Bond Investors: Be a Prudent Pig, not a Yield Hog

Share

- Bond Investors: Be a Prudent Pig, not a Yield Hog

- When Retirees Give Away Too Much Money

- $10bn Shop's Top Gatekeeper Gets ‘Interesting’ With Fixed Income

- After ‘rock fight’ in 2023, banks see businesses taking wait-and-see approach

- What does your spouse want in retirement? 6 questions to ask.

- When Retirees Give Away Too Much Money

- Johnson Financial Group: Expands presence in Madison new West Towne location

- Johnson Financial Group Shares Tips for Buying a Home in 2024

- Advisors Urge Caution On Penalty-Free IRA, 401(k) Early Withdrawals

- Donations of nearly $70K pour in following tool theft from Waukesha Habitat for Humanity

- Dominic Ceci appointed Chief Investment Officer for Johnson Financial Group

- Associated Bank, Johnson Financial partner to provide funding for affordable-housing project in Madison

- Understanding Interest Rates and Unlocking Financial Power

- Ben Pavlik, Top Corporate Counsel Award

- Your Guide to Women’s Wealth Management

- Tim Sheehy appointed to Board of Directors

- WMC, Johnson Financial Group: Announce 2023 Coolest Thing Made in Wisconsin

- Johnson Financial Group ready to serve Lake Country community

- Most Corporate Charitable Contributors in Wisconsin

- Preparing Clients For The Risk Of Cognitive Decline

- Johnson Financial Group expanding with acquisition in Appleton

- How Big A Gamble Is Monte Carlo For Advisors?

- Married … With Finances

- Johnson Financial Group CEO discusses branch strategy with one set to open and another in the works

- Squire to retire after nearly two decades as Johnson Bank regional president

- Bringing a Personal Touch to Digital Banking

- At This Rate: Financial Institutions Dealing with Higher Interest Rates and Lower Loan Demand

- Table of Experts: Reading the tea leaves

- Checking in on Wisconsin banks

- Beyond Lip Service In DEI

- Johnson Financial Group to sell its insurance business to Boston firm

- Johnson Financial Group plans new branches, including in West Milwaukee

- New Johnson Financial Group Branch Planned In West Milwaukee and Delafield

- Johnson Wealth Fixed Income Tilts at Emerging Markets Debt, Mortgage Backed Securities

- Your Financial Foundation with Al Araque on the Lifeblood Podcast

- Unexpected health insurance surprise possible when pandemic insurance programs expire

- Women Insurance Pros on Balance, Community and the Future

- Financial Planning For Couples Who Totally Disagree

- How To Help Clients Who Own Businesses in Declining Industries

- Johnson Financial Group presents 'Lightfield' coming to Cathedral Square Park

- Johnson Financial Group Named Top LGBTQ Workplace

- Financial advice is the midlife job that women want – but don’t know exists

- Expert Insight for Beginner Rental Property Investors

- Coolest thing made in Wisconsin announced by WMC and Johnson Financial Group

- Corporate Charitable Contributors in Wisconsin

- 'Coolest Thing Made in Wis.' voting begins

- Johnson Financial Group and Habitat for Humanity Kenosha work together to help homeowners

- We have a responsibility to be solution providers for our customers

- Being a leader is a team sport

- Jason Herried Joins Chuck Jaffe on Money Life

- Have questions about "Gray Divorce"? Attorney Kelly Mould, CRP® can help.

- Jazz in the Park Is Back Thursday Nights Starting July 21

- People in Business - Al Araque

- 2022 Housing Market Overview: Everything You Need to Know

- "Give Back More Than You Take" - Helen Johnson-Leipold

- A Brief History of Economic Crises, Crashes and Recoveries

- Kelly Mould and Kate Trudell Earn State Bar Award for Outstanding Service

- JFG Supports Affordable Housing through FHLBank Chicago

- Helen Johnson-Leipold shares business tips for success at Marquette speaker series

- Notable Commercial Banking Leaders: Thomas Moore

- Notable Commercial Banking Leaders: Viktor Gottlieb

- Johnson Financial Group partners with Racine Habitat for Humanity to service mortgages at no cost

- Upcoming Lineup Of Broadway Shows Announced At Marcus Performing Arts Center

- See the Milwaukee Business Journal's 2022 Real Estate Award winners

- Joe Maier “Employers are going to have to rethink their practices”

- Emotional Investments: Why They Happen and How to Avoid Them

- Investors are a growing force in the residential real estate market, but how should sellers evaluate these offers?

- Inflation advice for younger colleagues

- Amber Krogman: 40 Under 40

- Rising Stars in Wealth Management: Robert Schneider

- Should You Sell Your House to an Investment Company?

- Evoking change within the Milwaukee community with Johnson Financial Group's Jim Popp

- A Shift in the Tech Landscape

- Evoking change within the Milwaukee community with Jim Popp, CEO of Johnson Financial Group

- The Rising Trend Of "Gray Divorce" with Kelly Mould of Johnson Financial Group

- Evoking change within the Milwaukee community with Jim Popp, CEO of Johnson Financial Group

- Johnson Financial Group Recognized on Financial Planning's 2021 RIA Leaders List

- Find out why these business leaders are 2021 Milwaukee-area power brokers

- Thoughts for business executives on future-proofing a business

- Jim Popp Joins Fox 6 to Announce the Milwaukee Holiday Light Festival

- Milwaukee’s Holiday Lights Festival Kicks Off This Week!

- #FreeBritney: When Protections Turn Toxic

- WisBusiness: the Podcast with Jim Popp, president and CEO of Johnson Financial Group

- WE Energies Customer Spotlight On Energy Efficiency

- Johnson Financial Group donates $500,000 to United Way organizations across Wisconsin

- Madison’s Moving Business Forward Podcast

- Thoughts for business executives on return-to-office technology

- First look: Johnson Financial Group's new Downtown offices and branch

- Johnson Financial Group Shows Off High-Rise Office

- Six Tips for Developing a Business Plan for Uncertain Financial Times

- Is Bitcoin Here to Stay? An Assessment of Opportunities and Risk

- You may have a ‘huge edge over high-powered investors,’ says investing risk expert: Here’s why

- Executive Insights with Jim Popp

- CEO Jim Popp Honored as Distinguished Executive

- 2021 Guide to Wealth Management: A War on Wealth?

- Notable Alumni: Scott Cooney

- Jason Herried Joins Chuck Jaffe on Money Life Market Call

- Top Workplaces 2021: Q&A with three CEOs who were recognized for their leadership during a challenging year

- How will Biden's new tax plan affect you?

- American Jobs Plan: Potential Implications for You and Your Business

- Get on the Right Track to Financial Freedom

- Greater Madison area Top Workplaces 2021

- The Crazy Housing Market: Buy, Sell or stay on the sidelines?

- UPAF Ride for the Arts series will take place over three June weekends

- Financial services industry helped guide businesses through sharp downturn: Banks hustled to meet massive PPP demand

- Financial services industry helped guide businesses through sharp downturn: Banks hustled to meet massive PPP demand

- Johnson Financial Group matches food donations to help feed Wisconsin families

- Johnson Financial Group: To donate $300,000 to help feed Wisconsin families

- Women in Leadership: Sharing & Celebrating Women's Stories

- 2020 Milwaukee-area power brokers

- Dow Surges to Highest Level Since February on Vaccine Results, Biden Win

- Johnson Financial Group Named One of Wisconsin's Largest Corporate Charitable Contributors

- Don't forget about the "I" in D&I

- Johnson Financial Group to move Milwaukee offices to Cathedral Place

- Pandemic Uncertainty Leaves Wisconsin Bankers Ready To Reserve

- What's going on in the financial markets right now with Jim Popp of Johnson Financial Group

- Downside risk is now a pit, not a chasm. Still, underweight stocks & overweight (some) bonds.

- Why You Want To Keep Your Politics Separate From Your Investing

- Johnson Financial Group growing, still hiring on its 50th anniversary year

- The COVID Calculation

- Pleasant Prairie company gets boost from Paycheck Protection Program

- Banks locally, statewide step up to help businesses obtain $8.3 billion in PPP

- Johnson Financial Group donates $200K to support United Way, other nonprofits during COVID-19 pandemic

- Second round of PPP starts slowly as Milwaukee-area businesses still await loans

- Wisconsin lenders ready to shell out hundreds of millions in Paycheck Protection Program loans

- Planning opportunities under the CARES Act

- BizTimes Media Announces Milwaukee’s Notable Women in Commercial Banking

- Johnson Financial Group adviser honored

- Tech-driven R&D goes beyond the budget. Some Milwaukee execs speak up

- What would cause markets to react after Fed meeting

- Banking official remains confident in local economy's growth

- Rock County home prices continue to climb

- The coolest thing made in Wisconsin

- Dan Defnet named president of Johnson Bank

- Future Returns: Ignore Politics When Investing

- Local banker to get Forward Janesville's Lifetime Achievement Award

- Wisconsin Could See Economic Slowdown This Year, Not Recession

- When Corporate Bonds Are a Risky Investment

- Johnson Financial Group becomes Broadway at the Marcus Center title sponsor

- Getting Ready to Exit: What Baby Boomers know and should know about getting their business ready for sale

- Take Five: Putting some Popp in banking

- Jim Popp in the News

- Jason Herried's Take on the 'Booms and Busts' of the Economy

- Johnson Insurance creates new 'workplace of choice'

- Paul Ryan lauds Harvard award-winner Helen Johnson-Leipold

- Business Leader of the Year Helen Johnson-Leipold leads big parts of the Johnson family business

- Johnson Financial Investment Expert: More growth, low inflation ahead

- Foxconn's Balance Sheet Tipped in Mt. Pleasant's Favor

- JFG honored by Department of Defense

- The Open Road comes to the Milwaukee Art Museum

- 3 business lessons from the new Johnson Financial Group CEO

- Executive Q&A: Jim Popp takes the helm at Johnson Financial Group

- Banking exec Jim Popp named president of Johnson Bank

- Banker: Focus on millennials, not president

- American Birkebeiner Legacy Lives on with Support from Johnson Bank and Johnson Family Foundation

- TEMPO MILWAUKEE 2020

There is a certain type of investor, which I’ll call the “Yield Hog,” who prizes income above all else. Fat yields are a siren song he cannot resist. He checks his phone every day to see if bond interest or a stock dividend has posted to his account. The word “buyback” induces indigestion, as he believes companies should send their profits back to shareholders through increased dividends rather than share repurchases. Revenue growth does not excite him. Leverage does not concern him. Crypto makes him cringe. An appetite for Utilities and Energy stocks has made him wealthy and poor over the years. Closed-end funds and REITs have been his undoing more than once. Through it all, he remains steadfast in his pursuit of income.

The past decade has been a trying time for the Yield Hog. Cash has given him nothing, bonds next-to-nothing and dividend stocks have trailed growth stocks by a wide margin. Things were so dire for the Yield Hog that an acronym was invented to describe his plight when searching for income outside the stock market: T.I.N.A. (There Is No Alternative).

But there is good news for the Yield Hog as bonds are back as a source of income and total return. If the Yield Hog can restrain his worst impulses and become instead a Prudent Pig, then 2023 should be a profitable year for our porcine friend. Let’s look at his buffet of options in the current year.

Cash: The Prudent Pig doesn’t overallocate

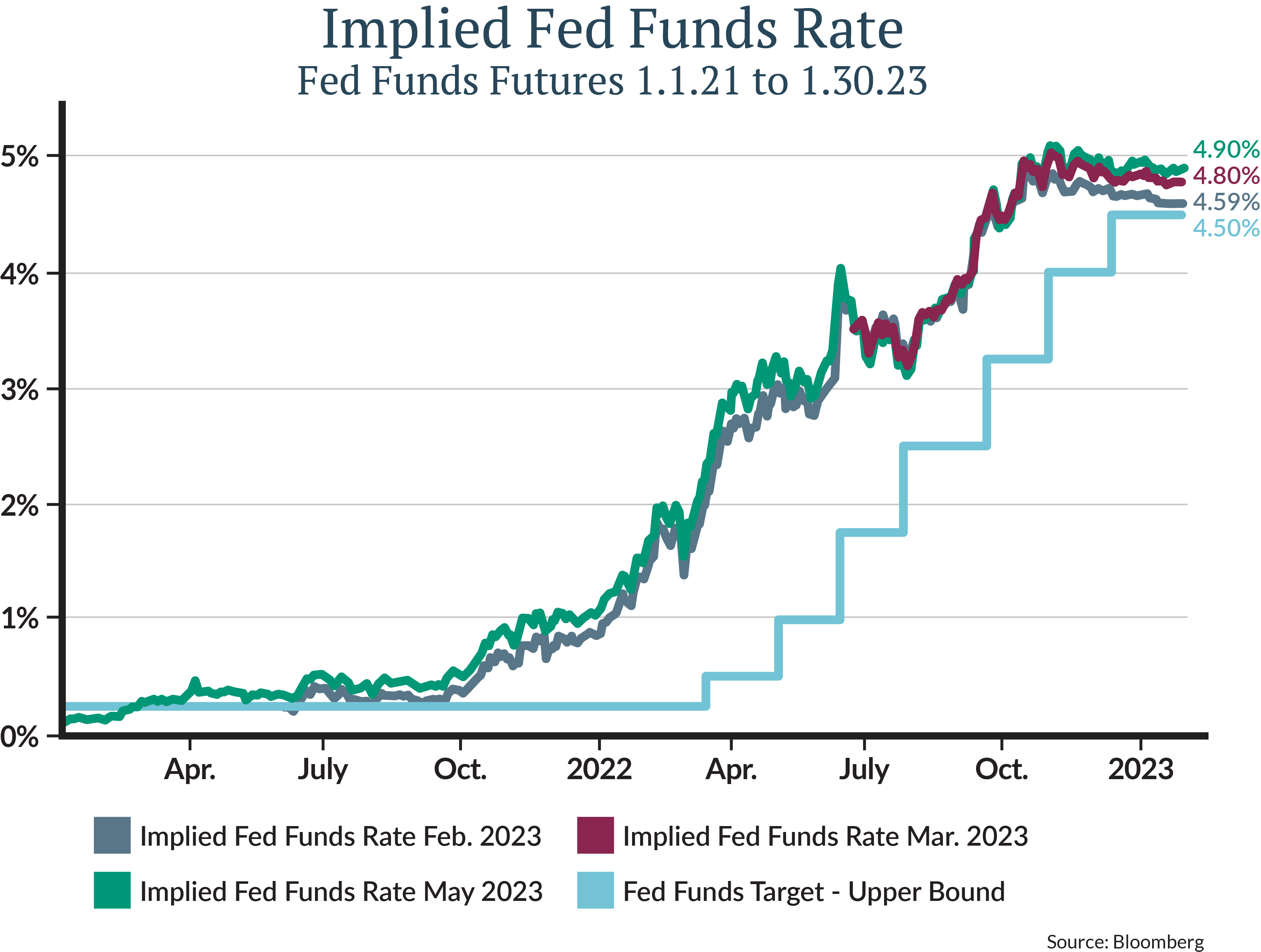

Cash was king in 2022, not because it made money but because it didn’t lose any. This year will be different as money market yields begin the year near 4% and are poised to go higher. Money market yields closely track the Fed Funds rate set by the Federal Reserve. The Fed’s rapid pace of rate increases caused stocks and bonds to reprice lower last year, but market participants believe the Fed is close to the end of its hiking campaign, with smaller rate increases expected in the first half of 2023 and a terminal rate of 4.90% priced in by the futures market (Figure 1).

Figure 1

Our friend the Yield Hog salivates over 4% T-Bills and compares them to the sub-2% yield on the S&P 500 Index of large-capitalization stocks. He wonders why he should take risk in the stock market and has contemplated selling his stocks and allocating a large chunk of his portfolio to cash.

The Prudent Pig, however, knows that the Fed may need to reverse course as the lagged effects of tighter monetary policy flow through the economy. He knows these cash yields may not last, and that future rate cuts may once again buoy stocks. The Prudent Pig decides to allocate his excess savings to a higher-yielding money market fund but doesn’t change his long-term asset allocation because, over the long term, he expects stocks to outpace bonds and cash.

Credit: The Prudent Pig resists the temptation to load up

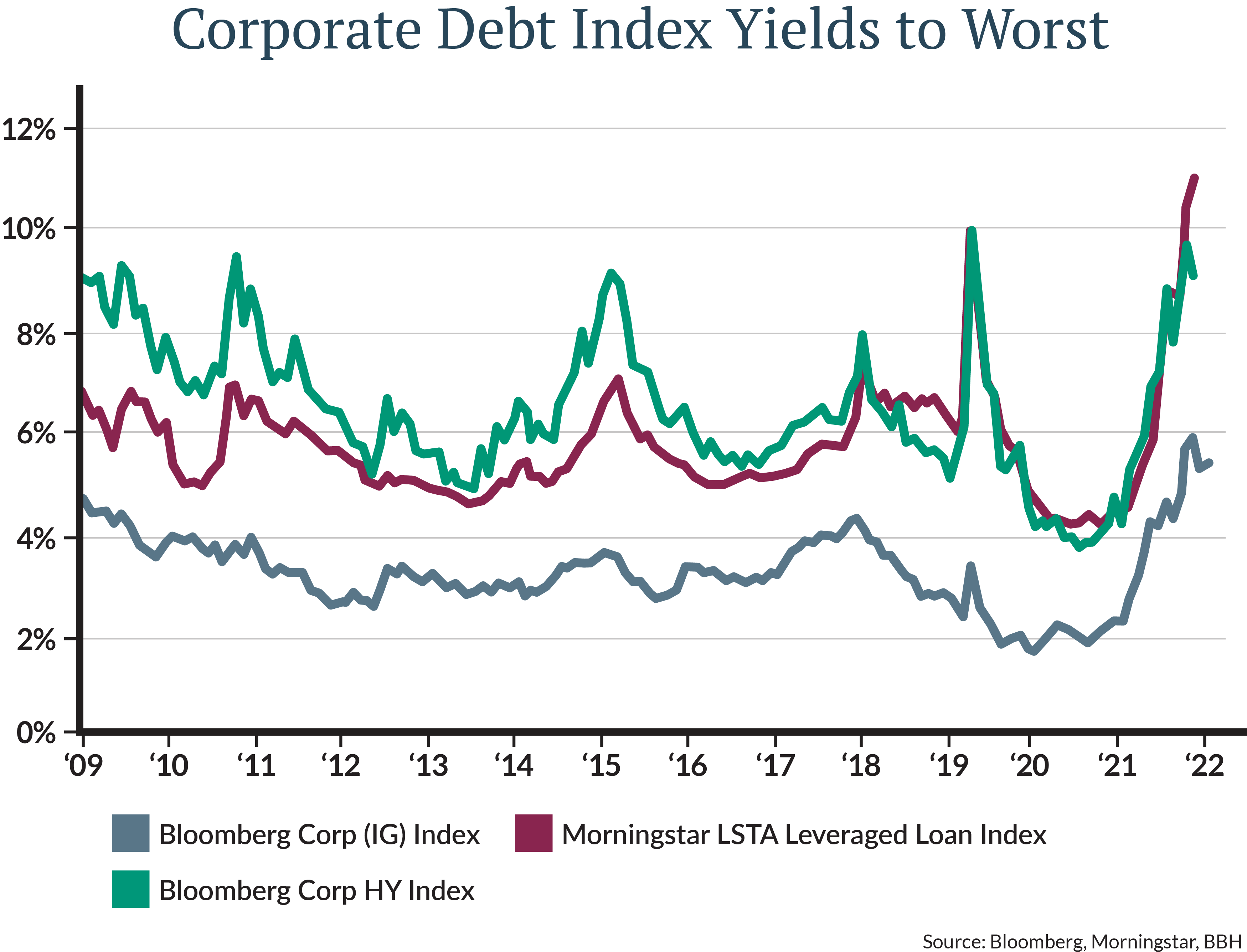

The Yield Hog can’t believe what he is seeing in the corporate bond market. Yields are the highest they’ve been in 15 years. Investment grade corporate bonds finished 2022 yielding over 5%; “junk” rated corporates yielded over 9%; and floating-rate leveraged loans yielded over 10% (Figure 2).

Figure 2

The Yield Hog is contemplating selling all his Treasury bonds and loading up on credit. After all, he reasons, these yields promise equity-like returns, and everyone knows bonds are safer than stocks.

The Prudent Pig is equally impressed by the income potential provided by the corporate bond market, but he has learned over the years to look beyond the nominal yields offered by an investment opportunity. He knows that an unusually high yield on a stock can portend a dividend cut, and he knows that the highest-yielding corporate bonds come with higher risk of default.

Also, the Prudent Pig sees rising recession odds and higher borrowing costs as headwinds for highly leveraged companies. He decides to keep his fixed income allocation tilted toward higher-quality bonds. He knows he may not get rich settling for 4%-5% returns, but he owns bonds for stability and income, not growth.

Tax-exempt bonds: The Prudent Pig pays attention to leverage and relative value

While the Yield Hog loves income, he hates paying taxes. Over the years, he has invested his taxable accounts primarily in tax-exempt municipal bonds. It has been a source of frustration for the Yield Hog that high-quality municipal bond yields have spent much of the past decade below the rate of inflation. Now, he is excited by after-tax yields near 4% on investment-grade munis. He is even more excited by municipal closed-end funds, which use leverage to boost returns and offer taxable equivalent yields over 5%. He is contemplating a “diversified” strategy of owning three or four closed-end municipal funds and basking in the warm glow of tax-exempt income.

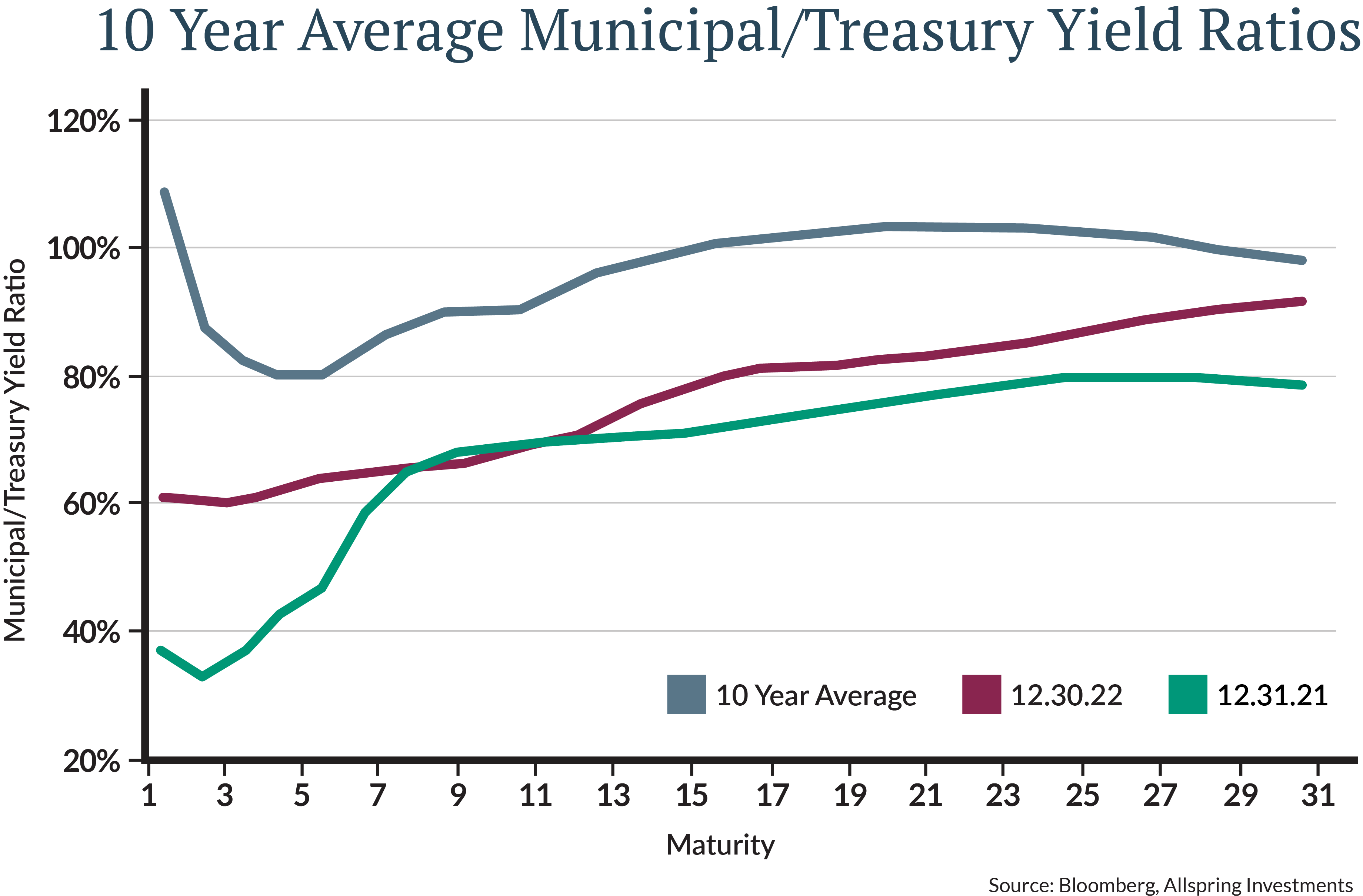

The Prudent Pig doesn’t like paying taxes either and is also excited about earning a positive real (inflation-adjusted) return on his municipal bonds. Unlike the Yield Hog, however, the Prudent Pig pays attention to leverage and relative value. He knows that when borrowing costs rise, leveraged funds may have to cut their distributions as several closed-end funds have already done in recent months. He also knows that municipal bond valuations are expensive relative to Treasury bonds due to a lack of supply to meet municipal bond demand, as shown in Figure 3.

So, the Prudent Pig treads cautiously when investing in closed-end funds and keeps the bulk of his municipal bond portfolio in high-quality intermediate-term munis, where he is finding nominal tax-exempt yields near 2.5%.

Figure 3

Be a Prudent Pig, not a Yield Hog

Today’s environment is an exciting one for bond investors. Yields on cash, corporate credit, and tax-exempt bonds have not been this high in 10-15 years. The world of T.I.N.A. and trillions of dollars of negative-yielding debt will not be missed by savers and bond investors, and we hope it doesn’t return for a very long time.

But in the excitement, we caution income investors to be more like the Prudent Pig that I have described than the Yield Hog. As always, it’s important to carefully assess today’s opportunity set. Finding attractive yields in fixed income today does not require taking risk in the lower-quality tiers of corporate credit or using leverage to boost returns.

A time will come for greater risk-taking, but already the Prudent Pig is in hog heaven, just knowing that the “income” is back in “fixed income.”