Recently, the valuation of private assets has been in the news, with the latest headlines bringing scrutiny to the finances of the Harvard endowment. The question amounts to whether Harvard may be overstating the value of its private investments. On its face, this topic may seem irrelevant for everyday investors who aren't responsible for "valuing" or "pricing" their assets. However, the topic is quite important, because investors at every level need—and deserve—confidence about the value of their investments.

In past commentaries, we've noted that private market investments continue to grow in size and influence throughout the economy, and may be a benefit to investor portfolios by offering exposure to an expanded opportunity set. This is even more true in recent years as more companies these days seem to never "go public" at all. When recommending private assets to our investors, we take their trading and valuation characteristics very seriously.

Here, I'd like to share a few high-level reasons why private market valuations may be more robust than headlines suggest.

Valuations in Private vs. Public Markets

Private company valuations differ from those of public companies. Public companies are priced in real-time, and are often swayed by investor sentiment and trading activity. Private companies, on the other hand, are valued just a few times a year based on their financial performance, recent deals, and comparisons to similar public firms. Some critics say this makes private equity less reliable—but data from experienced firms like Hamilton Lane tells a different story.

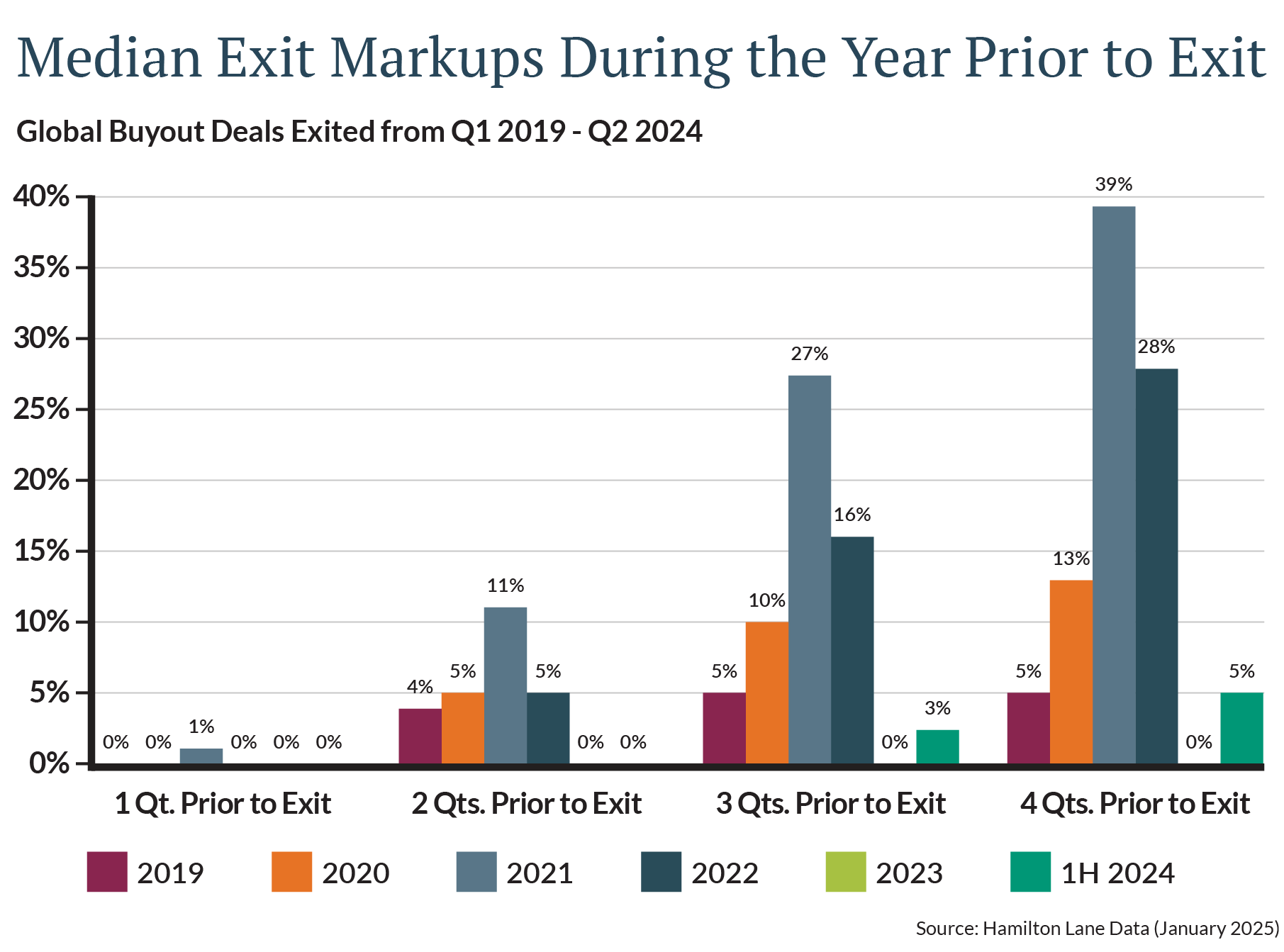

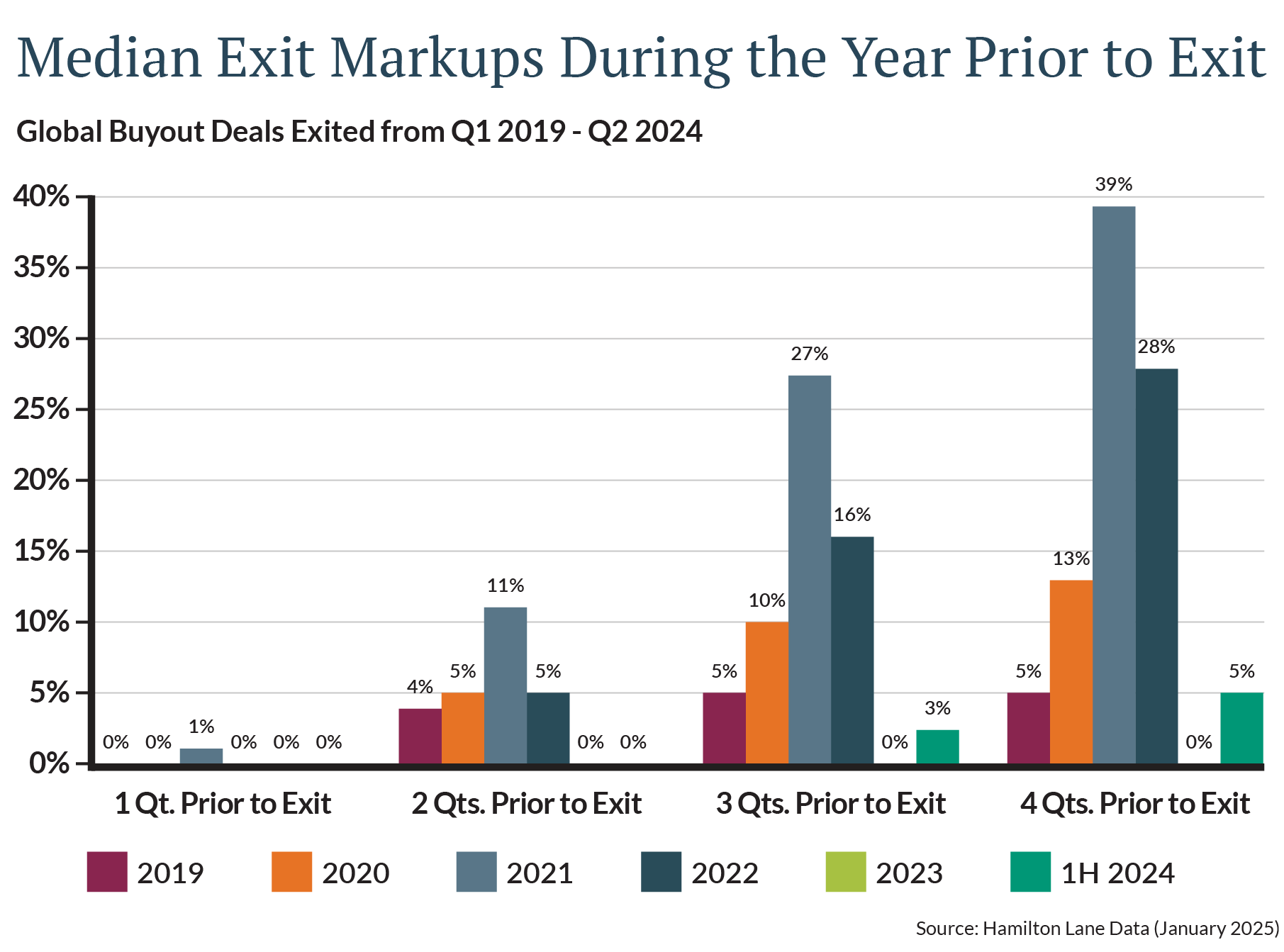

Exit Markups

The following chart, from longtime private market consultant Hamilton Lane, shows several years' worth of data on "exit markups"—that is, valuations in the time leading up to the business sale and the determination of value to a buyer. Note, in particular, the right-side portion of the chart, which indicates that private assets have generally sold at higher prices than they were valued at four quarters (one year) before exit. This suggests that, if anything, private asset managers may have conservatively valued the assets in question.

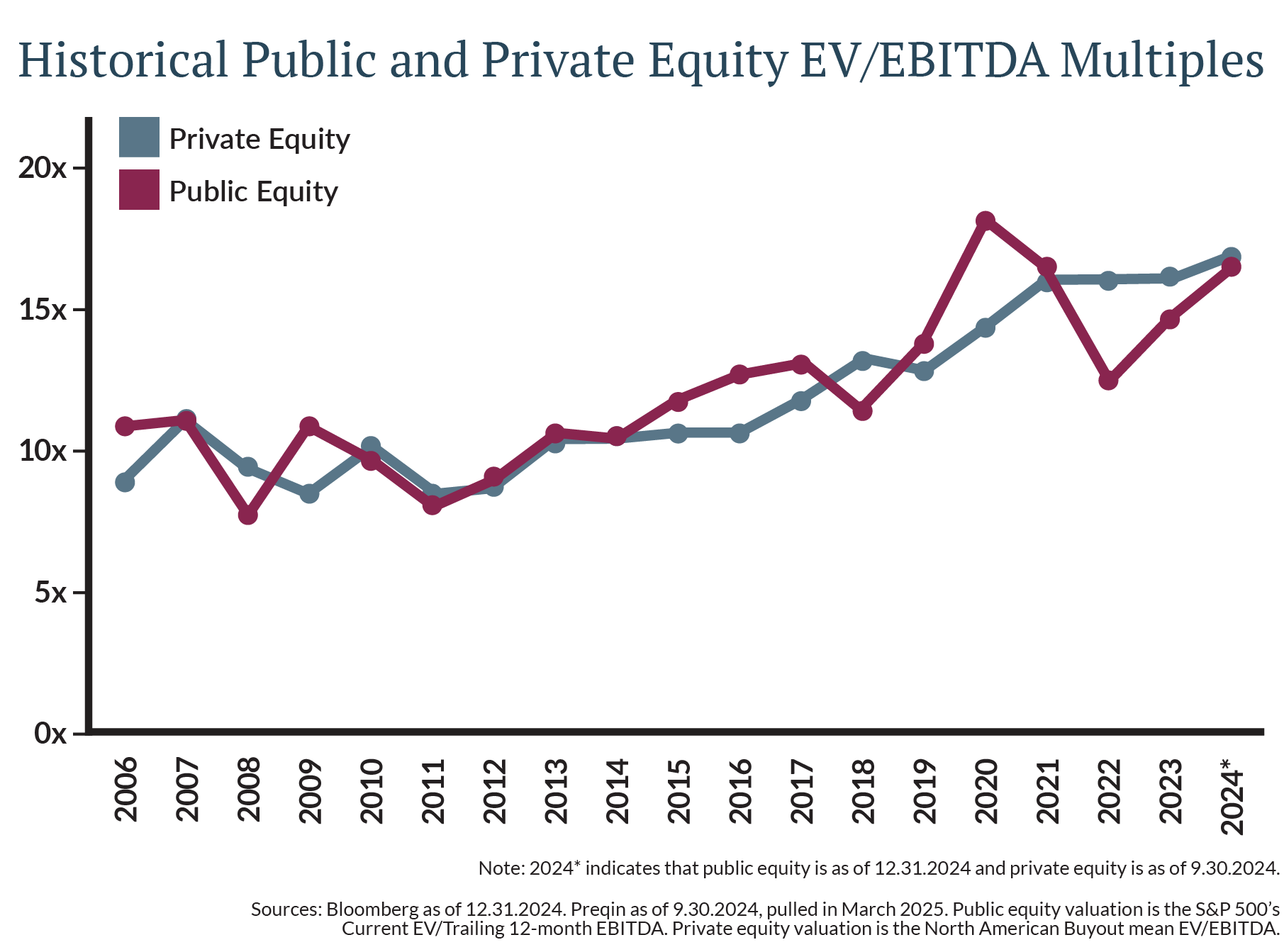

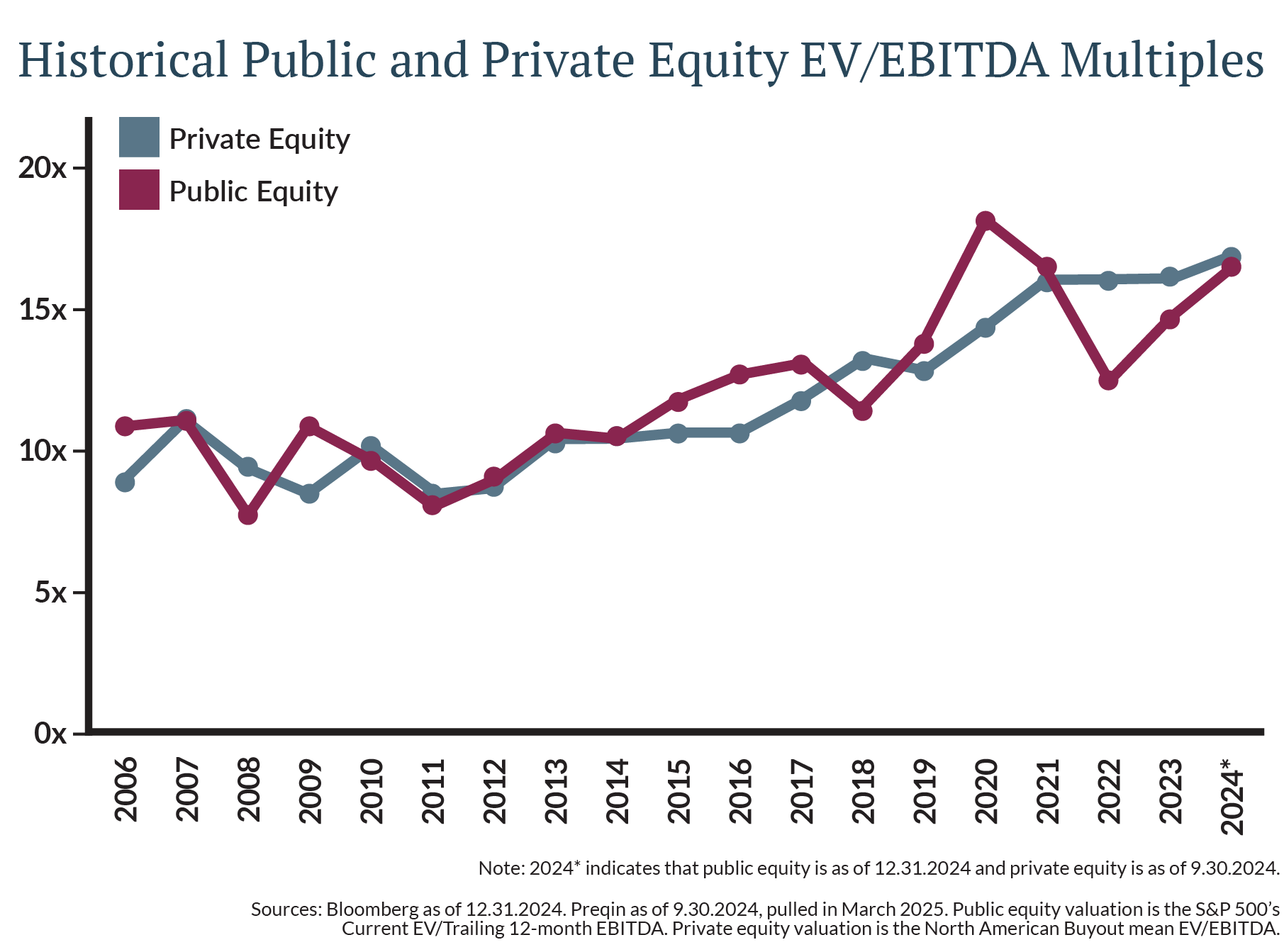

Comparing Valuation Multiples

This next chart provides a way to compare valuations of publicly traded assets (in this case, stocks) with private equity. Note the blue and maroon lines generally move together over time. Both lines reflect the ratio of total enterprise value to a measure of company earnings called EBITDA (the amount the company earns before deducting expenses for interest, taxes, depreciation, and amortization).

Multiples (that is, the value of the company as a multiple of EBITDA) vary over time as the economy and investor preferences change. While there are periods of divergence between the private and public equity ratios—often driven by broader public market dislocations—they have proven to be temporary.

Understanding the Role of Secondaries

Another area that has drawn press coverage is the reported "secondary sales" from several prominent university endowments. The prices paid in these transactions reportedly occurred at a discount. Unfortunately, the reporting has suggested that the discounted transaction prices are indicative of inflated company values.

To clarify, a private market secondary sale typically refers to an investor selling their interest in a private market fund, not the sale of individual underlying businesses. Such sales are often driven by specific investor needs—such as a university endowment rebalancing its portfolio or responding to changes in funding sources—rather than underlying performance concerns.

When large institutions like Harvard seek liquidity from their private investments, they often accept a discounted price that reflects their unique need for liquidity, not necessarily a decline in the quality or value of the assets held by the fund. It's a nuance that headlines often miss, but one that makes all the difference.

It's also worth noting that funds focused on acquiring these secondary interests may be positioned to benefit from such discounts. These strategies are built around the idea that temporary pricing dislocations from those seeking liquidity can create attractive buying opportunities.

Regulations Apply

With the continued growth of private markets, it's natural that they would attract more regulatory attention. Transparency, consistency, and investor protection are essential in any market—whether public or private. That said, it's important to distinguish between healthy oversight and mischaracterizations meant to drive narratives.

Most reputable private equity firms adhere to valuation standards such as those established by the Institutional Limited Partners Association (ILPA) and the International Private Equity and Venture Capital Valuation (IPEV) guidelines. These frameworks are designed to promote consistency and fairness in reporting portfolio company values.

Final Thoughts

Ultimately, valuation is both an art and a science. It involves judgment and a disciplined process. While private equity valuations do not benefit from daily pricing like public markets, that does not make them inherently flawed or inflated. In fact, the data suggests the opposite: private equity valuations are generally aligned with realized outcomes and market trends.

As allocators of client capital, we strive to ignore the noise and focus on what the data tells us. Amid headlines and political commentary, maintaining perspective is as important as ever.