Should you follow the trend into sustainable investing?

Some adages stay with you during the transition from childhood into adulthood. Less frequently, some of them cross over and become relevant in a new way that intensifies their meaning and relevance.

For me, one of these is “Be a leader, not a follower.” Originally this adage related to my parents’ desire for me to come home safely before dark, and perhaps with less mud caked on my shoes. Now it has found a new meaning during my career as a financial advisor.

Specifically, I’ve been thinking about how “Be a leader, not a follower” relates to sustainability in investing, often known as “Environmental, Social, and Governance” (ESG) standards.

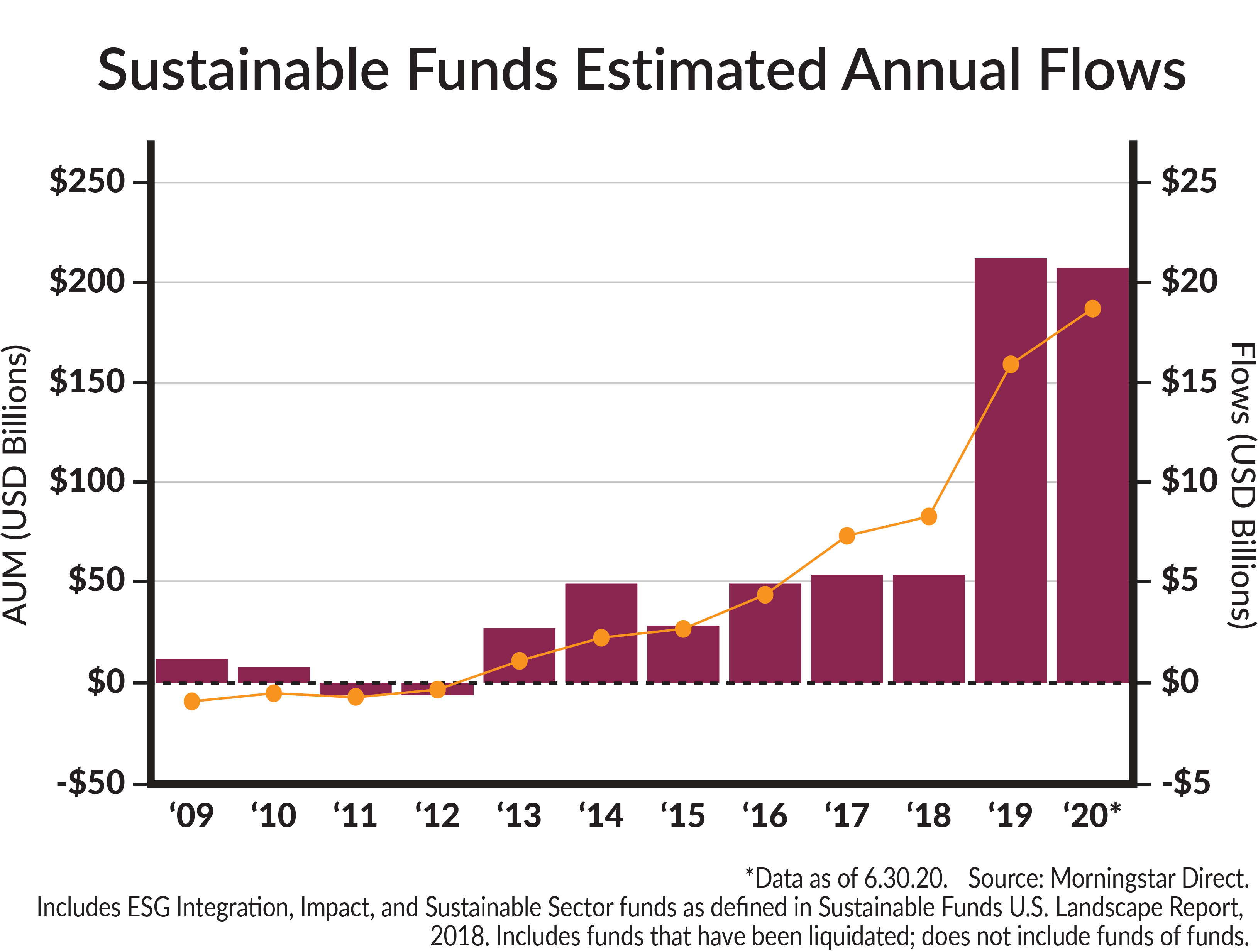

This year, flows into funds that incorporate these ESG descriptors have continued at a record pace. This trend has been accelerating, with 2019 flows reflecting a four-fold increase from 2018 alone, as illustrated below.

While these trends are substantial, they represent only a fraction of the roughly $21 trillion U.S. mutual fund market, so ESG is still a nascent component of the marketplace.

As ESG investing has grown, many questions have arisen regarding these standards and their efficacy. Let us aim for some clarity regarding the nomenclature, classification, and implications of utilizing these funds.

The ABCs of ESG

The adoption of ESG descriptors reflects a progression in the sustainable investing space, in that they attempt to provide structure to the analysis of these risks in a consistent and uniform manner. ESG factors attempt to analyze various risks that firms may be exposed to, and by extension, investors.

The Environmental component of ESG concerns companies’ ability to reduce climate and other environmental risks, and how companies can take advantage of investment opportunities afforded by a transition to renewable energy resources.

The Social factors involved in ESG relate to human capital and how companies are utilizing assets and resources to focus on employee retention, diversity in the workforce, positive community relations and reputational risk.

Finally, Governance descriptors emphasize the alignment between the interests of employees, leadership, and shareholders, as well as the risks associated with litigation and regulatory penalties.

These factors may be considered or applied as a part of the investment manager’s process, by weighting these factors appropriately across economic sectors and businesses. For example, the ESG risks associated with an accounting firm will be much different than those of an energy firm. Companies or economic sectors with greater regulatory scrutiny may have additional weighting applied to the “governance” criteria, whereas firms with a relatively large labor force would find these “social” factors more relevant.

Now I know my ABCs, it’s time for…taxonomy

The dramatic increase in flows to these ESG funds have been accompanied by a nearly 85% increase in conventional mutual funds that consider ESG factors. Consideration of ESG factors, however, does not equate to utilization of ESG criteria in a material or consistent manner. Conversely, there are more discriminating sustainable funds which incorporate these descriptors as a part of their security selection, and yet others may be more stringent and elect to exclude certain companies based on their preferred criteria.

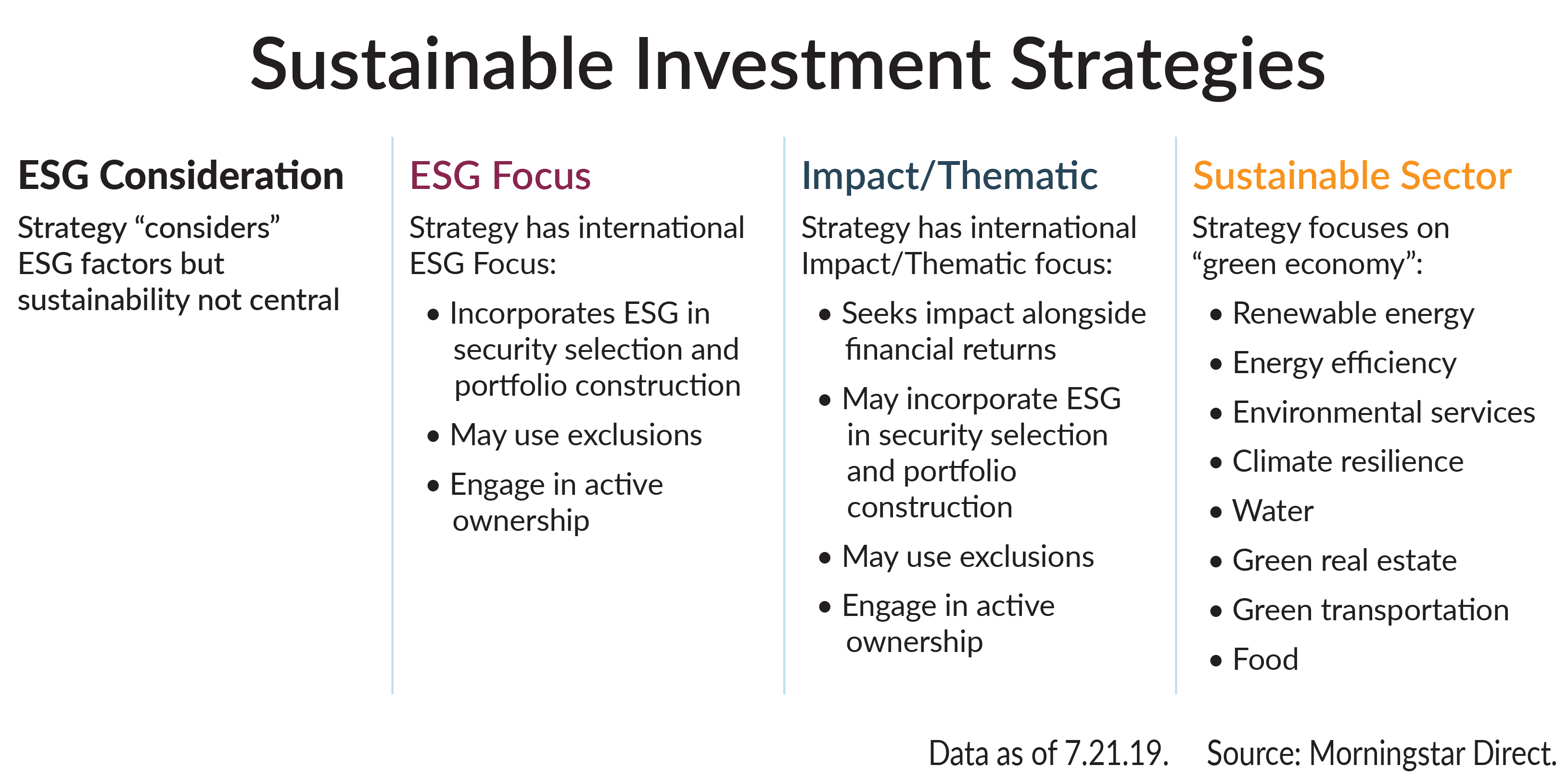

One firm, Morningstar, suggests the following classification system:

As an investor, the most important thing is simply to know that ESG funds are not all created equal. Using some classification system will help sort out how these funds incorporate ESG factors.

What to watch for

Proponents of ESG suggest that application of these standards results in meaningful reductions in risk, volatility, and superior investment return over time. In a 2018 survey of asset managers conducted by Harvard Business School, 80% said they consider ESG criteria during the security selection process. Moreover, they shared that this is not only due to growing client demand, but also because they believe ESG information is material to investment performance.

Many strategies now consider ESG information even without orienting their entire investment process and outcomes around sustainability. Implementation of these ESG standards may simply be a formalization of risk analysis across companies and investment firms, now with an eye toward maximizing value for both shareholders and stakeholders.

As noted above, multiple standards and criteria have sprouted up—and these can be confusing and inconsistent. There may be greater costs associated with the funds that adopt these more rigorous standards. Also, some investment firms may advertise incorporating ESG standards as client demand increases—but their actual focus on ESG is little more than sloganeering.

Over time, investors will benefit from more transparency and consistency around these standards as they make investment decisions. So, for investors, joining the ESG trend may be an ideal match for their individual purposes. Just make sure to do your due diligence and avoid simply being a follower.

Your Trusted Partner for Life's Biggest Moments

As Vice President, Wealth Advisor, Kyle equips clients with tools to make sound financial decisions about retirement, saving and estate planning. Through a detailed approach to financial planning, Kyle’s goal is to help clients shoulder the burden of managing their financial life. With a strong passion for learning, Kyle is always excited to share his knowledge with clients.

LEARN MORE ABOUT KYLE