SUMMARY

This comprehensive guide offers a comprehensive guide for homebuyers on what to ask mortgage lenders during the pre-approval process.

Your Financial Life

4 minute read time

This comprehensive guide offers a comprehensive guide for homebuyers on what to ask mortgage lenders during the pre-approval process.

Buying a home is one of the most significant financial decisions you’ll make and finding the right mortgage loan is crucial. To ensure you’re making the best choice for you, it’s important to ask your mortgage lender the right questions and be well-prepared. Here’s everything you need to know about meeting with a mortgage lender and the information you need to make the pre-approval process easier:

Short answer: As soon as you decide you want to buy a house. We recommend starting the conversation early and planning ahead. That way, you can understand the approval process and have time to compare different loan options to ensure you’re committing to the right one. It’s a long-term commitment, so it’s important to make an informed decision.

If you’re ready to start the pre-approval process, reach out to one of our mortgage loan officers today!

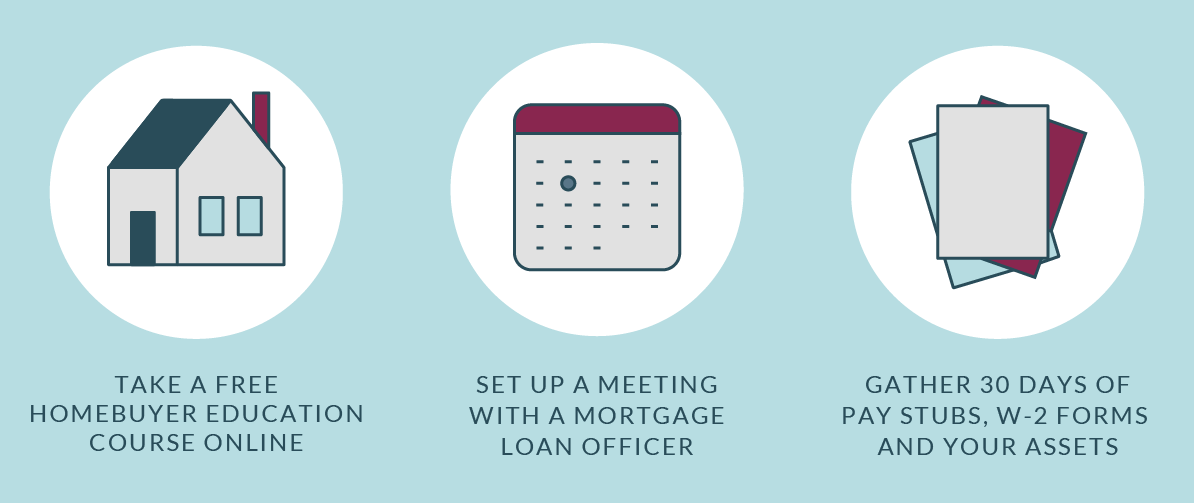

It’s important to be well-prepared for your meeting with a lender. Here are some steps to take:

Here are some important terms to familiarize yourself with before you meet with a lender:

Understanding the different types of loans available can help you choose the one that best fits your financial situation. Each loan type comes with its own set of terms, rates and requirements and knowing your options can help you make a more informed decision.

For example, you might be considering a fixed-rate mortgage, which offers a consistent interest rate over the life of the loan or an adjustable-rate mortgage (ARM) where the interest rate can change over time.

One of the most critical pieces of information to gather during the pre-approval process is the minimum down payment required for the mortgage you're considering. This number can significantly influence your budget and savings plan. Knowing the minimum down payment helps you set realistic financial goals and ensures that you have enough funds set aside to meet this requirement. Most first-time homebuyer programs allow for 0% down, but you should plan a minimum of 3%.

Many first-time homebuyers are eligible for special programs designed to make homeownership more accessible and affordable. These programs can offer a range of benefits, such as reduced down payment requirements, lower interest rates or even grants to cover some of the costs. It's important to ask your lender about these programs to see if you qualify.

The interest rate and the Annual Percentage Rate (APR) are two key factors that will significantly impact your monthly mortgage payments and the total cost of the loan over its lifetime. The interest rate is the cost of borrowing the principal amount, while the APR includes the interest rate plus other fees and charges, giving you the full picture of the loan's cost. Understanding these rates is crucial for assessing the affordability of the loan.

Does it vary per loan? Private Mortgage Insurance (PMI) is typically required if you put down less than 20% of the home's value as a down payment. This insurance protects the lender in case you default on the loan, and the cost can vary depending on the type of loan you choose. It's important to understand how PMI will affect your overall expenses, as it can add a significant amount to your monthly payment. Ask your lender about the different PMI loan options as they can vary from one loan to another.

Your monthly mortgage payment is more than just the principal and interest on the loan. It typically includes several components like your principal, interest, property taxes and homeowners insurance. Some loans may also include additional fees, such as mortgage insurance.

Are there any other pre-paid expenses I’ll need? Closing costs are the fees and expenses you must pay to finalize your mortgage and complete the home purchase. These costs can add up quickly and include items such as loan origination fees, appraisal fees, title insurance and attorney fees. Additionally, you might need to pay for pre-paid expenses, such as property taxes or homeowners insurance, which are typically escrowed and paid upfront. Being aware of these costs can help you avoid surprises and ensure that you have the necessary funds available for the final stages of the homebuying process.

To get started on your homebuying journey, connect with one of our mortgage loan officers today.