Is Bitcoin Here to Stay? An Assessment of Opportunities and Risk

Download Our Whitepaper

Among the most topical issues in the world of both finance and pop culture is Bitcoin. Perceptions of Bitcoin vary widely, with some believing it represents the future of global commerce and others convinced it can only end ruinously for anyone involved. What follows is intended to provide a general introduction without being comprehensive or technical.

Background

The Bitcoin network is a digital creation established by a pseudonymous individual or group, whose ambition was to establish a medium of exchange beyond the control of any single entity or government. From this concept the Bitcoin network was born, a software protocol of interconnected computers operating together to facilitate activity on the network and maintain a permanent public record of transactions. There is no single owner or operator of the Bitcoin network, much the same as there is no single entity which owns or operates the internet. Anyone with an internet connection, anywhere in the world, can transact on the network with anyone else.

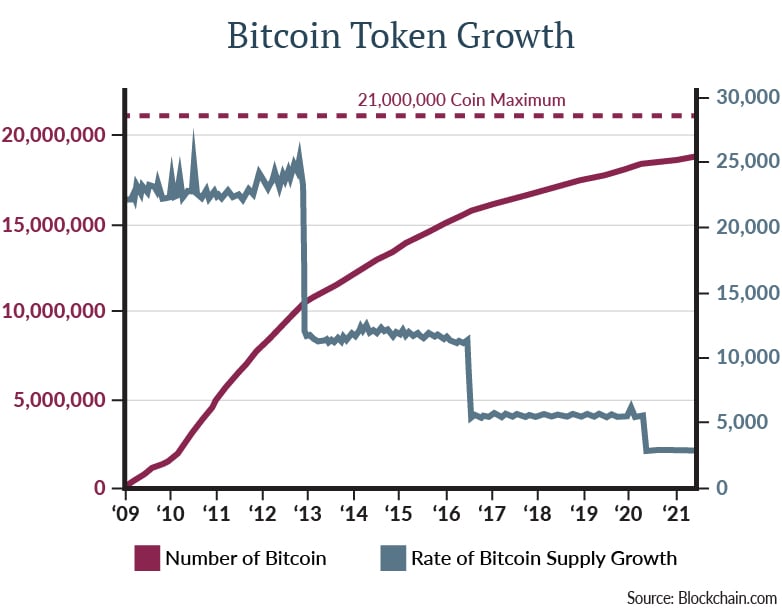

Functioning on the network as its native currency are bitcoins, digital tokens which can be transmitted at will between network participants. A maximum of 21 million bitcoin were programmed at the inception of the network, and at the time of this writing, approximately 18.7M bitcoin have been created. Creation of new bitcoin occurs daily via a process known as mining, steadily awarding new bitcoin to the participants powering the network. As shown below, the release of new bitcoin occurs at a predetermined and steadily declining rate, with the final bitcoin scheduled to be mined around 2140.

Case for Ownership

Initially viewed as a payment network or a currency, supporters have evolved their use case arguments for bitcoin over its 12-year lifespan. As currently designed, potential transaction volume suffers from structural limitations which make bitcoin impractical for widespread global transaction use. This has led supporters to reposition bitcoin as digital gold; a valuable item used as a store of value as opposed to a medium of exchange. In support of that claim, supporters remark on the following properties:

- Store of Value - Ownership of bitcoin offers the possibility of sustaining value through time, whereas central bank money printing and inflation devalue traditional currency already in circulation. Unlike government currencies, new bitcoin cannot be created at the discretion of a centralized body.

- Scarcity – Only 21M bitcoin will ever be created, and unlike gold, changes in price have no influence on the rate of new bitcoin production. If interest in bitcoin grows, the resulting increase in demand relative to its limited supply may translate to higher prices.

- Independent – No single authority governs policy or distribution.

In addition to the characteristics shared with gold, bitcoin offers additional attributes as well:

- Divisibility – Each bitcoin is divisible into 100 million units, making acquisition feasible even in small denominations of traditional currencies.

- Portability – Existing in the digital world, bitcoin owners can access their tokens in an instant from anywhere in the world.

- Verifiable – Transactions and rightful ownership are constantly recorded on the ledger, publicly viewable and maintained by network users. No bitcoin has ever been counterfeited, or past transactions altered.

In the author’s view, the strongest argument for bitcoin ownership is for the small possibility that it fulfills its great potential and becomes a globally accepted asset. It should be viewed as a high risk, growth asset which carries the potential of extensive volatility and possibility of complete loss.

Opposing Views and Risks

The case for bitcoin is not without its issues, however. The clearest of these arguments is that bitcoin produces no cash flows and has no intrinsic value, making determination of fair value difficult, if not impossible. The value of bitcoin endures merely as a social construct, a tacit agreement amongst users that ownership today will confer value tomorrow. The continued growth of participants strengthens the network and yet a sense of fragility remains. Commonly cited risks and reasons for pause include:

- Regulation - Lack of regulatory support poses substantial risks to users. First, transactions on the Bitcoin network cannot be reversed, even if conducted improperly. Consequently, the lack of formal regulatory protections leaves users to fend for themselves should they be taken advantage of by bad actors. Second, the lack of regulatory support opens the possibility of government intervention. Though the decentralized nature makes it unlikely that the network could be shut down entirely, governments could impose restrictions on the conversion of bitcoin back to the existing financial system, jeopardizing the real-world functionality of bitcoin.

- Security – The digital nature of bitcoin makes it susceptible to all the commonly known weaknesses of our modern digital world. Properly securing bitcoin requires specialized hardware to isolate the tokens from the electronic network, along with the preservation/memorization of a complex password. Any digital device used to access bitcoin accounts or maintain passwords could serve as a point of attack for hackers.

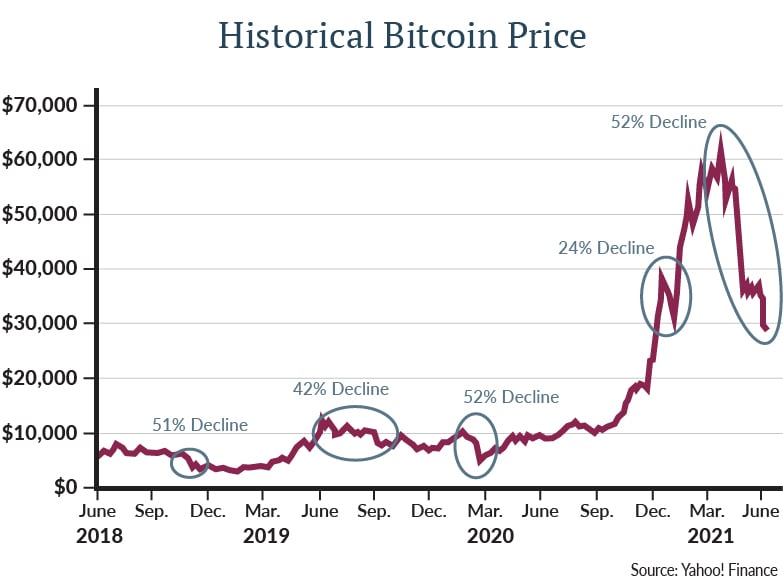

- Volatility – The store of value claim is challenged by substantial price volatility, as represented by a 3-month standard deviation that is more than five times greater than gold. Furthermore, the price of bitcoin has experienced several 90% declines in route to its current value. Owners of bitcoin relying on a conversion to US dollars may be in for a rude awakening should their need for physical cash coincide with a bitcoin crash.

- Competition – While bitcoin arguably offers improvements to gold and even traditional currencies, it too has its limitations. Should a competing digital asset be created with fewer limitations, a better digital asset, the relevance of bitcoin could diminish and cause its price to decline.

How To Invest

After considering the opportunities and risks, some may choose to purchase bitcoin. The vehicles to gain exposure to bitcoin have grown since it last rose to prominence in late 2017. At that time, few institutionalized platforms existed, but in the ensuing years the financial industry has been working to build the infrastructure for professionalized and secure ownership. Exposure to bitcoin can be achieved in the following ways:

Direct – Accounts can be created at one of a wide number of platforms which function similar to a traditional brokerage account. Selection of a reputable platform is critical, as is understanding the security measures necessary to protect and store the digital asset. Investors can purchase bitcoin with a modest minimum investment.

- Indirectly via private funds – An array of firms, including newcomers and legacy entities, offer investment into private funds which own bitcoin. The investment appreciates or depreciates based on the price movement of bitcoin but the investor does not directly own bitcoin. Investments via private funds incur a management fee and require minimum investments commonly in excess of $25,000. Investors must understand the security measures the fund has in place to ensure security of the underlying bitcoin.

- Listed Trusts – While there are numerous submissions before the SEC at the time of writing, there is not yet an approved U.S. listed bitcoin ETF. However, there are multiple listed trusts which own bitcoin and permit intraday buying and selling similar to an ETF. An important element to understand is that the value of the trust can diverge from the value of the bitcoin owned, resulting in meaningful premiums or discounts to the value of underlying bitcoin. These vehicles allow investors to gain bitcoin exposure via traditional brokerage accounts (including retirement accounts). The trusts charge a management fee and the minimum investment is the cost of a single share.

- Foreign ETFs – The SEC has yet to approve a U.S. listed bitcoin ETF, but numerous foreign countries have done so. Availability of foreign ETFs on U.S. brokerage platforms varies, limiting their usefulness to US investors.

Conclusion

Predicting the future for bitcoin is a task even more challenging than most financial predictions. The camps of believers and naysayers are firmly rooted in their views that it will either “go to the moon” or “go to zero.” An allocation to bitcoin is likely unsuitable for most investors given the level of uncertainty which remains. Aggressive investors enticed by bitcoin’s prospects to supplant gold as a global store of value and gain widespread adoption across investment portfolios might consider a modest allocation, but only after acknowledging the distinct risk involved. A lack of traditional custodial solutions means that at the present time Johnson Financial Group is not allocating on behalf of clients, though we’re happy to discuss the rationale for owning.

One thing for certain is that the road ahead for bitcoin is unlikely to be boring. Whether that is a good thing for investors remains to be seen.