions with your teenager about college aspirations and associated costs. Establish joint savings goals allowing them to contribute through part-time jobs, allowances or gifts. Active participation teaches valuable budgeting skills and motivates diligent saving.

Setting a monthly savings goal is crucial for consistent saving habits. Estimate college costs based on tuition rates and institution type, then divide by the months until your child turns 18 to determine monthly savings needs. Small contributions accumulate significantly over time due to compound interest. Automate savings with monthly transfers from your checking account to stay on track effortlessly.

Involve family and friends in your college savings journey. Share your goals and invite contributions to your child's education fund during occasions like birthdays and holidays. Creating a savings fund that others can contribute to not only grows savings but also engages your support network in your child’s future education. Consider age-based portfolios to maximize growth potential over time.

Financial Aid Opportunities

Understanding financial aid and scholarships is important for families saving for college ages 13-18. Financial aid can significantly help with tuition costs and comes in various forms, including grants, loans and work-study opportunities. Scholarships, awarded based on merit or specific criteria, also assist in covering college expenses. It's important to research options early, as many scholarships have deadlines well before college enrollment.

Consider how savings impact financial aid eligibility. The federal formula evaluates family income and assets to determine aid eligibility. Higher savings in a student’s name can reduce the financial aid they qualify for, as student assets are assessed more heavily than parental assets. Strategically planning savings can maximize aid opportunities.

To increase chances of receiving aid and scholarships, complete the Free Application for Federal Student Aid (FAFSA) as soon as it becomes available. Monitor local scholarships and grants, often with less competition than national programs. Ensure your student's academic records and extracurricular activities are well-documented, as these factors are key in scholarship applications. By being proactive, families can navigate financial aid opportunities and secure necessary funding for a successful college experience.

College Savings for Every Stage

Whether your child is in preschool or high school, we’ll help you plan with confidence. Find the right savings plan for your child based on their age and your financial goals.

Let's start a conversation

Whether your child is in preschool or high school, we’ll help you plan with confidence. Fill out the form below and an advisor will reach out to help you get started.