Business owners who sponsor 401(k) and other defined contribution plans will soon be faced with another decision: whether to offer alternative-investment options among a plan’s investment options.

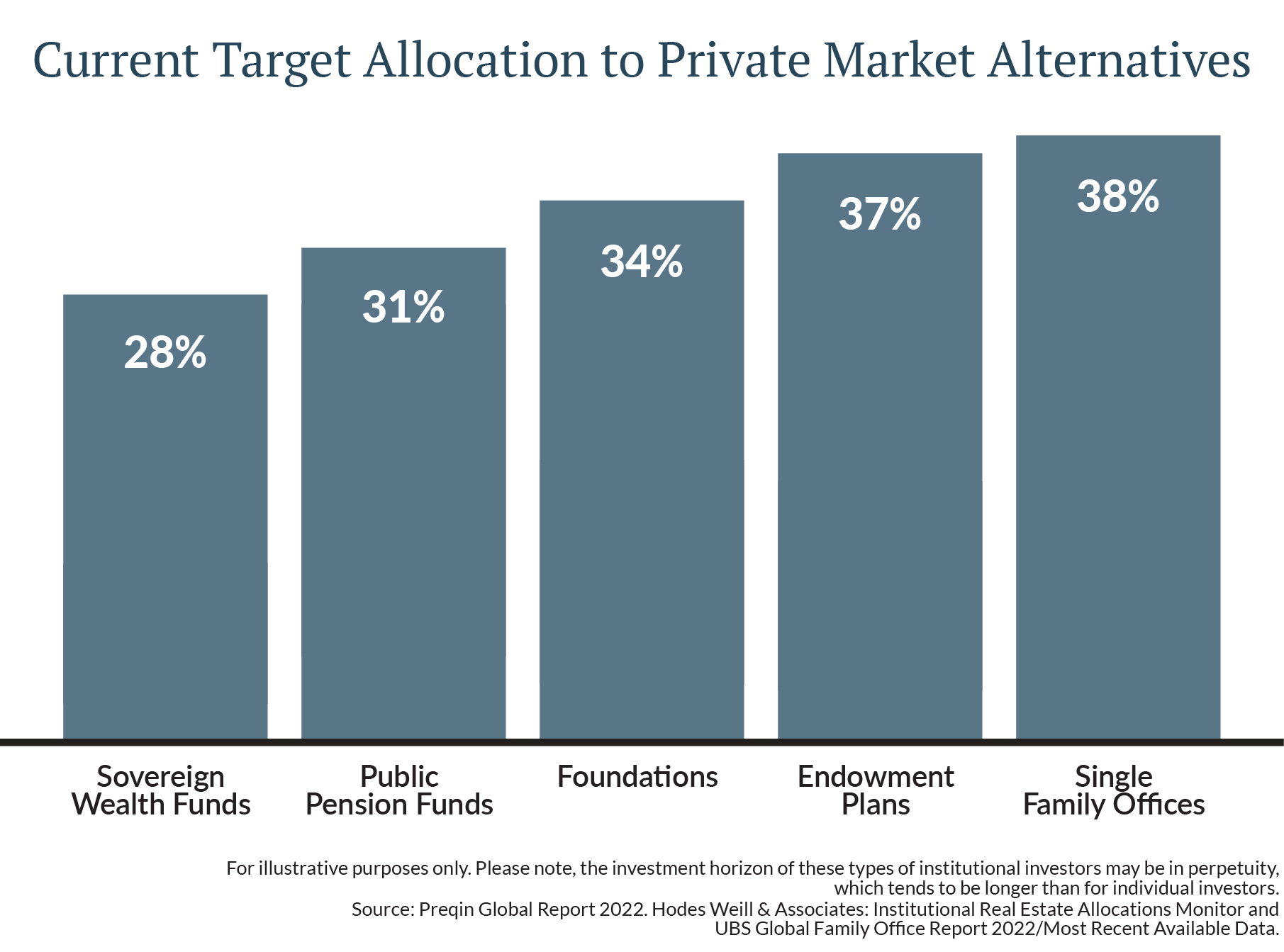

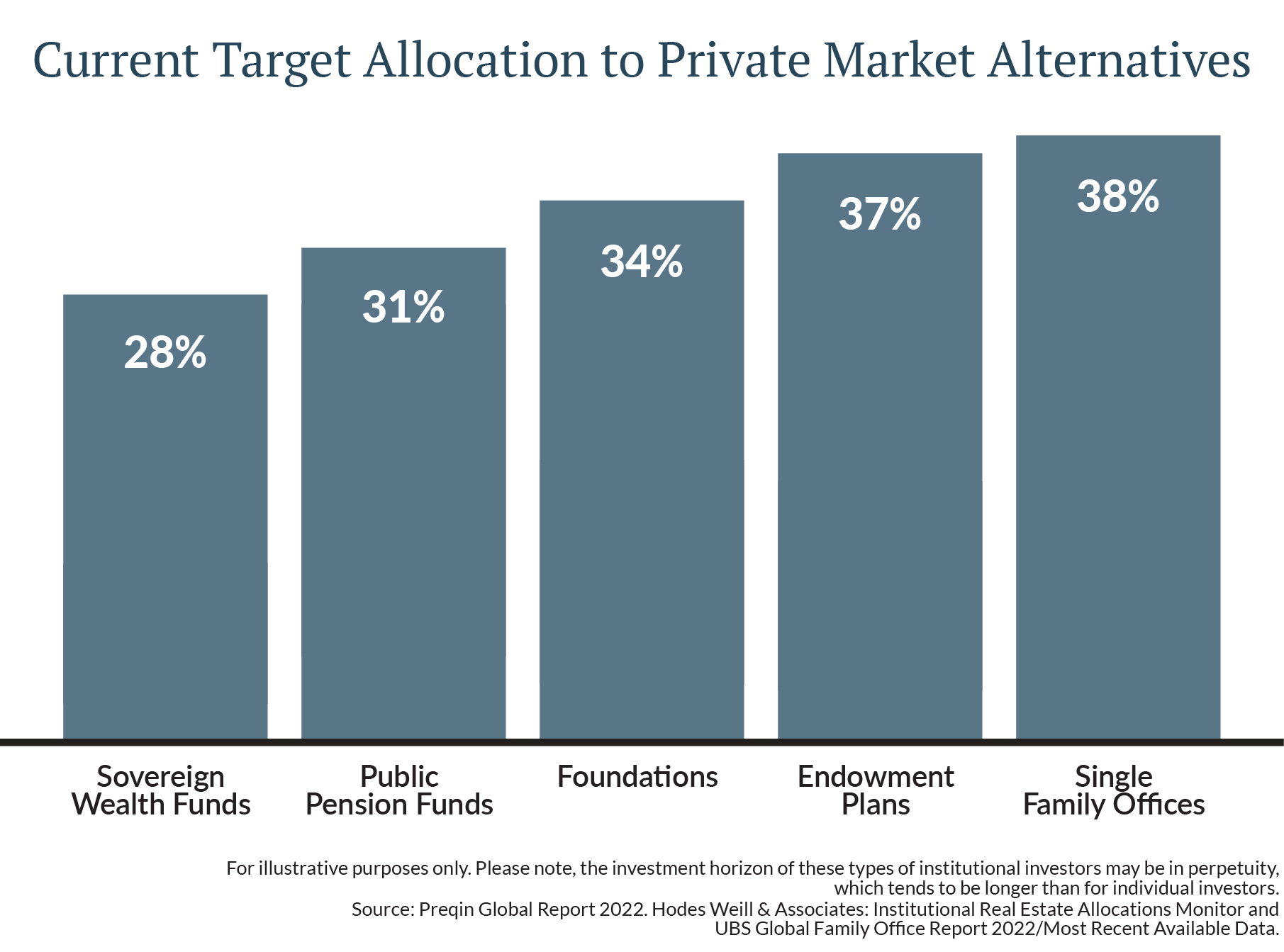

Alternative assets have long been utilized by institutional investors (pension plans, endowments, foundations and others). For this type of investor, exposure to alternatives represents a meaningful portion of their total investments. As reflected in the chart below, this figure ranges from about 30-40% of their overall allocation. Behind these large allocations are a number of factors. These include:

- Companies are staying private longer

- The number of publicly traded companies has declined

- Alternatives offer lower correlation to traditional assets like stocks and bonds

- Alternatives offer the potential for higher returns relative to traditional assets.

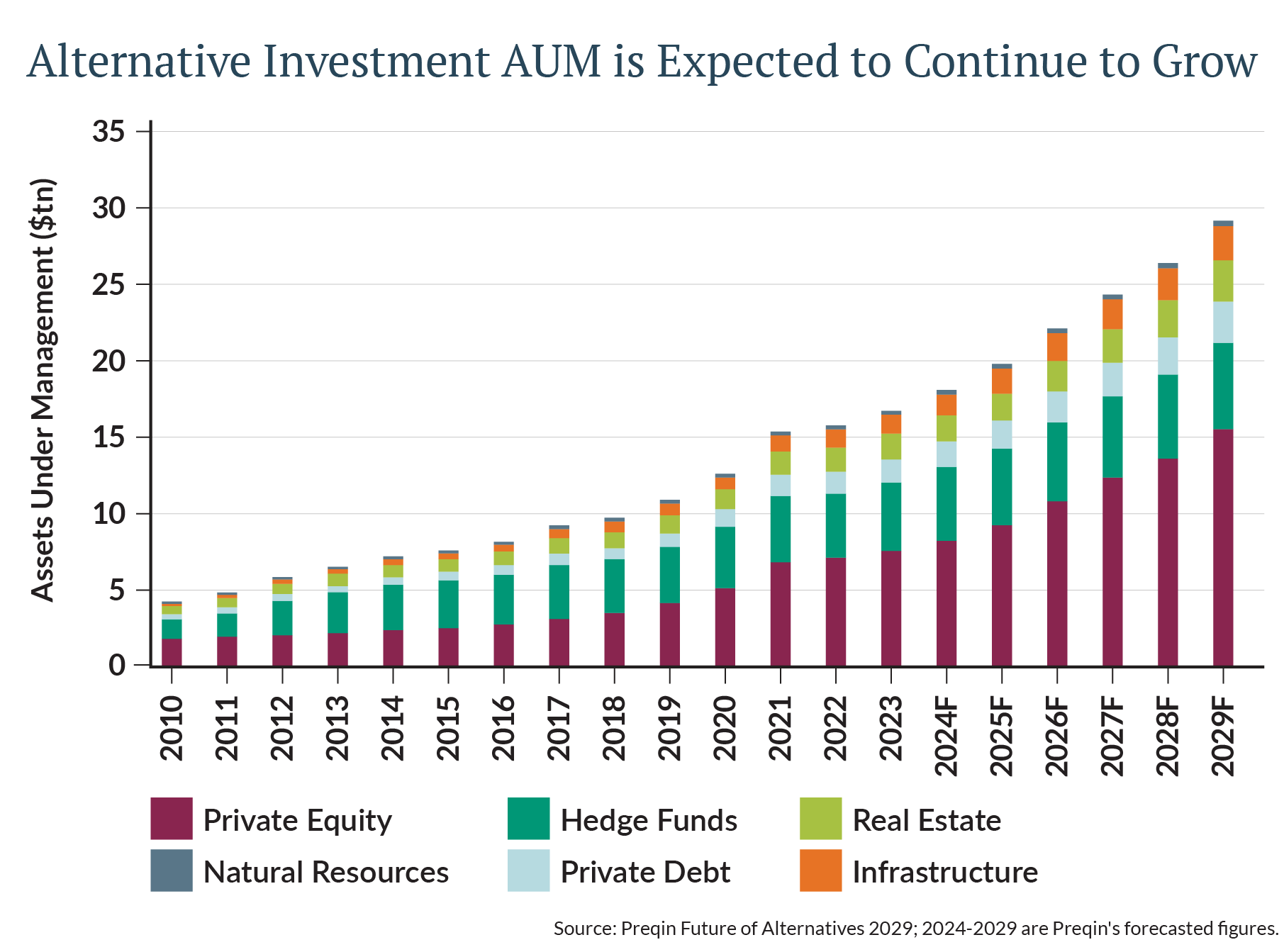

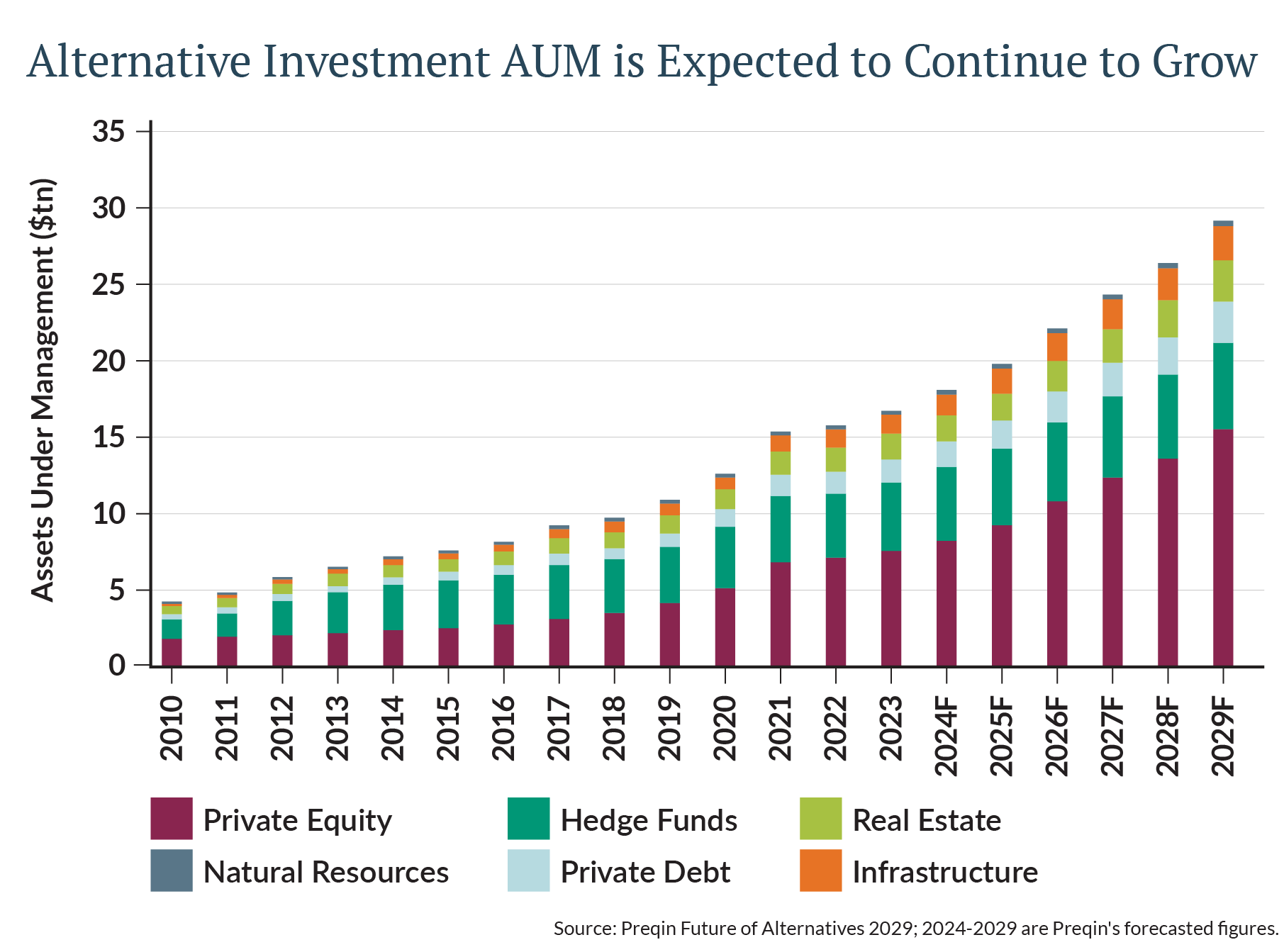

Growth in alternative asset categories continues to climb. According to a study by Preqin, alternative assets registered $18.2 trillion at the end of 2024 and are forecasted to exceed $29 trillion by the end of 2029.

Interest in alternative assets has expanded along with this growth in recent years, as more retail investors seek the same benefits that have accrued to institutional investors. The investment industry has responded to this demand by improving access to alternatives, via lower minimums and different vehicles (liquid products such as mutual funds as well as semi-liquid products such as interval funds) to meet the needs of a wide range of investors.

Now, this trend of increasing access is expanding into the defined contribution 401(k) realm.

Adding Alternative Investments to 401(k) Plans

On August 7, 2025, President Trump signed an executive order titled “Democratizing Access to Alternative Assets for 401(k) Investors.” The objective is to expand access to alternative assets to the 90 million individuals who participate in employer-sponsored 401(k) plans. The executive order does not have the force of law. Instead, it directs the Department of Labor (DOL), the Securities and Exchange Commission (SEC), and other federal agencies to re-examine the existing regulations that have thus far limited access to alternative assets in 401(k) plans.

Key directives of the executive order include:

- Requiring the DOL to examine existing guidelines on fiduciary responsibilities when considering alternative assets.

- Requiring the DOL, in concert with other federal agencies, to identify what criteria plan fiduciaries should take into account when trying to balance the higher expenses of alternative assets with long-term performance and diversification benefits.

- Directing federal agencies to collaborate to align regulatory changes.

- Emphasizing reducing Employee Retirement Income Security Act (ERISA) litigation that “constrains fiduciaries’ ability to apply their best judgement in offering investment opportunities to relevant participants.”

The executive order provides further momentum for consideration of alternative assets in 401(k) plans and more closely aligns them with defined benefit (pension) plans with respect to such assets. One important aspect of the executive order is the mention that exposure to alternative assets should be via allocations in professionally managed portfolios (e.g. target date funds, managed accounts, etc.), and not as a standalone option plan participants could select.

The executive order adds further complexity for plan sponsors as they seek to adhere to their fiduciary responsibilities under ERISA. This is an opportunity for plan sponsors to consider alternative assets; it is not a mandate to include them as part of an investment menu line-up. We believe utilizing professionally managed portfolios to gain exposure to alternative assets may be a prudent approach, should a plan sponsor determine this is a path they would like to pursue.

As with all aspects of ERISA, plan sponsors should develop, maintain, and document a prudent process when considering any investment menu line-up or plan design changes. We strongly recommend that plan sponsors leverage an experienced qualified plan advisor like Johnson Financial Group to ensure they are meeting and adhering to their fiduciary responsibilities. Doing so helps mitigate potential liability issues, allowing plan sponsors to focus on running their business.

To learn more, connect with your Johnson Financial Group advisor or find one today.

ABOUT THE AUTHOR

VP Director of Investment Research CFA® | Johnson Financial Group

As Vice President, Director of Investment Research, Joe leads a team responsible for the selection and monitoring of investment vehicles, including mutual funds, exchange traded funds, and separately managed accounts, used in wealth client portfolios. Along with the Investment Research team, Joe also assists portfolio managers in the management of investment models.