For this week’s investment commentary, we’re sharing a Q&A with Jon Henshue, CFA, Director of Alternative Strategies and a member of the Wealth investment team.

Recently Jon shared thoughts on alternative investment markets with a Business Roundtable group in Milwaukee. Participants asked excellent questions. To learn more about the role of alternative investments in portfolios, we encourage you to contact your JFG advisor.

Q. What’s the risk-return gap?

The risk-return gap refers to a lack of traditional investment options between lower-risk/lower-return investments (such as bonds) and higher-risk/higher-return investments (such as equities, both public and private).

Some alternative investment options offer moderate-risk/moderate-return profiles that may fill this gap. Examples include private debt markets and real estate. These and other alternative-investment asset classes have the potential to bring more diversification to overall portfolios. That means more potential to mitigate risk while achieving return objectives.

Q. How have expected returns in private markets changed over past few years?

The blessing and the curse of being the “alts guy” on the investment team is there’s always something exciting and always something damaged.

Sometimes that’s one and the same thing … like certain parts of the real estate market. Real estate has been punished to a degree that it’s not a great time to already own a property—but for those with cash available to buy, prices are cheaper than 18 months ago. We think industrial and multi-family property is interesting (and continue to stay away from office).

Elsewhere, public equities did better than private equity last year. That could be the case again. Private debt, on the other hand, remains attractive even given strong recent performance.

Q. What are evergreen funds in the context of alternative investments?

Increasingly, investment managers are finding ways to make strategies previously available only in private investment vehicles available to more investors, via registered funds.

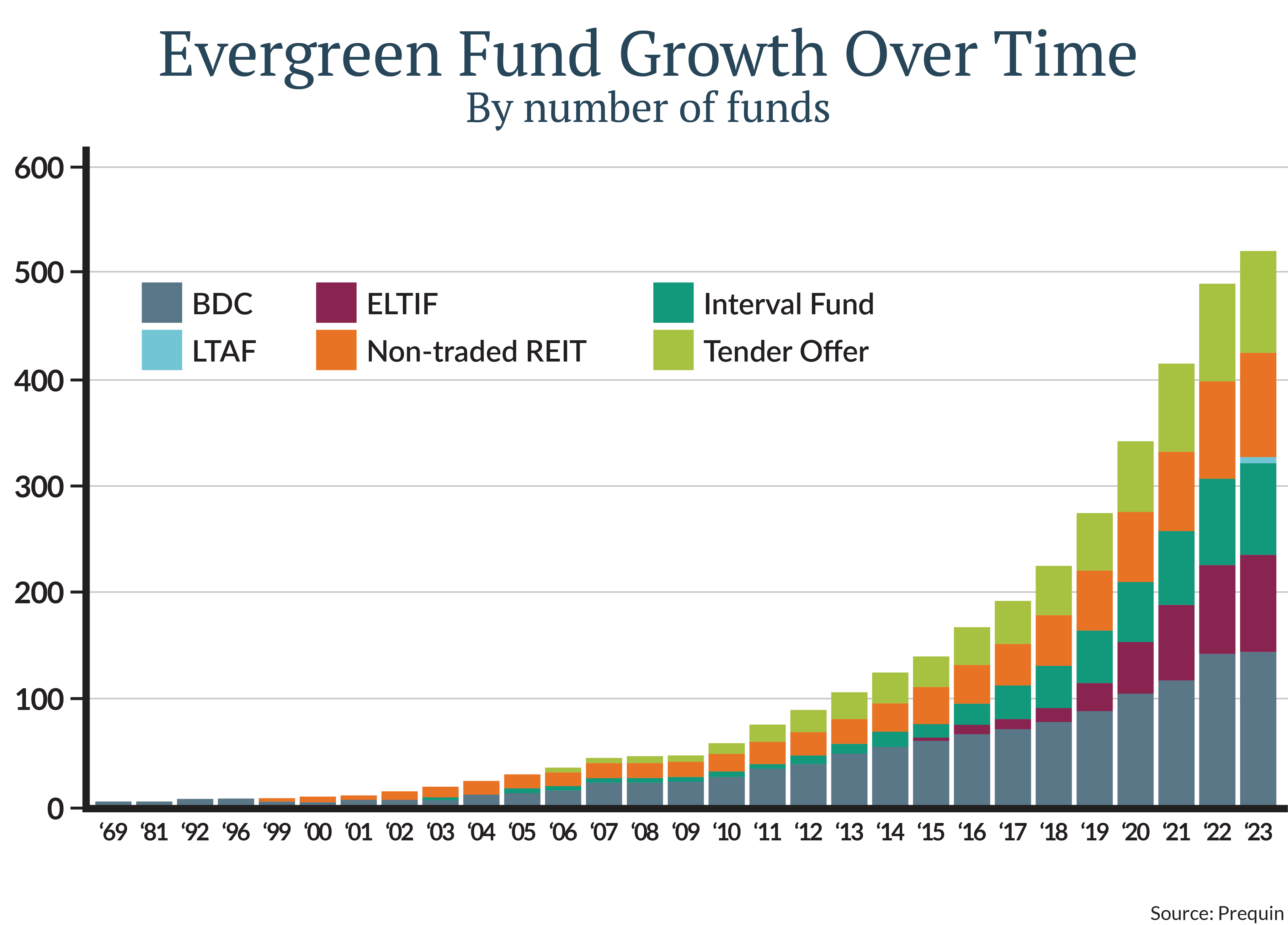

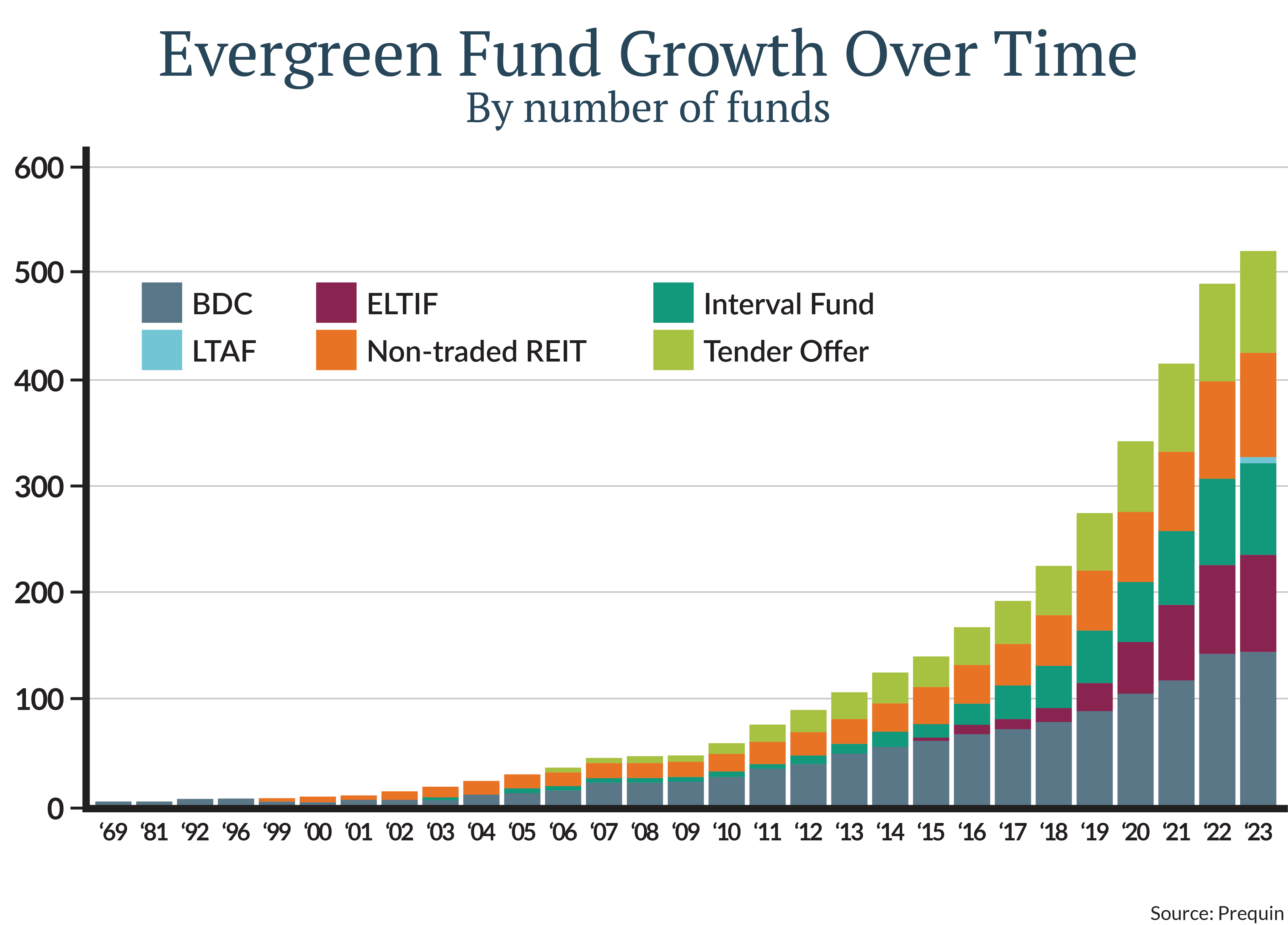

Some of these are so-called evergreen funds, named for their contrast with traditional limited-term structures such as private equity funds.The following chart shows the increase in several types of evergreen funds that are getting significant attention from investors and their advisors in recent years. These fund structures allow investors to allocate to the strategies daily or monthly, and commonly provide exit opportunities on a quarterly basis.

How big is the alternative investments landscape, and which asset classes are growing rapidly?

JPMorgan estimates that alternatives represent about 15% of total global capitalization—so neither trivial nor gigantic.

Venture capital has grown rapidly in recent years, but I’d say private debt funds have been the belle of the ball. That’s happened as private lenders have taken business from banks. A typical borrower might have earnings on the order of a hundred million dollars, so neither a small business nor large enough to garner focused attention from large banks, especially given regulatory constraints. The loans tend to be floating rate, with current new loans in the 10-12 percent range. From an investor perspective, these loans can be attractive given their favorable place in the company’s capital structure—that is, senior to most other debt.

Q. What’s new in the “secondaries” market?

“Secondaries” refers to new-investor purchases of existing interest in private-equity and other investments with limited liquidity. High interest rates and profit-margin pressures have contributed to a financial environment that’s delayed exits for many existing private-fund investors. In 2022 and 2023, M&A deal activity fell off a cliff. The secondary market gives them a way to exit at a negotiated price.

The discounts enjoyed by new investors were historically wide in 2022 and somewhat narrowed in 2023, but remain attractive entry points.

Q. Is there an asset class that you personally find interesting right now?

I think the reinsurance market is especially interesting—especially when thinking about diversification for an overall portfolio. Hurricanes, after all, aren’t correlated to financial market performance.

There’s only been one negative year for catastrophe bonds in the 22-year history of the index that measures performance. Recently, some key insurance rates have risen—skyrocketed, even—which may create a greater margin of safety than usual for those entering the reinsurance market.