Kelsey Ellsworth

VP Wealth Portfolio Manager | Johnson Financial Group

As Vice President, Wealth Portfolio Manager, Kelsey works with clients to achieve their unique goals and objectives.

Investment Commentary

4 minute read time

This week, more than 20% of companies that make up the S&P 500 Index report their earnings. Sticky inflation raises the bar for companies to keep delivering earnings and supporting consumer sentiment. Last week, the S&P 500 Index was up 2.67%, breaking a three-week losing streak, led by mega-cap technology stocks after better-than-expected earnings from Google and Microsoft. This week, we’ll look inside earnings and explore the effects on consumer confidence.

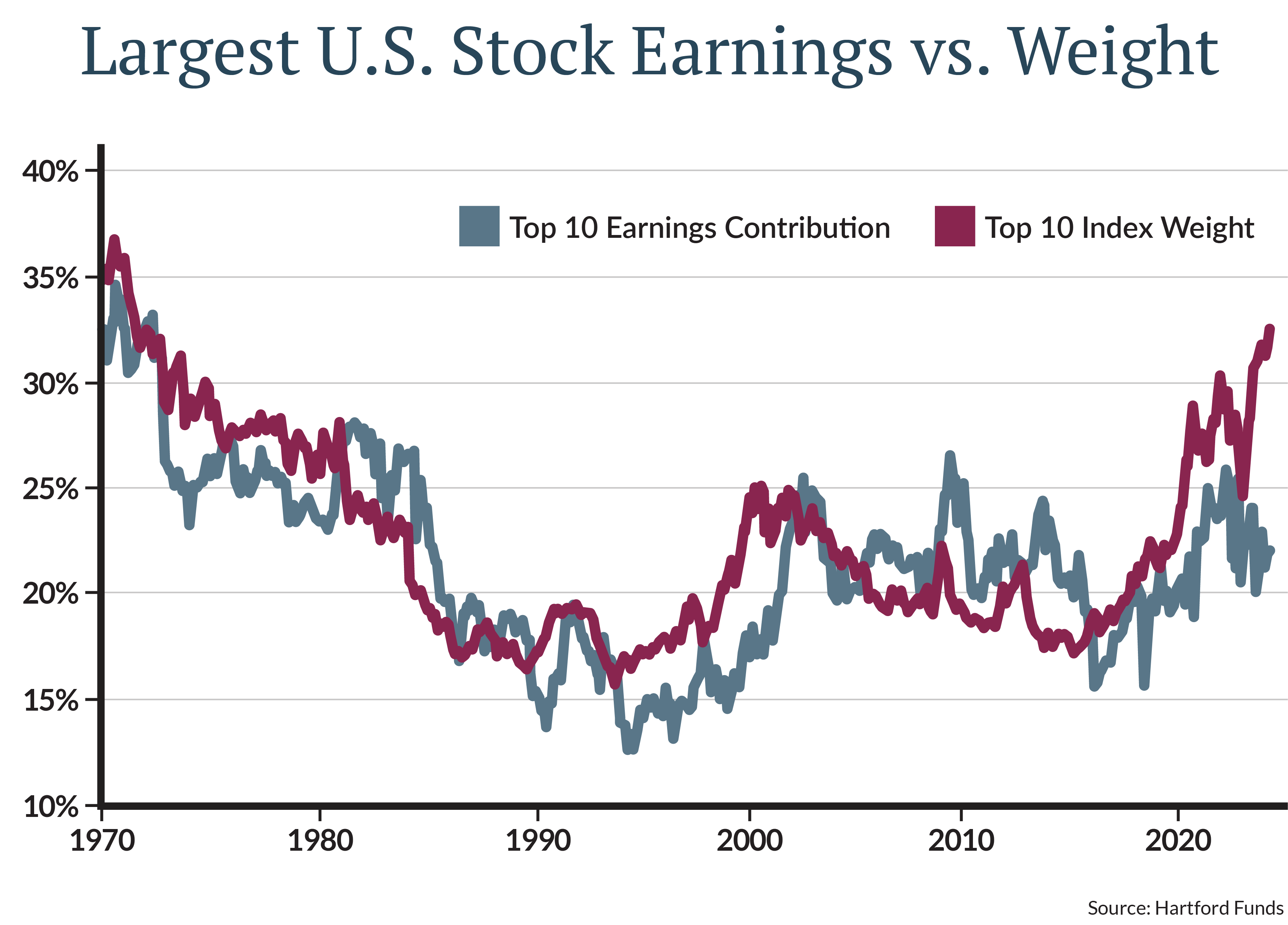

In 2023, the Magnificent Seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) surprised investors with stellar earnings growth, while earnings for the rest of the market declined. Yet in 2024, we are off to a strong start to earnings season with more than three-quarters of reporting S&P 500 Index companies beating expectations. The chart below shows the increasing divergence between the weight of the top 10 stocks in the US by market cap and their contribution to overall earnings.

The weight of the top 10 stocks has been increasing at a much higher rate than their contribution to earnings. A stock’s placement in the top 10 tends to be short-lived and volatile. If earnings growth converges between the Mag 7 and the rest of the market, leadership may shift. Additionally, the price to earnings (P/E) ratio of those same top 10 stocks is significantly higher than the bottom 490, signaling that valuations may be stretched among this group. Higher valuations pose a downside risk to stocks should sentiment sour or earnings disappoint.

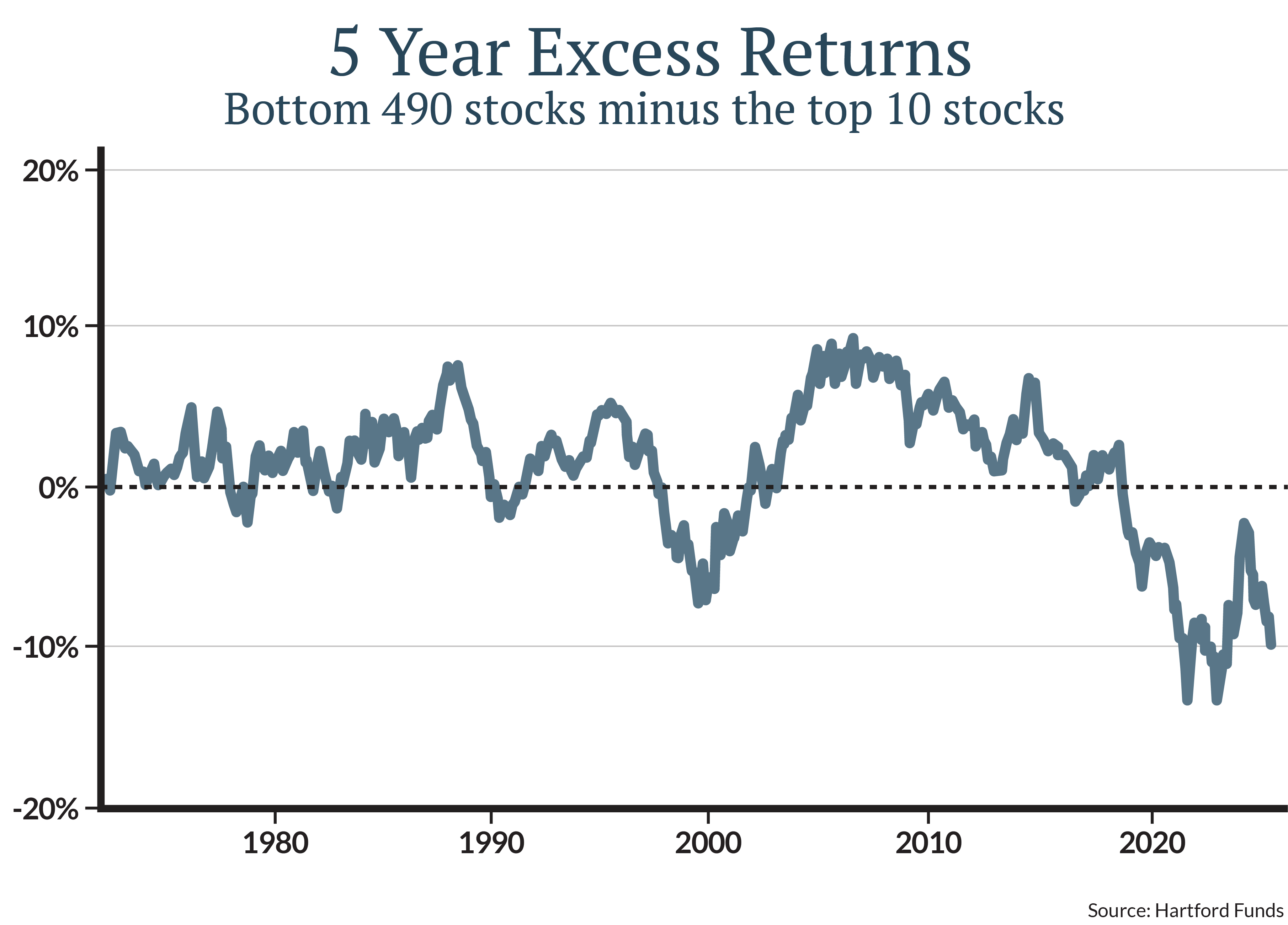

According to Hartford Funds, historically, when the P/E ratio of the bottom 490 has been this inexpensive relative to the P/E ratio of the top 10, the bottom 490 have outperformed by 4.5% on average over the next five years. The chart below illustrates performance of the top-10 stocks versus the bottom 490. When the line is above zero, the bottom 490 stocks outperformed the top-10 stocks. This has occurred in 70% of rolling five-year periods.

Year-to-date, the S&P 500 Index is up over 7%. Growth stocks continue to lead driven by earnings growth and optimism while higher rates have been a headwind to small cap and international stocks. Analysts expect earnings growth to accelerate in 2024 to 10% from just 4% in 2023. This year, as the market has broadened out, we have seen a divergence among the Mag 7 stocks:

Within US equities, we are currently underweight small cap, cyclical sectors, and highly valued growth stocks.

We keep an eye on consumer sentiment, as it can fuel consumer spending—which makes up about two-thirds of US GDP. The Conference Board Consumer Confidence Index and the University of Michigan Consumer Sentiment Index are two metrics that measure optimism among American consumers. For April, both indexes reported slightly lower overall confidence but remained in positive territory.

Overall consumer sentiment ticked down in April, primarily driven by lower income consumers. There is an increasing bifurcation in consumer confidence, and in turn, consumption. Middle and high-income consumers’ spending is keeping price levels high and companies catering to those consumers have the most pricing power. The middle 33% of consumers by household income, which tends to be the biggest driver of overall economic activity, actually has edged up.

On the flip side, lower income consumers show confidence levels in recession territory, but this cohort doesn’t drive overall economic activity. Stock market gains disproportionately accrue to high earners, with the top quintile (excluding the 1%) accounting for nearly 50% of total US equity wealth according to Piper Sandler. Strong stock market performance has pulled up confidence for high income earners, and in turn, these consumers continue to spend, supporting earnings.

We will continue monitoring these companies over the coming weeks for more insight into the health of the US consumer.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE