Back to Even

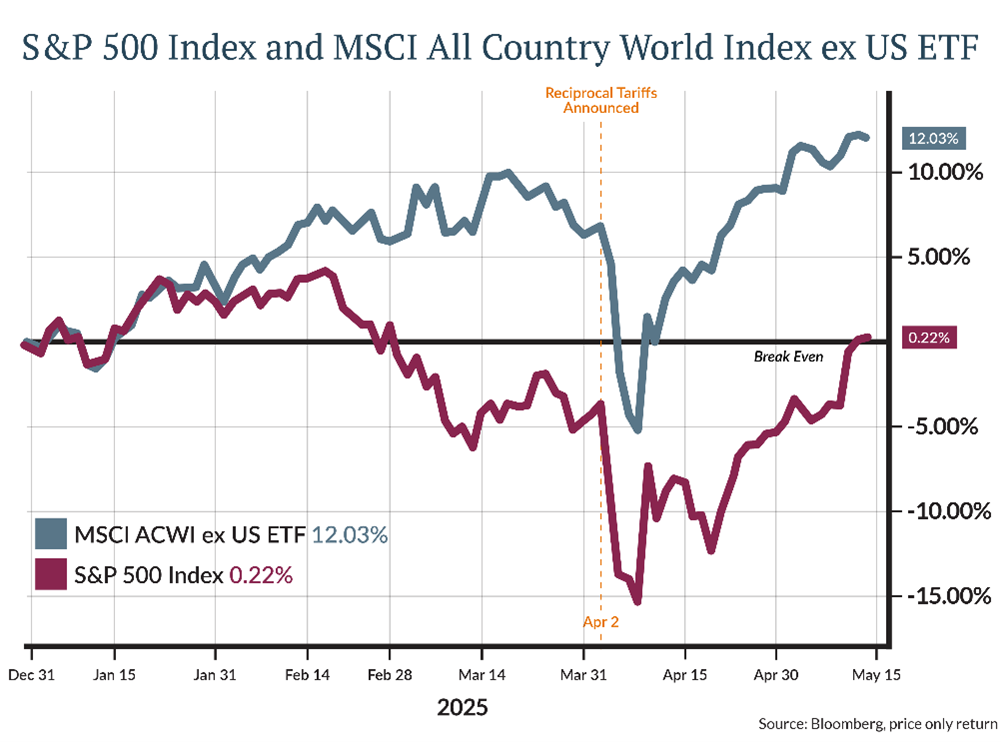

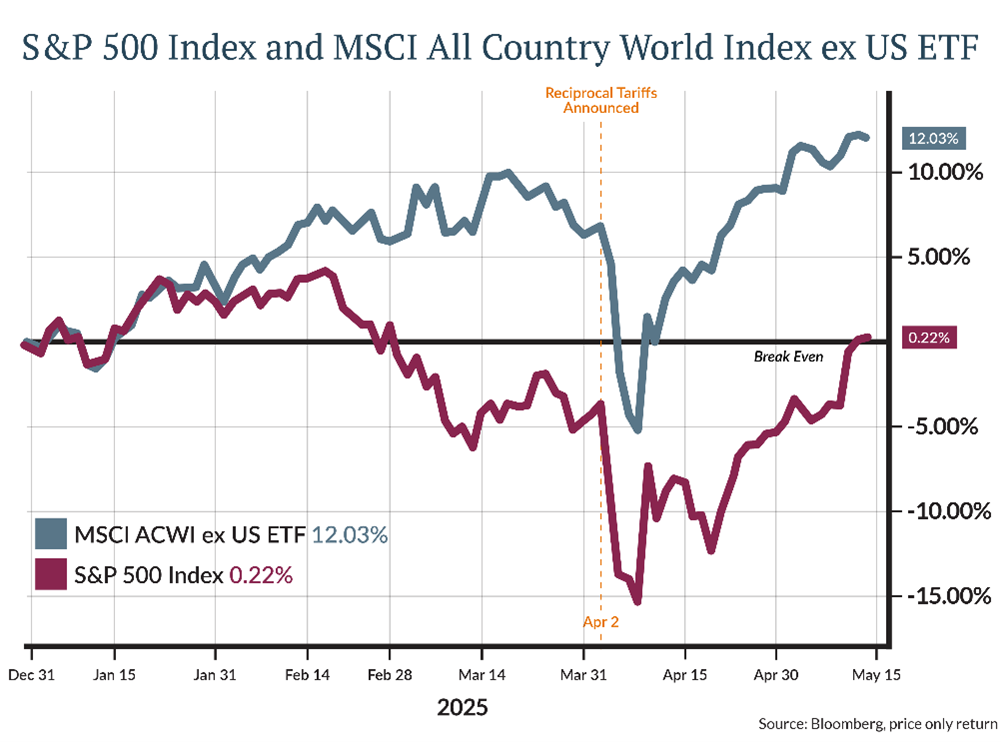

Stocks have had a wild ride so far in 2025, riding the ebbs and flows of tariff news. Fear turned to panic after the Trump administration announced its proposal for reciprocal tariffs on our trading partners. The panic turned a 10% decline about trade worries into an 18% decline in a matter of days when tariffs came in much higher than expected.

A key point here is how quickly—even outside normal market trading hours—new information gets priced into the market.

In this case, cooler heads seemed to prevail after a week of pain when the administration announced a 90-day pause on many of the tariffs to allow time for negotiation. The rebound that ensued has recovered the majority of the decline with the S&P 500 Index returning to breakeven on the year as the panicked sellers buy back their shares.

International stocks have outperformed US stocks year-to-date providing some offset to the decline in US stocks. The outperformance has been driven by the downgrade to US economic growth as a result of the tariffs and a return boost from a weaker US Dollar, which have added about 8% to international returns.

After-Hours Markets and Market Timing

With the recent panic came volatility, and with volatility comes large movements in the market. Investors question whether the sell-off is an opportunity to buy more or is only the beginning of a further decline. The challenge is that new information often comes when markets are closed or when trading is only available during after-market hours. Therefore, the highly efficient stock market reflects the new information almost instantly as investors reset the prices at which they are willing to buy and sell stock.

Before we share some examples of how new information is reflected in the stock market, an explanation of the after-hours market is worthwhile.

After-hours trading refers to the buying and selling of stocks outside of the standard US market hours, typically between 3:00 p.m. and 7:00 p.m. Central Time. This extended trading period, among other things, allows investors to react to news events and earnings reports which are often released after the regular session ends. Trading in the after-hours market is typically more volatile than the regular session because there is lower liquidity (fewer market participants), which makes after-hours trading riskier and most appropriate for professional traders.

Market Efficiency

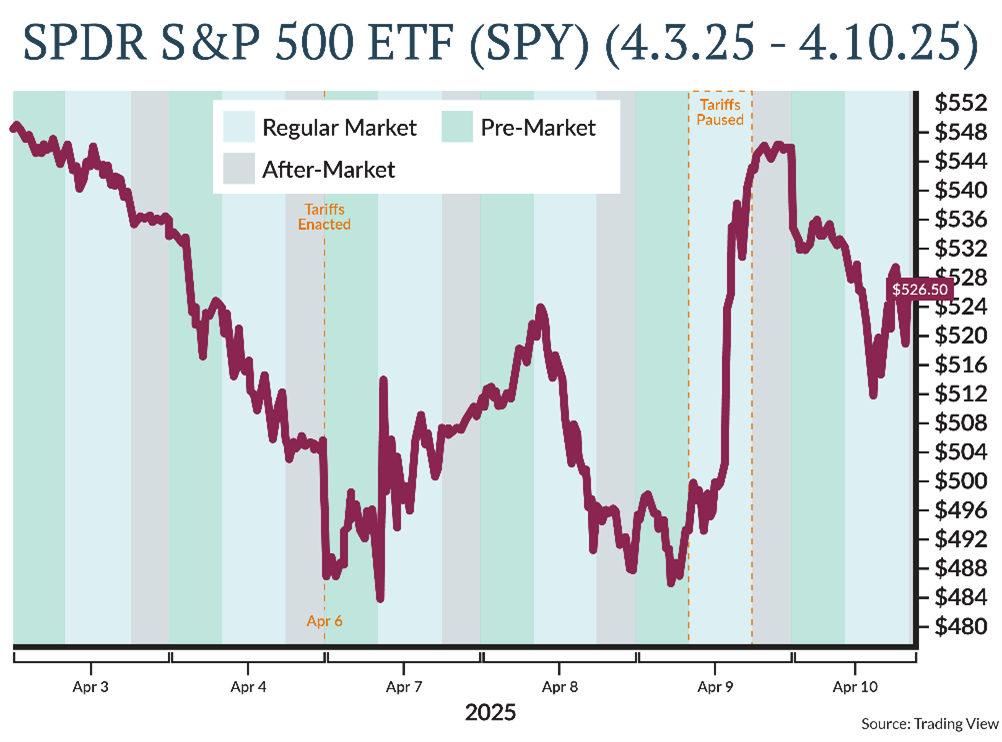

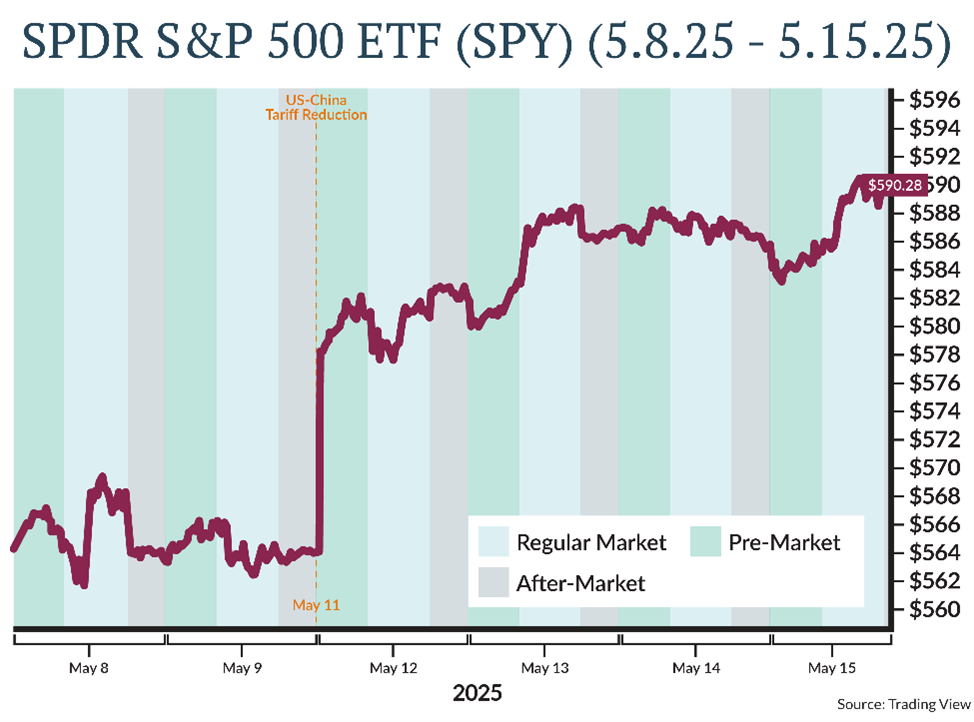

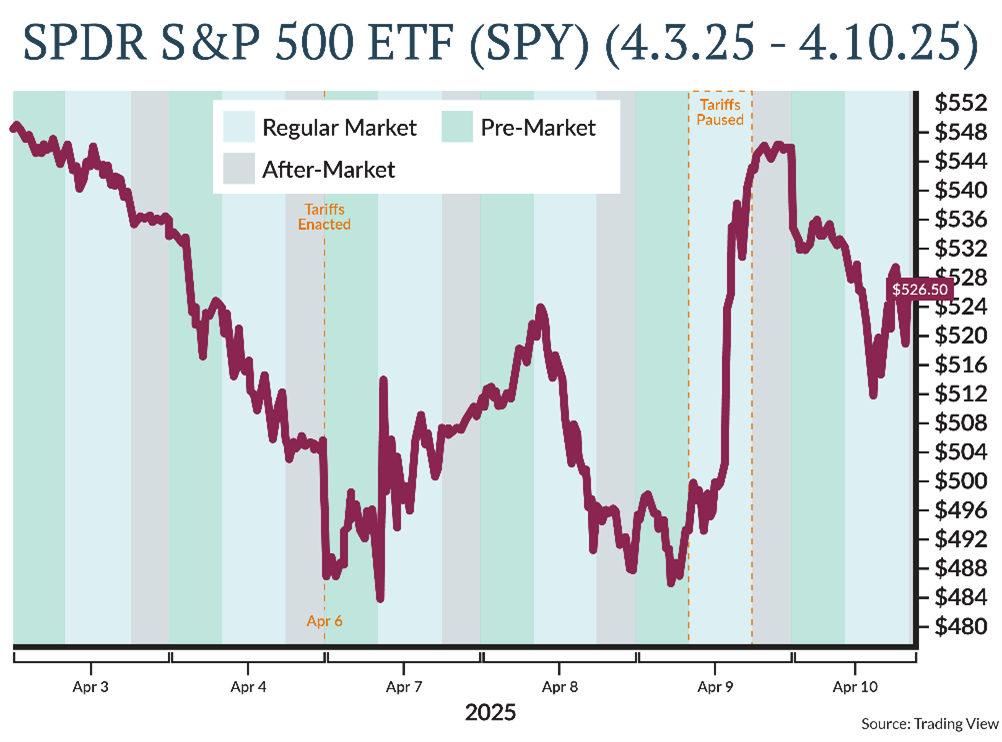

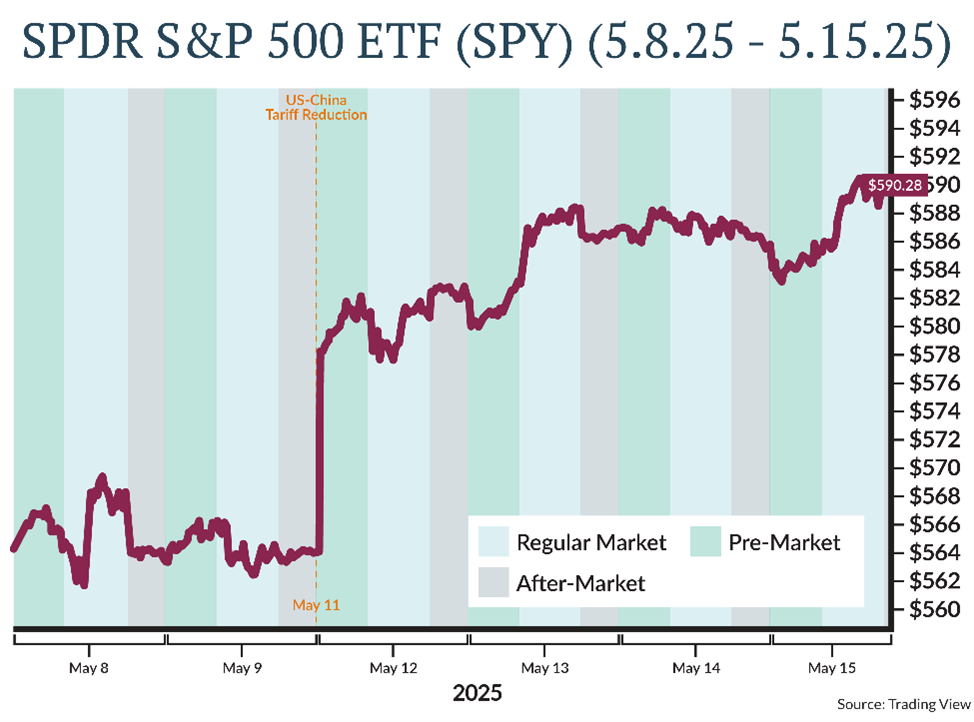

To demonstrate how quickly new information is priced into the stock market and the folly of timing it, we have segmented two periods during the recent tariff volatility. The first shows the market movement of the SPDR S&P 500 ETF (SPY) around the time that reciprocal tariffs were announced on April 2 and the pause was enacted a week later on April 9. The second shows the SPY during the week of de-escalation of trade tensions with China on May 11.

Observations/Conclusions

1. Market Efficiency

-

- Note how quickly the tariff news was reflected in prices over the weekend of April 5-6 when tariffs went into effect, when tariffs were paused on April 9 and when US-China reached a truce of sorts over the weekend of May 10-11.

- Furthermore, the weekend news was untradable and already reflected in market prices by the time you could have traded on the news.

2. Signally Effect

-

- Note that the price movement in the pre-market and after-market do not signal the trend of trading during regular market trading.

- In fact, if you had tried using the after-hours market as an indicator for regular session trading, your return would have been a cumulative -9.25% as of May 13. Whereas if you had bought SPY at the open on April 1 and rode the waves you would be up roughly 5.47%.

As mentioned in last week’s commentary, the noise around the news triggers an emotional response to do something, and skeptics would tell you to tune in to tomorrow’s broadcast. However, as the old adage goes, “time in the market is more important than timing the market.” We believe our disciplined approach to rebalancing is a better way to take advantage of market volatility as it increases the probabilities that your long-term investing goals are met by remaining invested.