2023 Annual Report

“While 2023 was a bit of a wild ride in the industry, the combination of solid fundamentals, good planning and sticking to who we are and what we do best has positioned us well for success in 2024 and beyond.”

- Jim Popp, President & CEO

A Message From Our CEO

Solid Fundamentals and a Little Defense

Entering 2023, Helen and I talked about how important balance and fundamentals would be for Johnson Financial Group in the year ahead. For us, that meant staying active and connected with our customers, while also playing a little bit of good, solid defense in what was looking to be a challenging and uncertain economy. The year started out pretty much as we hoped, with our teams focused on client and prospect outreach, while working through several important projects across our various business units.

But as Mike Tyson once said: “Everyone has a plan until you get punched in the face.” That happened to the entire banking industry late in the first quarter, as rising rates, rampant inflation, hyper-competitive deposit pricing and some isolated funding challenges resulted in three high-profile bank collapses, sending shockwaves through the industry. The ensuing “mini crisis” caused us all to take a hard look at our plans amid speculation about deeper, systemic issues in the industry.

Thankfully, the “crisis” was isolated to a small number of banks and did not turn out to be the systemic problem that was originally feared. And while we all felt a little bit of the hangover that ensued, the combination of solid fundamentals, good planning and a commitment to sticking to who we are and what we do well allowed JFG to come through the year not only unscathed, but well-positioned for success in 2024.

In June of 2023, we closed on the sale of our Johnson Insurance business to Risk Strategies, a dynamic, growing company in the risk management business. While we will certainly miss seeing our JIS associates daily, the move to Risk Strategies has provided the entire team – and our customers – with a deeper, broader set of capabilities at a company with the scale to compete with the best in the industry.

As we look to 2024, it’s already feeling like another one of those “grind it out” type of years. Uncertainty surrounding interest rates, the strength of the economy and the upcoming presidential election has many taking on a wait-and-see attitude. At JFG, we think it’s a good year to stick to the basics and stay focused on what matters most: Our customers, our associates and the communities we serve.

We thank you for the trust and confidence you continue to place in JFG every day. Here’s to a healthy, safe and successful 2024!

Best,

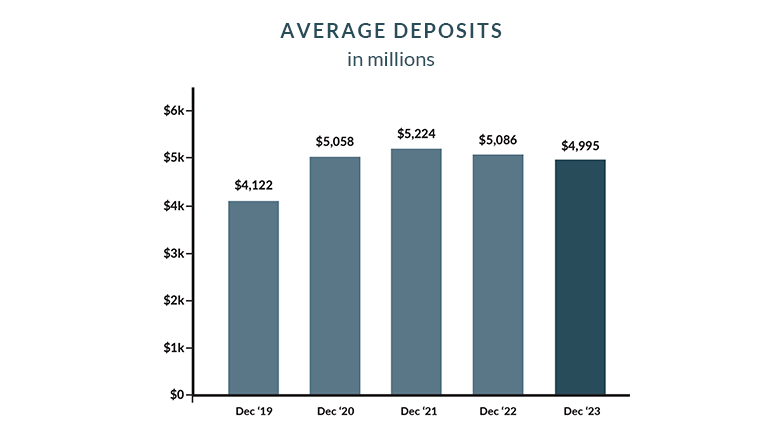

Financial Performance

As we look to 2024 and beyond, we’re grateful to be operating from a position of strength and confidence.

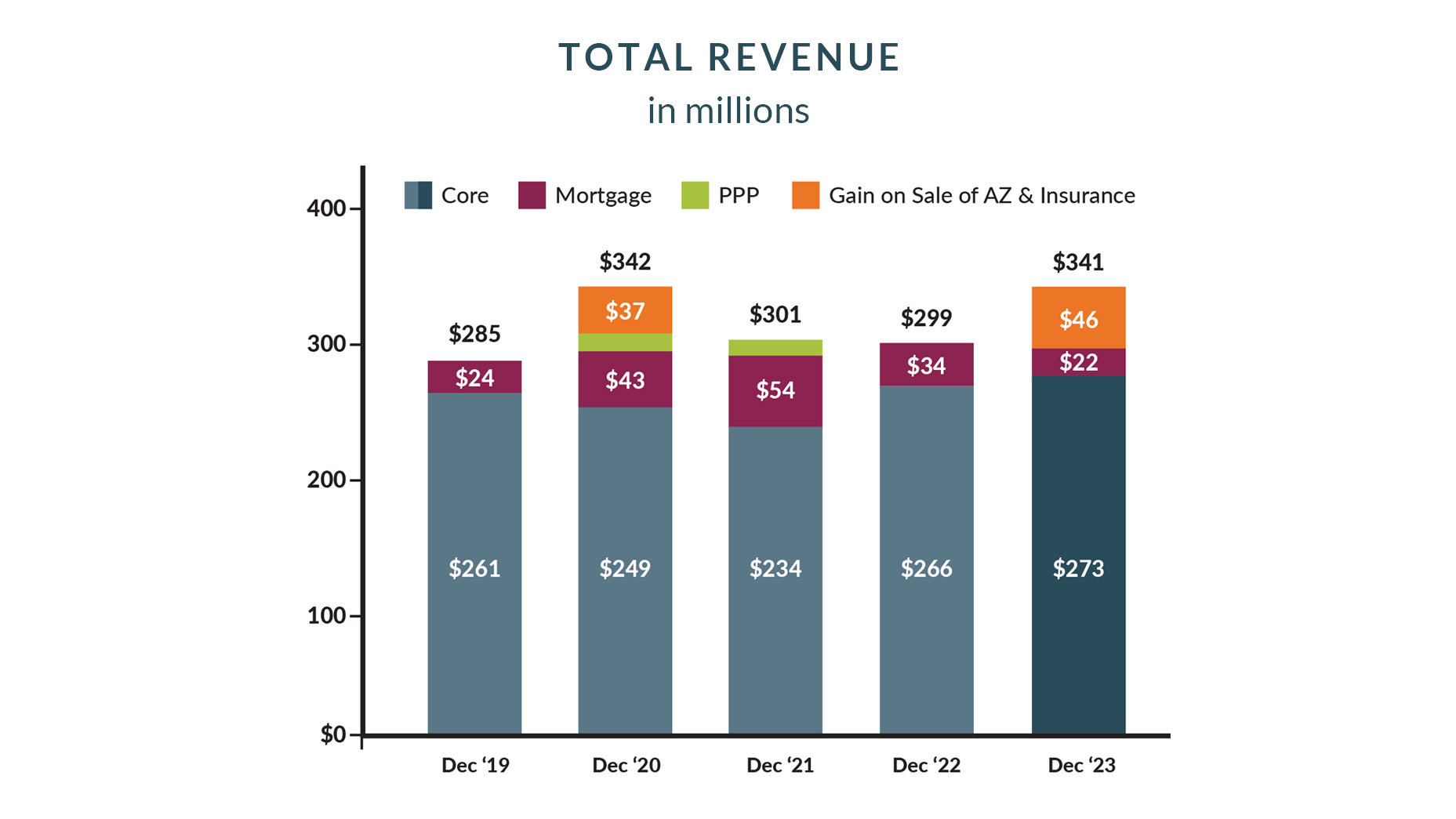

- Core Revenue of $295 million (excluding gain on sale of Johnson Insurance) was slightly behind last year, but better than expected given ongoing spread compression and prolonged softness in the mortgage business.

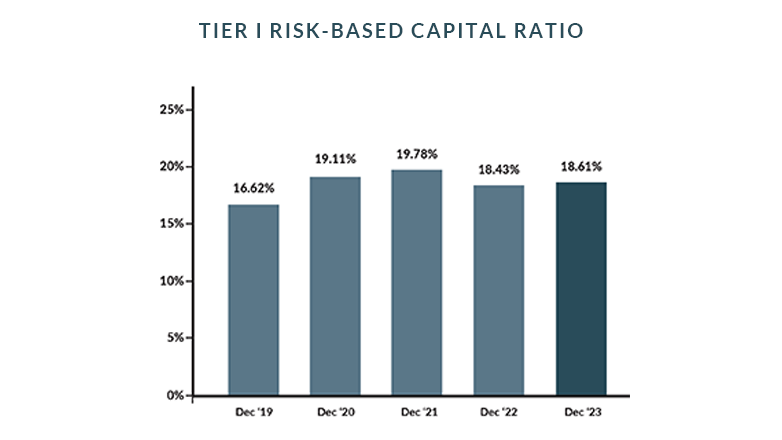

- Our balance sheet remains strong and well-positioned, with a Tier I Capital Ratio of 18.6% - at the top of our peer group and well in excess of regulatory standards for well-capitalized banks.

- We continue to make meaningful impacts in the communities we serve, as JFG contributed more than $1.7 million in charitable giving to various community partners.

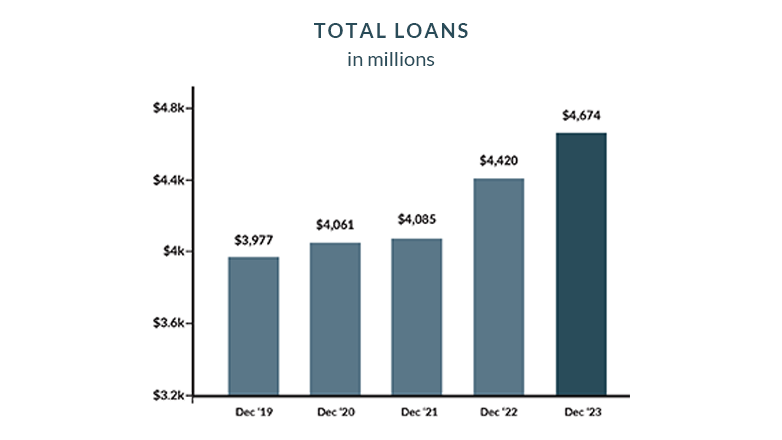

Financial Snapshot

2023 Highlights

Commercial and Consumer Banking

- Our Commercial Real Estate business continued to exceed expectations, growing 18% to just over $1.15 billion in total loans in 2023.

- We’re upgrading our core bank operating system to make it easier for you to do business with us, while also ensuring we remain durable, scalable and adaptable to the changing financial landscape.

- We continued to expand our branch network with the opening of our newest branch in Delafield in early September. In addition, we broke ground on our new West Milwaukee location, featuring an expanded community engagement area to encourage financial literacy and homeownership. Watch for news on that new location opening in May 2024.

- We’re excited to start construction on new full-service locations in the Fox Cities and West Towne in Madison, both opening at the end of 2024.

- As the rate environment shifted in both deposits and mortgage loans, we remain focused on finding the best solutions to serve our clients. Our mortgage team proudly helped facilitate over $2.1 million in down payment grants and assistance making homeownership possible in a market that has been met with intense competition and rate fluctuation.

Johnson Insurance Sold to Risk Strategies

In June, we closed on the sale of Johnson Insurance Services (JIS) to Risk Strategies, a national specialty insurance brokerage and risk management consulting firm. While it was difficult t o say goodbye to our JIS Associates, we felt strongly that the sale to a national agency with the scale and capabilities of Risk Strategies would put our JIS associates and customers in the best position for long-term growth and success.

Wealth

In 2023, we completed a three-year project transitioning to a more streamlined, robust platform. While offe ring an improved digital experience with real-time account information and analytics, complex planning capabilities and easy to understand statements and reports – all while keeping your accounts safe and secure.

We also welcomed The Appleton Group, a registered investment advisor with $210 million in assets under management to our Northeast region in September. With this acquisition, we gained a great group of talented associates and look forward to continuing to work with their clients to transition them to the JFG family.

Your Money. Your Mission. Podcast

Your Money. Your Mission. podcast ranked in the top 15 financial podcasts in its inaugural launch. The podcast aims to guide conversations that help listeners maximize their wealth by turning complex financial situations into actionable advice. The show covers a diverse range of topics, and host Kelly Mould meets with a number of professionals in the financial field to gain their insights.

- Legacy Planning: Creating a Positive Impact for Loved Ones

- Get Out of Debt: How Busy Professionals Can Achieve Financial Freedom

- Navigating Behavioral Investing: The Key to Financial Success

- How to Avoid Financial Fraud in 2023

- Home Sweet Home: Navigating Today’s Housing Market

Engaged Associates

We’re proud to be named a Top Workplace USA for the fifth straight year! In addition, for the second year in a row, we are proud to be recognized by Disability:IN and the American Association of People with Disabilities and the Human Rights Campaign Foundation as a leader in LGBTQ+ Workplace Inclusion.

As we continued to focus on our fundamentals, that extended internally as we’ve worked to refresh our Mission, Vision and Values – strengthening the foundation that has guided us for mor e than 50 years. Our official internal rollout began in early 2024 and has been an inspiration to our teams to continue focusing on what we’ve always done – be compassionate, be consistent and do what’s best for our customers and our communities.

Keeping Our Communities Strong

Our commitment to strong communities continued, with JFG donating $1.7 million dollars in 2023. We continued to give back through our branch network in our second annual Neighborhood Giving Campaign where associates chose to give to charities in their neighborhood. We wanted to make a more meaningful impact right where we live and work. We continued to focus on our three pillars for giving, the Arts, Financial Literacy and Community Welfare, throughout the entire year.

2024 Outlook

A Look Ahead

As we look to 2024 and beyond, we’re grateful to be operating from a position of strength and confidence. Our balance sheet is strong and well-positioned. Our credit portfolio continues to perform extremely well despite ongoing market challenges. And we’ve invested in the talent and platforms we believe will allow us to compete effectively in a rapidly changing industry.

So, for 2024, our theme is BACK TO BASICS. That means concentrating on what matters most in our business: creating an exceptional associate and customer experience in everything we do, prioritizing client retention, deepening existing relationships, focusing on flawless execution as a top priority and continuing to ramp up our market coverage.

It sounds simple, but being intentional about focusing on good, solid fundamentals will give us the best opportunity to have another successful year at Johnson Financial Group. We are grateful for your continued support and trust in our company, and we look forward to sharing our progress with you in the year ahead.

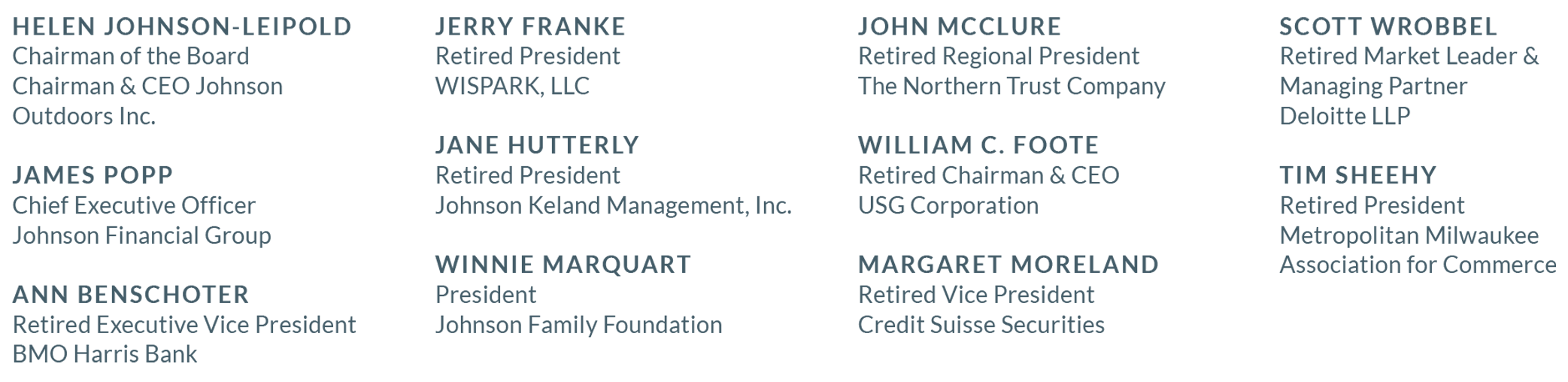

Our Leadership Team

Our Board of Directors

Thank you to our Board of Directors for their continued guidance and support.