Wealth Insights

Optimists Win Again

5 minute read time

One of my favorite sayings within the investing community is “Save like a Pessimist, Invest Like an Optimist.” It captures both the discipline and growth mindset required to be a successful investor. Time and again it has proved a winning formula, and the first half of 2025 was no different. Trade wars, military actions, and heated policy arguments unnerved investors at times, but the S&P 500 is hovering near all-time highs once again. Let’s look at what markets have overcome and the reasons to stay optimistic.

Let’s TACO Bout Trade

If you wanted to characterize the Trump administration’s tariff policy as chaotic, I don’t think you would get pushback from many quarters. We’ve seen a 10% baseline tariff on most imports imposed, with higher "reciprocal" tariffs on certain countries based on trade deficits, and specific tariffs on steel, aluminum, and automobiles. At one point tariffs on Chinese goods reached 145%.

But then something happened. Markets revolted, and tensions eased, with tariffs delayed or lowered amid ongoing negotiations. Markets recovered, leading cheeky Wall Street wags to coin the term “TACO trade,” an acronym short for Trump Always Chickens Out, to describe how markets tumble amid tariff threats, only to rebound sharply when things de-escalate, and negotiations start fresh.

What is important here is not whether Trump is tough or weak, a genius or a dolt. What is important is that he has shown a sensitivity to market forces and clearly does not want to induce a recession if he can avoid it. A consensus is developing among investors that while tariffs are likely here to stay, their effects can be managed, and the closer companies are to knowing the rules of the game, the better they can prepare and adapt. Companies CEOs don’t throw in the towel when policy changes, and neither should investors.

What About the Middle East?

If the trade wars didn’t scare you, perhaps the ongoing conflict in the Middle East has. The United States bombed three Iranian nuclear sites on June 21, raising fears that the U.S. would become embroiled in the conflict between Israel and Iran.

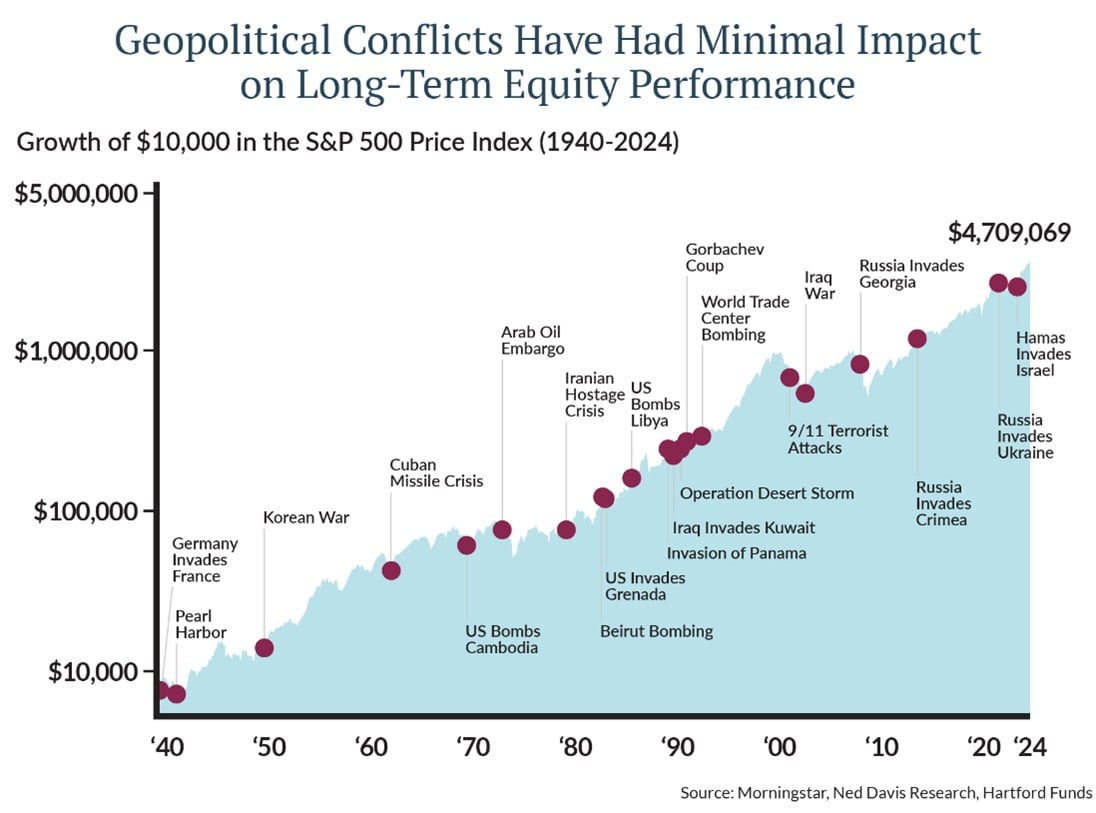

What has happened since then? The S&P 500 rallied to new highs and oil declined from a peak near $75/barrel to $65 today. Did anybody predict this? No. But long-term market watchers know that even geopolitical conflict has historically not derailed markets. Think of all the events markets have endured over the years, from World Wars to the Cuban Missile Crisis and the Cold War to 9/11 and Afghanistan. Economies and businesses have made it through to the other side every time, as the chart below shows. In fact, stocks generated positive performance one year after an act of aggression for 73% of the armed conflicts since World War II. Betting that this time is different is a bet against human innovation that has always triumphed over conflict.

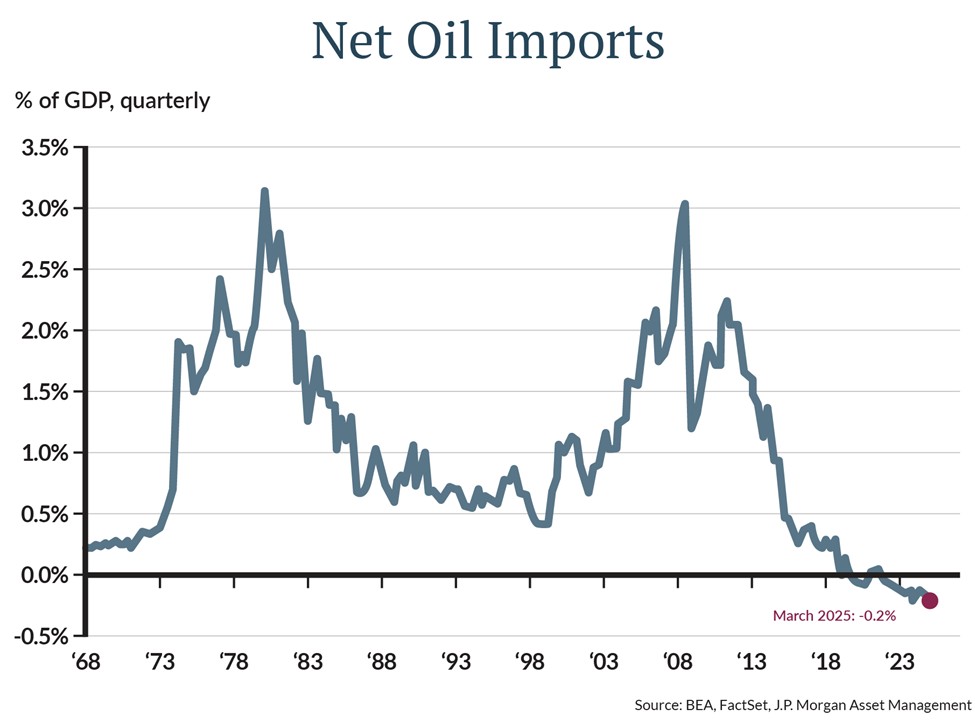

Remember, too, that the U.S. is not as dependent on foreign oil as it once was. The Wall Street Journal reports that in 1977, the U.S. had net imports of about 3.1 billion barrels of petroleum and refined products, or 14 barrels per person. That per-capita number was unchanged as recently as 2003 at the time of the Iraq war. Today, largely because of hydraulic fracturing, or “fracking,” the U.S. is a net exporter of oil and the world’s largest seller of liquefied natural gas. The world is no longer hostage to Middle Eastern oil.

A Time for Gratitude

Sometimes it feels like there is a disconnect between markets and world events. The news is incessantly negative, amplified by social media and the internet outrage machine that hungers for more and more clicks. Buoyant markets don’t make sense when doomscrolling. But overcoming adversity is normal for Americans. Our resilience, ingenuity, growth mindset, and optimism about the future is a blessing that we can all be grateful for as we celebrate the coming 4th of July holiday with friends and family. We are thankful to have the privilege of working with each and every one of you and look forward to a bright and prosperous future.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE