2021 Annual Report:

Stronger Together

“Through the resilience of our clients and associates … we’ve experienced another strong year.”

Pictured: Jim Popp, President & CEO, Helen Johnson-Leipold, Chairman

A Message From Our CEO

Looking back on 2021, Bill Murray’s fate in the 1993 movie “Groundhog Day” bears a resemblance to the circumstances we all faced throughout a unique and challenging year. In the movie, Murray’s character becomes trapped in a time loop, forced to relive the same day over and over. While we certainly weren’t forced to relive the same day repeatedly at Johnson Financial Group, 2021 sure felt a lot like 2020, didn’t it?

Like most companies, we began the year with high hopes for a strong economic recovery, with the expectation that we would soon return to in-person work arrangements and resume our “normal” social interactions. Instead, the lingering pandemic led us to spend most of the year with the majority of our associates working remotely.

Fortunately, despite the challenges that came our way, with clients like you and the resilience of our associates, we experienced another very strong year. We can’t thank you enough for the trust and confidence you place in JFG and our associates to help you make some of the most complex and important decisions for you, your family and your business.

Financial Performance

Despite market uncertainty, global supply chain issues and rising inflation, our entire company has continued to grow across all business segments. Our Wealth, Commercial, Consumer, Private Banking, and Insurance teams have welcomed a record number of new relationships. Whether you are new to JFG or have been with us for years, I encourage you to work with your Relationship Manager to learn about all of the services we have to offer to help you make your most important financial decisions.

I’m proud to report that Johnson Financial Group ended the year with as strong a balance sheet and capital position as we’ve ever had. More importantly, we did so while maintaining the stellar quality of our risk metrics, regulatory compliance and sound overall corporate governance.

Strong Mortgage Performance Leads to Growth

2021 was another strong year for JFG across almost every measure. Despite the continuing pressure on net interest margins, our revenue topped $302 million. Our Mortgage team led the way, closing more than 5,200 loans, totaling over $1.4 billion for what resulted in the busiest 24-month mortgage boom in our company’s history. If you bought or sold a home within the past two years, I’m sure you can agree!

Assisting Businesses When They Needed It Most

Paycheck Protection Program (PPP) loans played another significant role in our growth in 2021. Early in Q1, an additional 1,000+ borrowers accessed over $190 million. Together with the $580 million from round one, customers secured over $770 million of much needed funds for their businesses. Once again, our teams pulled together to work through the PPP process quickly to efficiently meet the needs of our clients.

Growing in An Uncertain Market

As financial markets recovered, our Wealth team has continued to take care of our clients, while welcoming many new relationships. By year end, assets under management grew to $10.5 billion, while our overall assets under administration topped $15.0 billion.

2021 Achievements

While we’re proud of our growth and the financial results we achieved, we are equally proud of the many transformational initiatives that were either started, advanced or completed in 2021. These initiatives make a strong impact on how we serve our clients each and every day.

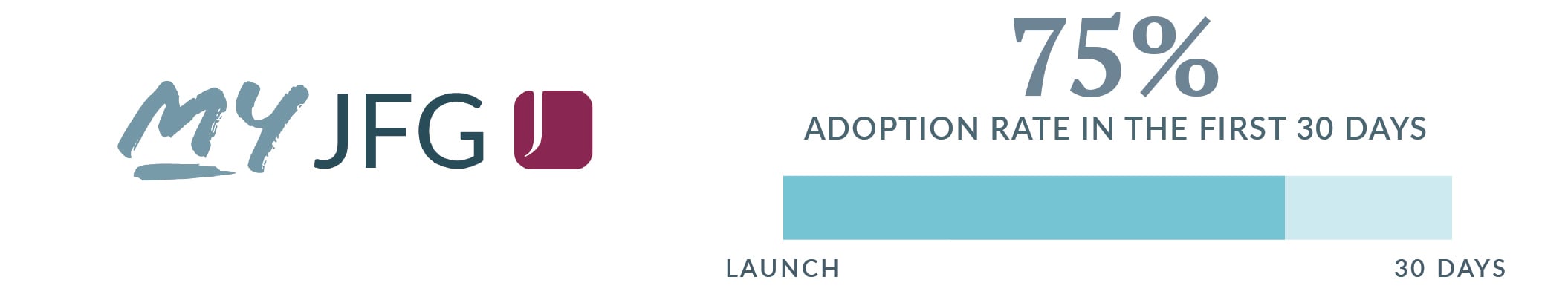

Introducing MyJFG

After the rollout of AccessJFG for our business clients in 2020, our teams spent months of diligent planning and considerable effort to roll out our new consumer digital banking solution, MyJFG. In a world where clients expect simple, intuitive and robust capabilities – anytime and from anywhere – the upgrade of our platform was critical. MyJFG represents a significant enhancement for clients to easily manage their money and financial future, while serving as a foundational part of our evolving digital strategy. Thank you to the 75% of our users who adopted this new solution in the first 30 days of launch!

A New Milwaukee Flagship

In October, we opened our new flagship location at Milwaukee’s Cathedral Place at Cathedral Square in the heart of Downtown Milwaukee. This office brings our Milwaukee-based banking, wealth, and insurance teams together in a modern, collaborative workspace. While the planning began pre-pandemic, the finished product represents a model for what we believe will be our workplace of the future, with technology, ultra-modern offices and collaborative spaces to balance the flexible workplace requirements of the future.

Empowering Associates

To be the best for our associates, we continue to work hard to foster an environment that is creative, diverse, inclusive and rich in work-life balance, personal development, career mobility and overall associate engagement.

We’ve made significant strides in JFG’s Diversity, Equity and Inclusion initiatives, including:

- Advancing our associate involvement and increasing membership and engagement with our three established Employee Resource Groups: Uplifting People of Color; Inspiring Women; and LGBTQ+ Pride at JFG. Two additional ERGs were added within the year supporting our Veterans and those Differently Abled.

- Participating for the first time in the Human Rights Campaign’s Corporate Equality Index, which helps us learn how we can better support our LGBTQ+ associates. After an initial score of 70 out of 100 in 2021, we’re proud to report that we’ve now increased our score to 100, earning recognition as one of the “Best Places to Work for LGBTQ+ Equality”.

- Receiving a prestigious recognition as a top workplace for disability inclusion with a score of 90 out of 100.

Additionally, we were named a Top Workplace USA and a Top Workplace in Wisconsin. We also received industry recognition for Top Workplace in the Financial Services Industry; Top Leadership; and Top Communication, Direction and Values.

Finally, as we’ve experienced the last two years, flexibility in the workplace is important in creating the necessary work-life balance our associates need to thrive. We remain committed to balancing flexible work environments with regular in-person interaction, firmly believing this creates the best outcomes for our clients, associates and our company.

Putting Our Communities First

We proudly contributed $2.1 million to local organizations in the communities we serve throughout Wisconsin and Minnesota. Contributions totaling $500,000 were given directly to United Way partner organizations in each of our regions to make a meaningful impact in addressing pandemic-related food security issues where we live and work. Teams throughout our footprint continued to align giving efforts with our three core pillars: the Arts, Financial Literacy and Community Welfare.

Looking Ahead

As we move forward in 2022, there are many reasons for optimism. Our business is strong, with a stable and growing balance sheet. From a market standpoint, there is high likelihood of the Fed raising rates several times in 2022. We’ll continue to work with our clients and partners to keep them apprised of changes and provide the tools and resources to help them navigate the potential impact to their business or their life.

For the past few years, we have ramped up our investments in new and improved technology solutions and digital platforms and capabilities to best serve our clients. Most importantly, we continue to prioritize our most valuable asset, our JFG Associates, with a renewed commitment to making Johnson Financial Group among the best places to have a healthy, balanced and fulfilling career.

2022 is likely to bring challenges as well.

- Our clients continue to deal with supply chain issues, slowing growth and creating uncertainty regarding future investments.

- Pandemic hangover, an aging demographic and a growing remote workforce have led to one of the most challenging – and expensive – labor markets ever.

- Conflict overseas poses a significant, and largely unpredictable, threat to the stability of our world economy.

At JFG, we will remain focused on the fundamentals that have served us so well:

- Creating a positive, collaborative and engaging environment for our associates. We have long known that our associates are the true “secret sauce” to our clients’ success at JFG.

- Continually striving to create the best experience possible for our valued clients. This means investing in great people and delivering exceptional capabilities through easier, faster and more convenient service. It means investing in technology and platforms to make managing your finances simple, safe, sophisticated and personal. We want to earn the right to do business with you.

- Continuing to keep pace with the rapidly evolving financial services landscape and the everchanging market conditions. As a company, we must embrace the swift changes in our industry and condition ourselves to adapt to faster, simpler, smarter and more efficient practices.

Along with our dedicated associates, our Board of Directors and chairman Helen Johnson-Leipold, I want to thank you for the honor and privilege it is to serve as your trusted financial partner. We close by expressing our deepest gratitude to you and thank you for your business. You are the reason that Johnson Financial Group is such a special and successful organization. We’re STRONGER TOGETHER and together, we can – and will – achieve great things!

With gratitude,

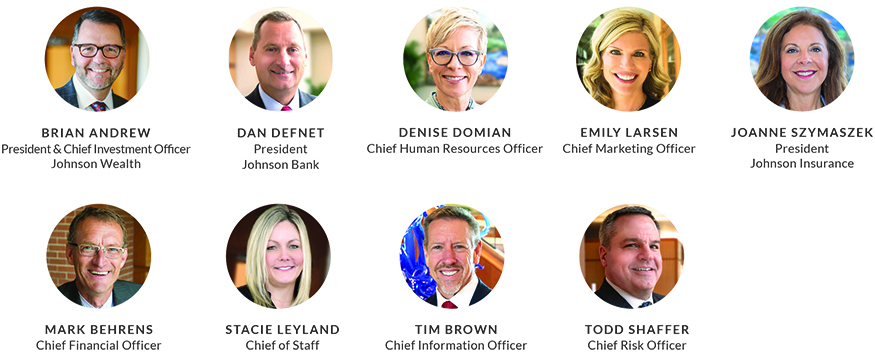

Our Leadership Team

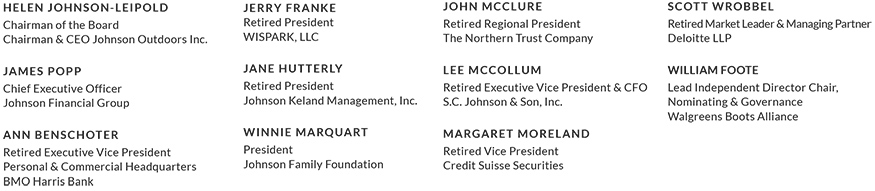

Our Board of Directors