SUMMARY

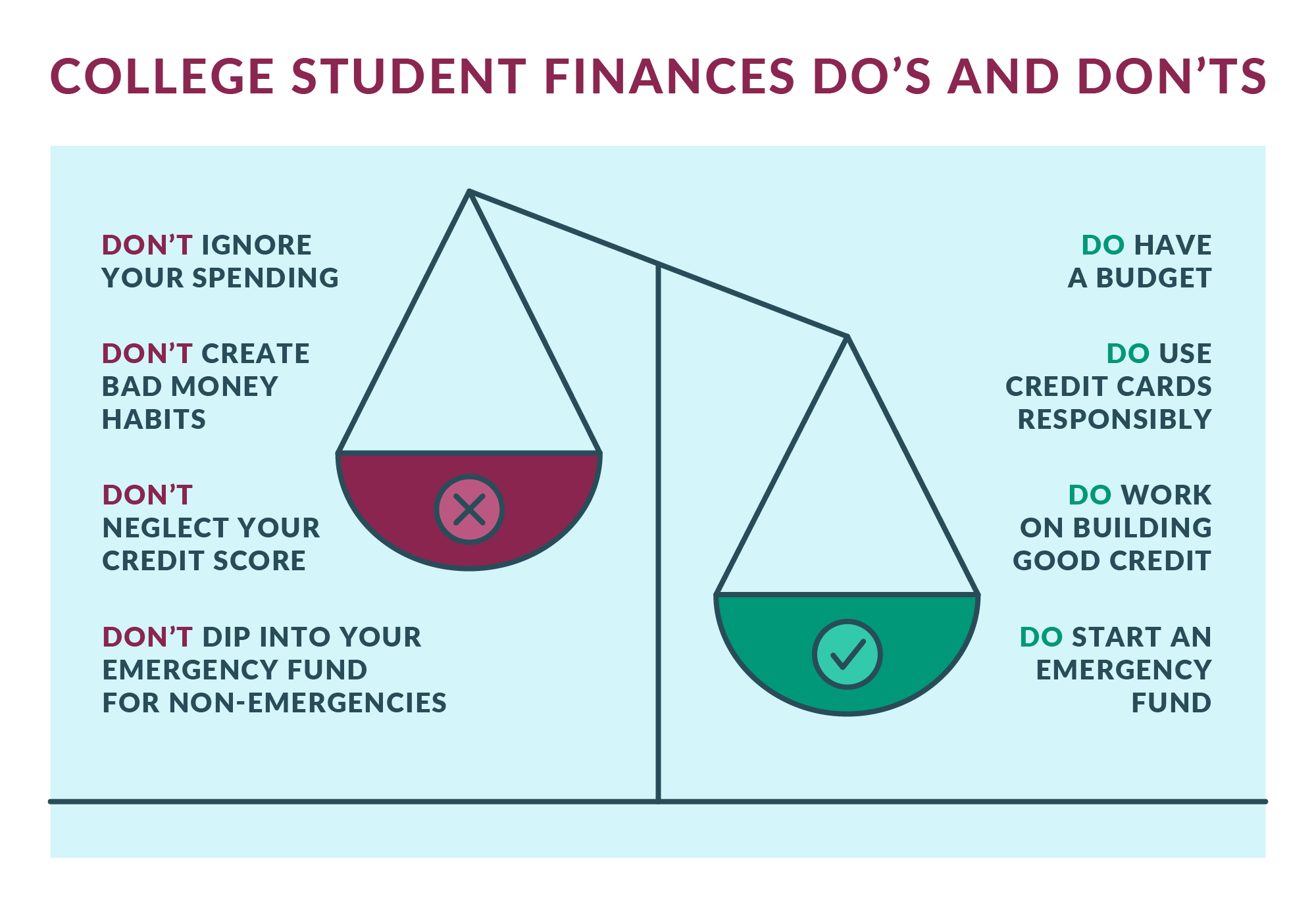

Discover essential money management tips for college students, including budgeting, responsible credit card use and building an emergency fund to secure your financial future.

Young Professionals

6 minute read time

Discover essential money management tips for college students, including budgeting, responsible credit card use and building an emergency fund to secure your financial future.

Taking your first steps towards financial independence can be daunting but it doesn’t have to be. Understanding where to get started can go a long way in securing your financial future. Here are a few money management tips to follow so you can start building strong financial habits:

A good budget offers a snapshot of your income, expenses and savings. Creating a budget is more than just "making ends meet" — it's a proactive approach to managing your money and setting yourself up for long-term financial wellness.

Steps to Create a Budget

Most financial institutions offer digital budgeting tools that automatically categorize your spending, allowing you to see where your money is going at a glance. MyFinance Manager has tools that can help you create a budget, monitor and categorize your spending and look at your finances.

College may be the first time you have access to a credit card. While debit cards offer less risk, they typically offer fewer rewards. Debit cards don't help you build credit history, since the funds are directly taken from your bank account, so there's less chance of accumulating debt.

However, credit cards are not just a convenient payment method — they're also a tool for building credit history. A good credit score can open doors for you when you're considering larger financial milestones like buying a house or car. When used responsibly, credit cards can also offer benefits like cash back, rewards and zero-liability fraud protection.

How to Use a Credit Card Responsibly

Your credit score affects various aspects of your life, including loan eligibility and interest rates. This score is based on several factors like payment history, credit utilization and the length of your credit history. Keep an eye on your credit score through the free tools offered by many financial institutions and aim to maintain a high score.

Life is unpredictable and having a financial cushion for unexpected scenarios like medical emergencies, car repairs or just an unexpectedly expensive textbook is essential. An emergency fund provides peace of mind and financial stability during uncertain times.

We typically recommend having enough to cover at least three to six months' worth of essential living expenses. For college students, even a smaller fund of $500 to $1,000 can make a significant difference.

By following these three simple, yet impactful tips, you can start laying a strong foundation. For personalized guidance, connect with a financial advisor to start your financial future on the right foot.