SUMMARY

Applying for a business loan? Here’s everything you need to know about the 5 Cs of credit and how they impact the loan approval process.

Business Guidance

8 minute read time

Applying for a business loan? Here’s everything you need to know about the 5 Cs of credit and how they impact the loan approval process.

Applying for a business loan can feel overwhelming, but it doesn’t have to be. Whether you’re looking to manage cash flow, expand your operations or invest in real estate, a solid understanding of how bankers review business credit can go a long way in securing the funding you need. That’s where the 5 Cs of credit come into play.

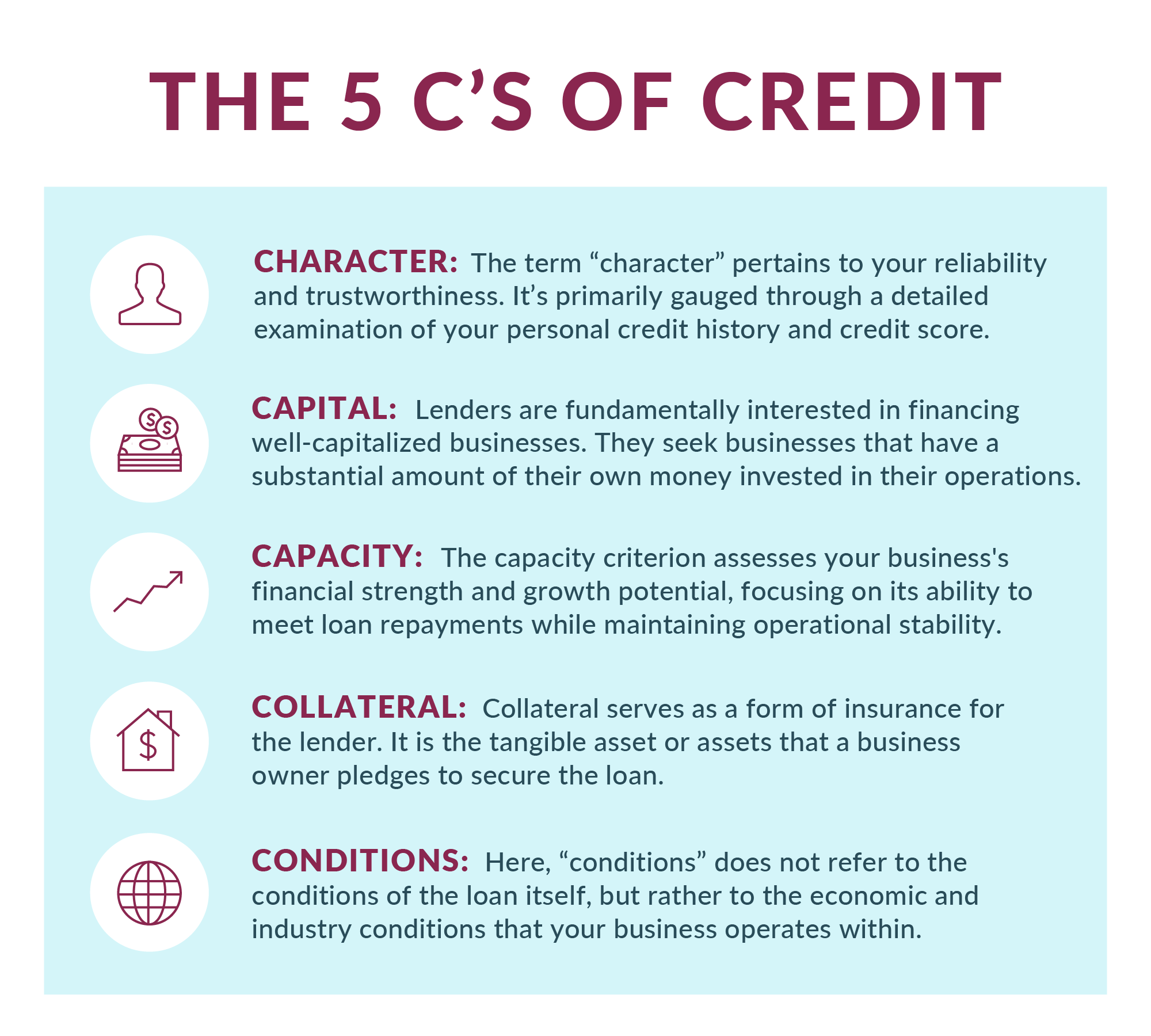

The 5 Cs of credit framework is the cornerstone of credit analysis in the banking industry. They consist of character, capital, capacity, collateral and conditions. Understanding each C will help you navigate the credit landscape confidently and make decisions that serve your business best. Here’s a breakdown on each one:

In a financial context, the term “character” pertains to your reliability and trustworthiness. It’s primarily gauged through a detailed examination of your personal credit history and credit score. A common misconception held by many business owners is the separation of their personal credit from their business dealings. These two spheres are closely interwoven. Especially in the context of new businesses, owners often stand as personal guarantors for their business loans. Therefore, your personal credit health can significantly impact your business's ability to secure funding. Understanding this interconnectedness is vital.

The process begins with a background check on the business owner, incorporating a review of personal credit history. This involves accessing your credit report from major credit bureaus. The objective is to assess your history of meeting financial obligations, your promptness in repaying debts and your overall management of personal finances. In certain cases, lenders may delve a bit deeper, examining your business’s reputation or even asking for business references. While this isn't common practice, it sometimes happens when a bank needs a fuller picture of the business or the owner's credibility. However, the emphasis primarily remains on the owner’s personal credit history.

Lenders are fundamentally interested in financing well-capitalized businesses. In other words, they seek businesses that have a substantial amount of their own money invested in their operations. This personal stake, or “skin in the game,” reassures lenders that you're sharing the financial risk and are committed to ensuring your business's success.

With respect to a specific loan, understanding how capital is evaluated can help you prepare for, and even increase your chances of, a successful application. Let's take an example of purchasing real estate or equipment for your business. Typically, a lender won't finance 100% of the purchase price. Instead, you might receive 75% to 80% of the needed funds from the bank, with the expectation that your business will cover the rest. This portion, funded by the business, is the equity or down payment portion.

Equity can come from various sources: the business's own profits, personal funds of the business owners or even from investors. However, one key point to remember is that lenders don't just look at your ability to make this down payment. They also want to ensure your business remains well-capitalized after the loan transaction. In other words, if your equity contribution wipes out all your cash reserves, leaving you with nothing to manage your day-to-day operations, that's a red flag for the lender.

Business lending usually requires a more substantial equity contribution than personal loans you may be familiar with, such as home and auto loans. This often comes as a surprise to many business owners. Therefore, it’s crucial to plan for this requirement and start saving for your equity contribution well ahead of the loan application.

Well-maintained financial statements play a critical role in this process. High-quality financial reporting allows lenders to assess your capital (and the next C, capacity), accurately. These documents show your business's financial health, the assets you have on hand and the state of your cash flow, both before and after the loan transaction. Therefore, maintaining thorough, accurate financial records can significantly bolster your standing when applying for a loan.

In essence, the capacity criterion assesses your business's financial strength and growth potential, focusing on its ability to meet loan repayments while maintaining operational stability. In assessing your business's capacity to repay a loan, lenders will review your financial performance over the past two to three years. This retrospective analysis provides an idea of the business's growth trajectory and financial health. Is the business steadily growing? Is it maintaining a stable revenue stream? Lenders also review a three-year profit and loss forecast, with a focus on gross profit, operating expenses and profit after owner salary.

Throughout the review, lenders consider the nature of the business. For a retail business, the cash cycle is shorter than for a B2B business that invoices customers and collects payments via ACH and check.

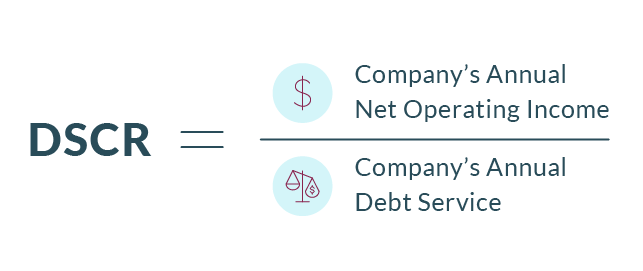

A common measure used to determine a business's capacity is the Debt Service Coverage Ratio (DSCR). This ratio compares your business's net income to its debt obligations. In general, lenders like to see a DSCR of at least 1.2. This means that for every dollar owed in loan payments, your business has $1.20 of income. This cushion provides assurance that your business hasn't only the ability to meet its loan obligations but also a buffer to handle unexpected expenses.

The principle here's like personal lending, where debt-to-income ratios are commonly used. However, in a business context, the focus is broader, considering not just the debt and income of the business but also its overall financial health and growth potential. These financial checks protect the lender by reducing risk. They also act as a safeguard for you, by helping to prevent situations where your business might become overburdened with repayments it can't afford.

The principle here's like personal lending, where debt-to-income ratios are commonly used. However, in a business context, the focus is broader, considering not just the debt and income of the business but also its overall financial health and growth potential. These financial checks protect the lender by reducing risk. They also act as a safeguard for you, by helping to prevent situations where your business might become overburdened with repayments it can't afford.

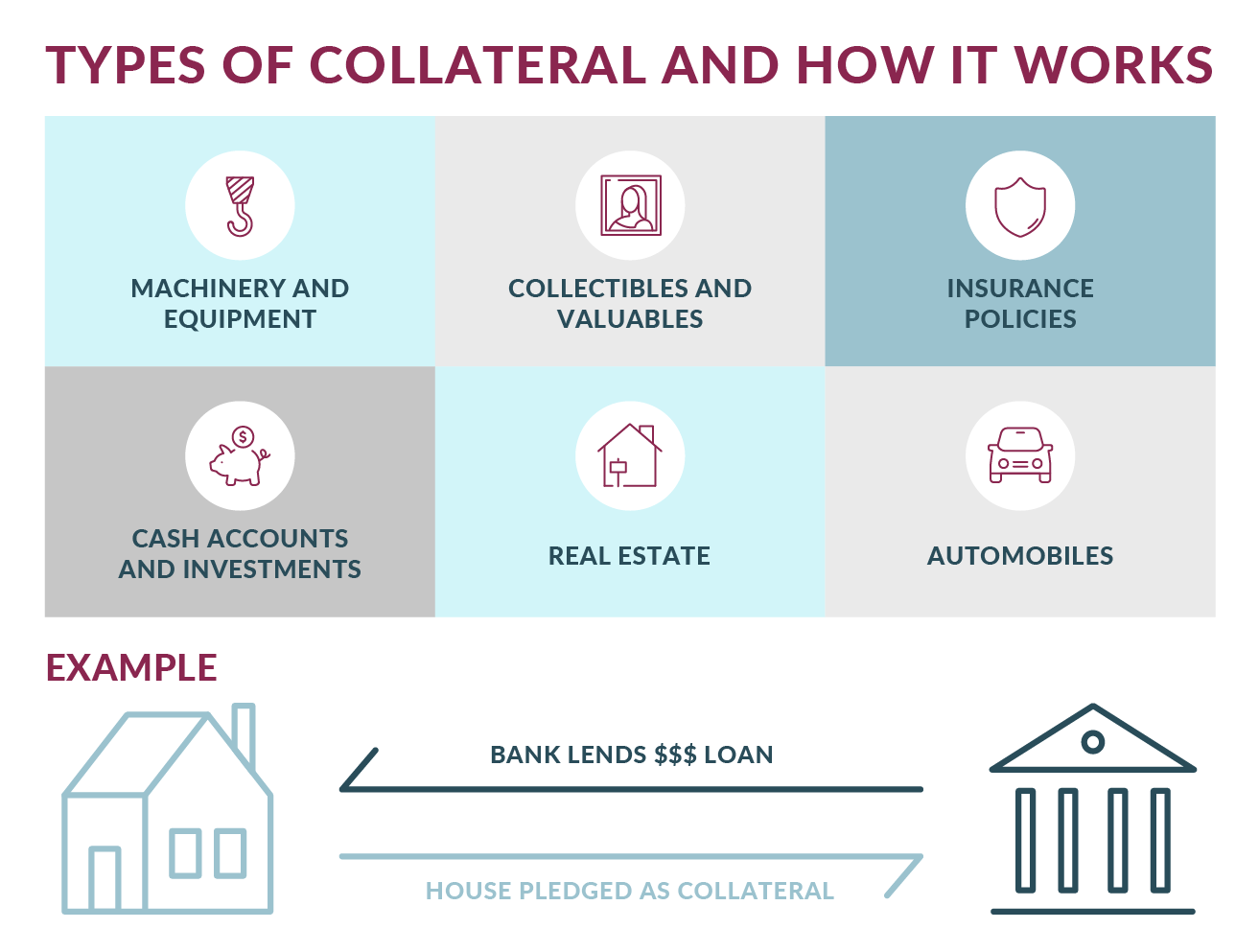

Collateral serves as a form of insurance for the lender. It's the tangible asset or assets that a business owner pledges to secure the loan. If the borrower is unable to repay the loan, the lender has the right to use the assets to recover its funds.

Typically, banks lend based on a percentage of an asset's value. This means that a lender will evaluate your balance sheet to determine which assets can be utilized as collateral. This can be business assets such as real estate, equipment, inventory or accounts receivables. For example, it’s common practice to lend up to 80% of the value of real estate, new equipment and accounts receivables. For inventory, by contrast, the figure is typically 50% of its value.

In scenarios where business assets aren't sufficient to secure the loan, the bank may consider the personal assets of the owner if the owner is willing. This option may be a fit for newer or startup businesses that may lack substantial business assets.

Here, “conditions” doesn't refer to the conditions of the loan itself, but rather to the economic and industry conditions that your business operates within. A thorough understanding of these conditions is essential for securing a loan, just as it is for successfully operating your business.

Conditions encompass a range of external factors that may impact your business, such as the macro and local economy, your competitors, opportunities and threats in your market. For instance, consider how a mild winter might negatively affect landscaping and snow removal businesses due to a lack of demand. However, where there are challenges, there are often opportunities too. New businesses emerged and thrived due to changes in market conditions brought on by such circumstances.

Remember, as lenders, we're rooting for your success. When evaluating conditions, we're sitting on the same side of the table as you, gauging the likelihood of your business's success. The better you understand your business environment and can plan for it, the more likely it is you won't only secure the loan you need but also steer your business towards sustained success.

Understanding and successfully navigating the 5 Cs of credit — character, capital, capacity, collateral and conditions — is a cornerstone of securing financing for your business. As we've discussed, each of these elements offers perspective on your business and its potential fit for a loan. Understanding them can help in the loan process and in the inevitable ups and downs of business ownership. You may also find the 5 Cs helpful as you consider your own financial and operational strategies.

At the end of the day, as your advisor we aren’t just interested in providing a loan — we're invested in your success. We're on your side, hoping to see your business thrive and grow. The more you understand the 5 Cs, the better positioned you'll be to make that a reality.

Let’s start a conversation. Connect with an advisor if you have any questions or to start the loan process.