Wealth Insights

Risk, Reward, and Rory at the Masters

5 minute read time

The calendar says spring starts in March, but for me, it starts with The Masters golf tournament that is traditionally played the first full week of April. Watching my favorite players compete on the lush green grass of Augusta National Golf Club with white, pink, and purple azaleas blooming in the background is an annual reminder that warmer weather is on its way. Inevitably, this is when I break out the golf clubs and start working on my swing.

The Masters also happens to be my favorite sporting event. There is something about the combination of risk and reward on the back nine that makes for the most compelling theater in golf. Slippery, undulating greens and water hazards routinely make fools of the greatest golfers in the world. But it’s also a marvelous canvas on which to watch geniuses at work. Legends are made at Augusta, making it the most coveted prize in golf.

This year’s tournament was one of the most compelling I have ever witnessed, and Rory McIlroy’s long-awaited playoff victory contains a number of life lessons that are relevant for investors.

It’s a Mental Game

Elite golf is a mental game as much as physical. If you want proof, look at how many pros work with sports psychologists. Dr. Bob Rotella has become famous for helping athletes, including McIlroy, manage their emotions to improve performance. For over a decade, McIlroy had faced the pressure of coming to The Masters trying to win the career grand slam of all four major tournaments, something only five players in history had ever achieved. Despite being the greatest golfer of his generation with a game perfectly suited for Augusta, McIlroy had been unable to win the tournament that would cement his legacy. Everyone knew it was mental.

At this year’s tournament, McIlroy went into the final round with a two-stroke lead. He promptly double bogeyed the first hole, later admitting he was as nervous as he had ever been. By the 13th hole, he had regained and extended his lead to four strokes, with victory all but certain. He again made double bogey, followed by another bogey at the 14th hole, and his lead was gone. He only had a few holes left, and it seemed like his dreams were slipping away.

For investors, there’s an obvious parallel here. It can feel like your dreams are slipping away when markets tumble and hard-earned retirement savings seem to evaporate. Market volatility over the last few months has unnerved many investors, just as it has during previous periods of economic uncertainty. But experienced investors know that volatility is the price we pay for long-term gains. Without risk, there would be no reward. With each setback, the seeds for the next bull market are sown. Investing, too, is a mental game. And just like sports psychologists, our job as advisors is to help clients manage their emotions.

The Risks of Playing it Safe

In professional golf, it is notoriously hard to win from ahead. Players chasing the lead are aggressive, knowing they must take risks to climb the leaderboard. Leaders are burdened with having one hand on the trophy and the fear of blowing it. Greg Norman famously lost a six-shot lead at the 1996 Masters, something every Sunday leader at Augusta since knows in the back of his mind.

With fear of making a mistake, the temptation to play it safe can take over. McIlroy’s struggles on Sunday included laying up on a reachable par five, only to put an easy short pitch in the water. He thought he was playing it safe, but disaster ensued.

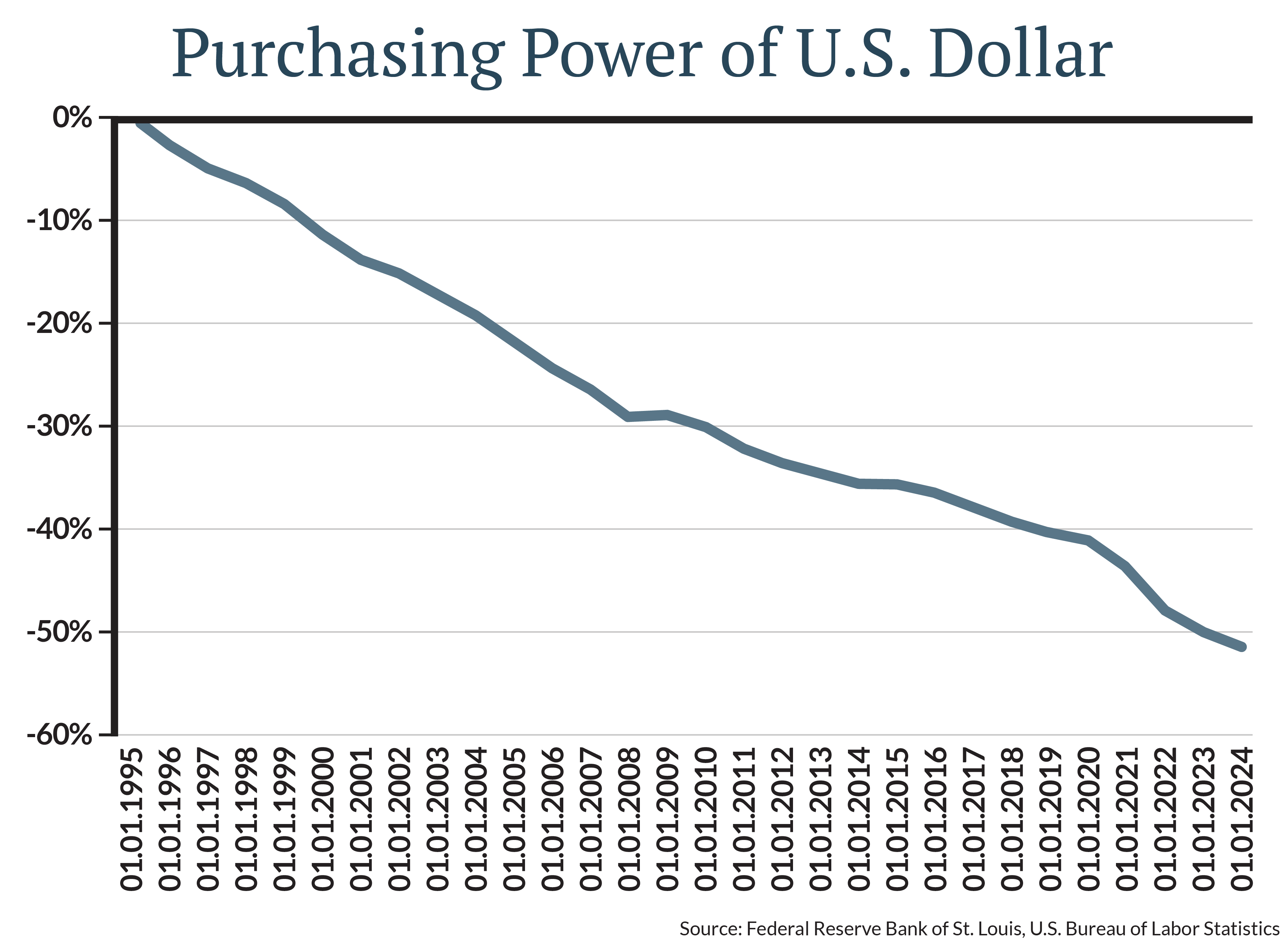

Let me show you something even scarier than a four-foot, downhill putt to win The Masters . The chart below shows the loss of purchasing power of the dollar over the past 30 years. If this isn’t the most powerful reason to invest, then I don’t know what is. Inflation is a silent killer of purchasing power that will erode the value of uninvested savings. Money stored under a mattress won’t fluctuate like the price of the S&P 500 Index, but it is far from safe.

Consistency and Patience

McIlroy’s resilience over the last few holes of the tournament and into the playoff was as impressive as any of the prodigious drives or precise irons he played on Sunday. When everything seemed likely to fall apart, he rallied and outlasted the charging, gritty Englishman Justin Rose with a bridie on the first playoff hole.

In his acceptance speech, Rory turned and looked at his young daughter, telling her, “Don’t ever give up on your dreams.” It was a tremendous moment and a lesson for us all. McIlroy is beloved by fans for his emotional accessibility, and golf fans had witnessed his disappointment repeatedly in recent years. But his determination, consistent preparation, and patience finally paid off at Augusta, ending in tears of joy. It was a triumph over self and fear of failure. The lessons for life and investing are ones I will try never to forget.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE